Spotlight on Archer Aviation: Analyzing the Surge in Options Activity

Deep-pocketed investors have adopted a bullish approach towards Archer Aviation (NYSE:ACHR), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in ACHR usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 25 extraordinary options activities for Archer Aviation. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 40% leaning bullish and 40% bearish. Among these notable options, 2 are puts, totaling $397,000, and 23 are calls, amounting to $1,484,599.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $3.5 to $17.0 for Archer Aviation over the last 3 months.

Analyzing Volume & Open Interest

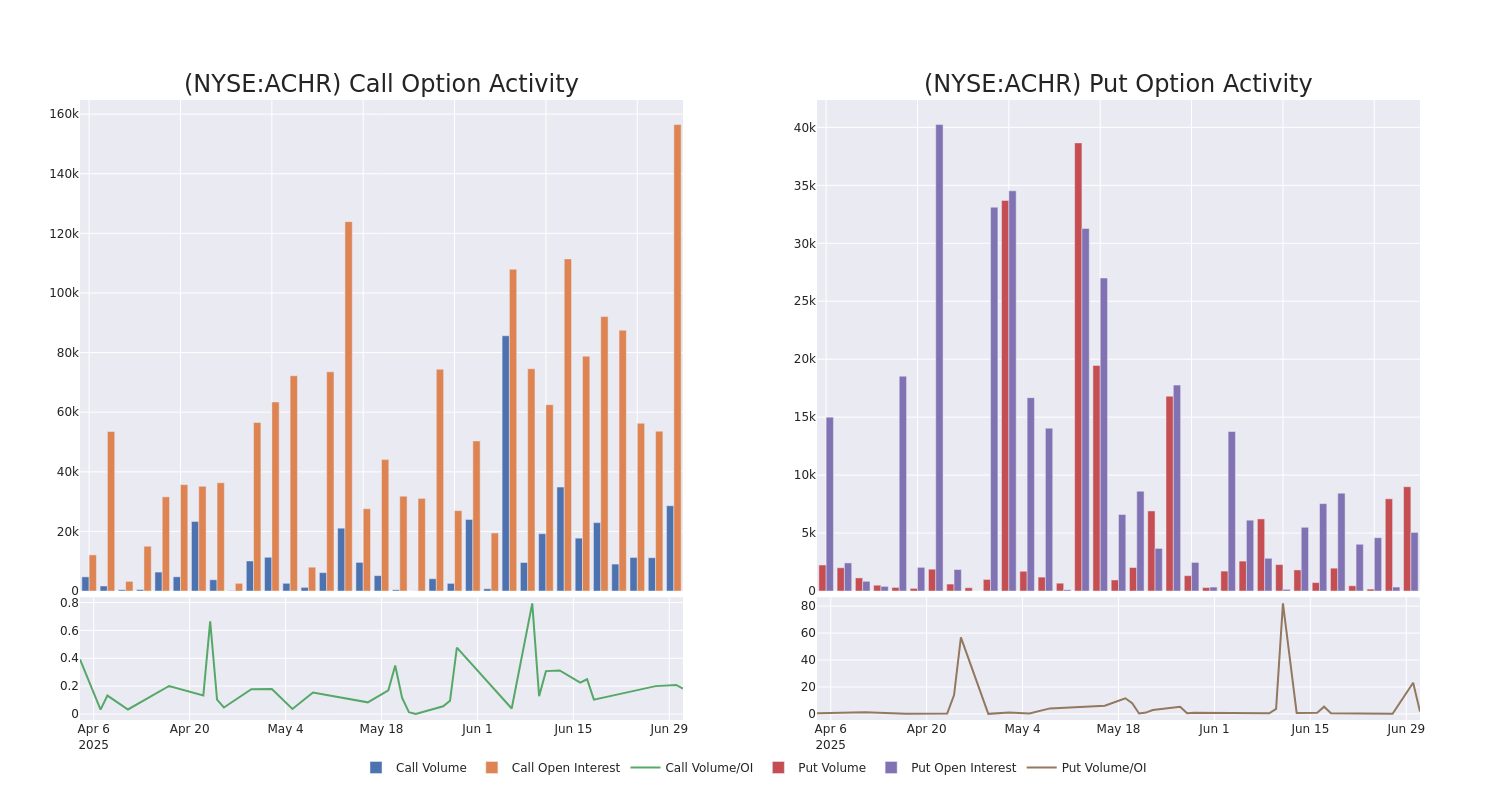

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Archer Aviation's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Archer Aviation's significant trades, within a strike price range of $3.5 to $17.0, over the past month.

Archer Aviation Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ACHR | PUT | SWEEP | BEARISH | 08/08/25 | $0.79 | $0.78 | $0.79 | $10.00 | $316.0K | 5.0K | 4.0K |

| ACHR | CALL | SWEEP | BEARISH | 01/15/27 | $7.1 | $7.0 | $7.0 | $4.00 | $175.1K | 4.0K | 256 |

| ACHR | CALL | SWEEP | BULLISH | 08/15/25 | $2.33 | $2.29 | $2.33 | $8.00 | $116.5K | 460 | 2.5K |

| ACHR | CALL | TRADE | BULLISH | 08/15/25 | $2.33 | $2.28 | $2.32 | $8.00 | $116.0K | 460 | 2.0K |

| ACHR | CALL | SWEEP | BULLISH | 08/15/25 | $2.33 | $2.28 | $2.32 | $8.00 | $116.0K | 460 | 2.0K |

About Archer Aviation

Archer Aviation Inc advances the benefits of sustainable air mobility. The company is engaged in designing and developing a fully electric vertical takeoff and landing eVTOL aircraft for use in UAM networks. It is creating an electric airline that moves people throughout cities in a quick, safe, sustainable, and cost-effective manner.

Current Position of Archer Aviation

- Trading volume stands at 48,846,482, with ACHR's price down by -8.62%, positioned at $9.91.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 37 days.

What The Experts Say On Archer Aviation

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $14.67.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Canaccord Genuity continues to hold a Buy rating for Archer Aviation, targeting a price of $13.

* Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Overweight with a new price target of $13.

* Consistent in their evaluation, an analyst from HC Wainwright & Co. keeps a Buy rating on Archer Aviation with a target price of $18.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Archer Aviation options trades with real-time alerts from Benzinga Pro.