Arista Networks Options Trading: A Deep Dive into Market Sentiment

Whales with a lot of money to spend have taken a noticeably bearish stance on Arista Networks.

Looking at options history for Arista Networks (NYSE:ANET) we detected 9 trades.

If we consider the specifics of each trade, it is accurate to state that 33% of the investors opened trades with bullish expectations and 44% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $63,960 and 7, calls, for a total amount of $401,398.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $45.0 to $100.0 for Arista Networks over the recent three months.

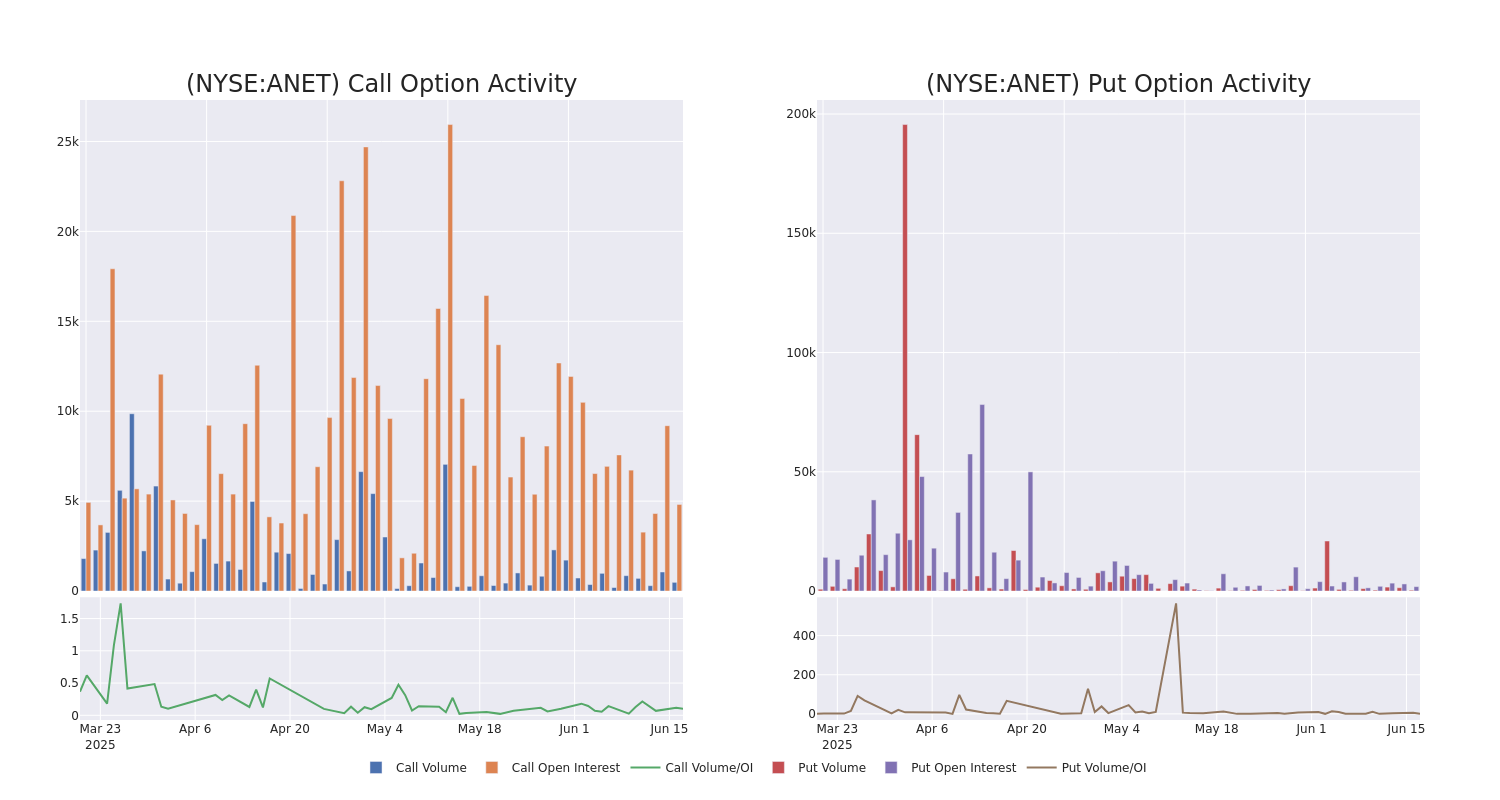

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Arista Networks's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Arista Networks's substantial trades, within a strike price spectrum from $45.0 to $100.0 over the preceding 30 days.

How Matt Maley Is Trading the Final Week of June—Live Sunday at 1 PM ET

With the Fed out of the way, traders are shifting focus to key macro data, tariff headlines, and rising geopolitical risk. Join Matt Maley as he shares the real trades he’s targeting this week—including how he plans to repeat his recent wins on SQQQ and GDX by staying nimble, tactical, and tuned into market signals. Register for free to attend.

Arista Networks 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ANET | CALL | TRADE | BULLISH | 09/19/25 | $10.5 | $10.4 | $10.5 | $90.00 | $105.0K | 2.1K | 220 |

| ANET | CALL | TRADE | BULLISH | 09/19/25 | $10.5 | $10.3 | $10.5 | $90.00 | $105.0K | 2.1K | 20 |

| ANET | CALL | TRADE | BEARISH | 01/16/26 | $27.6 | $27.1 | $27.26 | $70.00 | $54.5K | 774 | 20 |

| ANET | CALL | TRADE | BEARISH | 09/19/25 | $16.2 | $16.0 | $16.08 | $80.00 | $48.2K | 1.1K | 87 |

| ANET | PUT | SWEEP | BULLISH | 06/18/26 | $17.0 | $16.8 | $16.8 | $95.00 | $36.9K | 404 | 22 |

About Arista Networks

Arista Networks is a networking equipment provider that primarily sells Ethernet switches and software to data centers. Its marquee product is its extensible operating system, or EOS, that runs a single image across every single one of its devices. The firm operates as one reportable segment. It has steadily gained market share since its founding in 2004, with a focus on high-speed applications. Arista counts Microsoft and Meta Platforms as its largest customers and derives roughly three quarters of its sales from North America.

In light of the recent options history for Arista Networks, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Arista Networks

- Trading volume stands at 5,967,494, with ANET's price down by -4.0%, positioned at $91.28.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 42 days.

What The Experts Say On Arista Networks

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $112.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Redburn Atlantic has revised its rating downward to Buy, adjusting the price target to $112.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Arista Networks, Benzinga Pro gives you real-time options trades alerts.

NEW: Get Access to The Leaderboards That Reveal Tomorrow’s Top Stocks

Updated daily, Benzinga’s Top Stock Leaderboards highlight our best buys right now. Spot breakout opportunities before the crowd catches on—without the noise. Get access now and start using the same research trusted by hedge funds, analysts, and serious traders. Get started here.