Smart Money Is Betting Big In CEG Options

Investors with a lot of money to spend have taken a bearish stance on Constellation Energy (NASDAQ:CEG).

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with CEG, it often means somebody knows something is about to happen.

Today, Benzinga's options scanner spotted 9 options trades for Constellation Energy.

This isn't normal.

The overall sentiment of these big-money traders is split between 22% bullish and 55%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $164,362, and 8, calls, for a total amount of $555,831.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $200.0 to $340.0 for Constellation Energy over the recent three months.

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Constellation Energy options trades today is 278.5 with a total volume of 135.00.

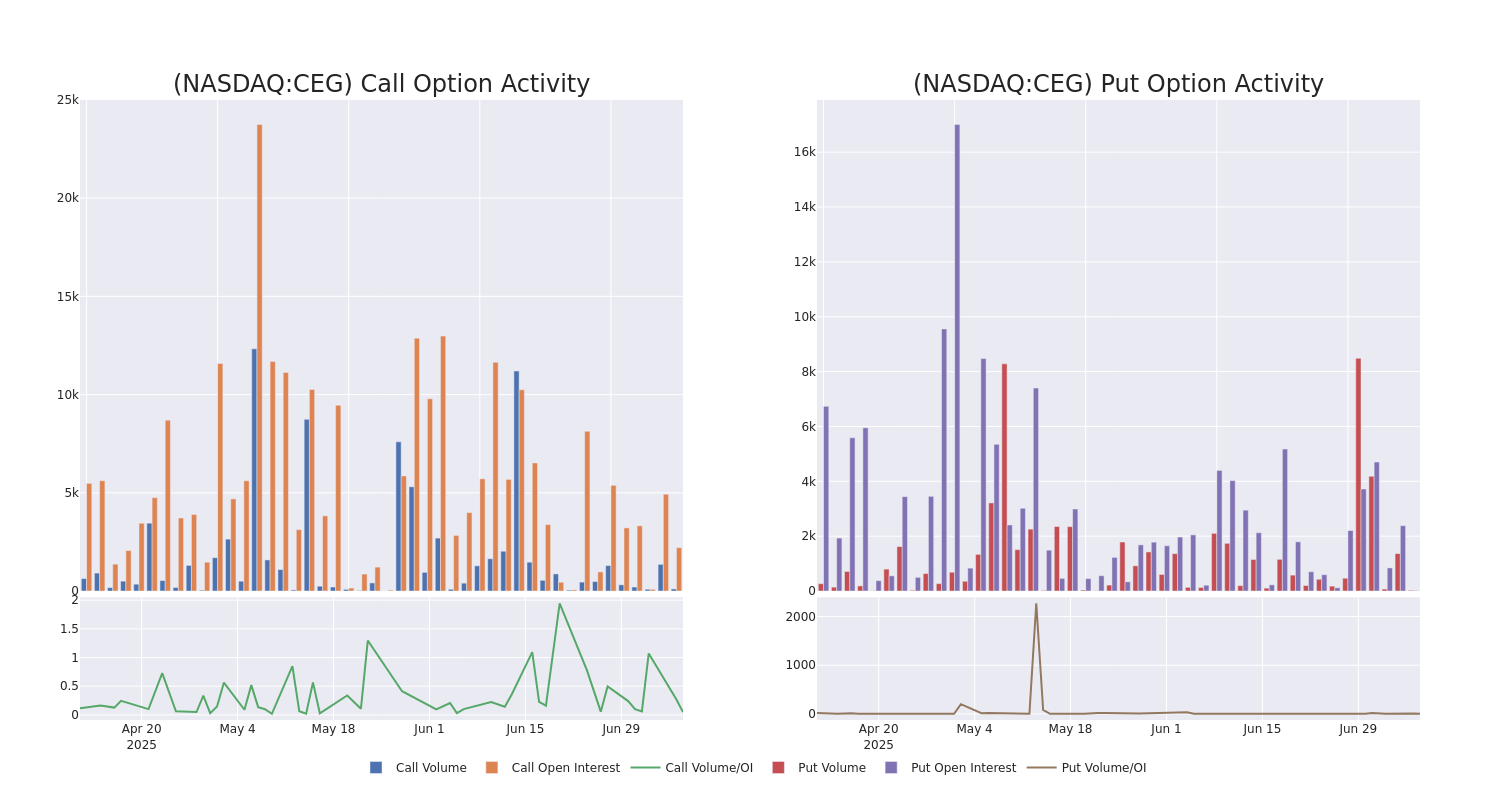

In the following chart, we are able to follow the development of volume and open interest of call and put options for Constellation Energy's big money trades within a strike price range of $200.0 to $340.0 over the last 30 days.

Constellation Energy Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CEG | CALL | TRADE | NEUTRAL | 07/18/25 | $64.5 | $61.7 | $62.9 | $250.00 | $176.1K | 80 | 28 |

| CEG | PUT | SWEEP | BEARISH | 03/20/26 | $60.9 | $59.5 | $60.9 | $340.00 | $164.3K | 19 | 27 |

| CEG | CALL | TRADE | BEARISH | 01/16/26 | $106.2 | $105.5 | $105.5 | $220.00 | $94.9K | 357 | 12 |

| CEG | CALL | TRADE | BEARISH | 09/18/26 | $74.4 | $72.0 | $72.0 | $320.00 | $72.0K | 3 | 0 |

| CEG | CALL | SWEEP | BEARISH | 11/21/25 | $37.4 | $35.5 | $35.6 | $320.00 | $50.4K | 278 | 20 |

About Constellation Energy

Constellation Energy Corp producer of carbon-free energy and a supplier of energy products and services. The company offers generating capacity that includes nuclear, wind, solar, natural gas, and hydroelectric assets. It sells electricity, natural gas, and other energy-related products and sustainable solutions to various types of customers, including distribution utilities, municipalities, cooperatives, and commercial, industrial, public sector, and residential customers in markets across multiple geographic regions. Its operating segments and reporting units are Mid-Atlantic, Midwest, New York, ERCOT, and Other Power Regions.

In light of the recent options history for Constellation Energy, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Constellation Energy's Current Market Status

- With a trading volume of 680,239, the price of CEG is down by -2.0%, reaching $311.9.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 28 days from now.

Expert Opinions on Constellation Energy

2 market experts have recently issued ratings for this stock, with a consensus target price of $353.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from JP Morgan persists with their Overweight rating on Constellation Energy, maintaining a target price of $380.

* An analyst from Raymond James has revised its rating downward to Outperform, adjusting the price target to $326.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Constellation Energy, Benzinga Pro gives you real-time options trades alerts.