Spotlight on Devon Energy: Analyzing the Surge in Options Activity

Financial giants have made a conspicuous bullish move on Devon Energy. Our analysis of options history for Devon Energy (NYSE:DVN) revealed 11 unusual trades.

Delving into the details, we found 72% of traders were bullish, while 27% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $295,495, and 7 were calls, valued at $233,930.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $22.5 and $40.0 for Devon Energy, spanning the last three months.

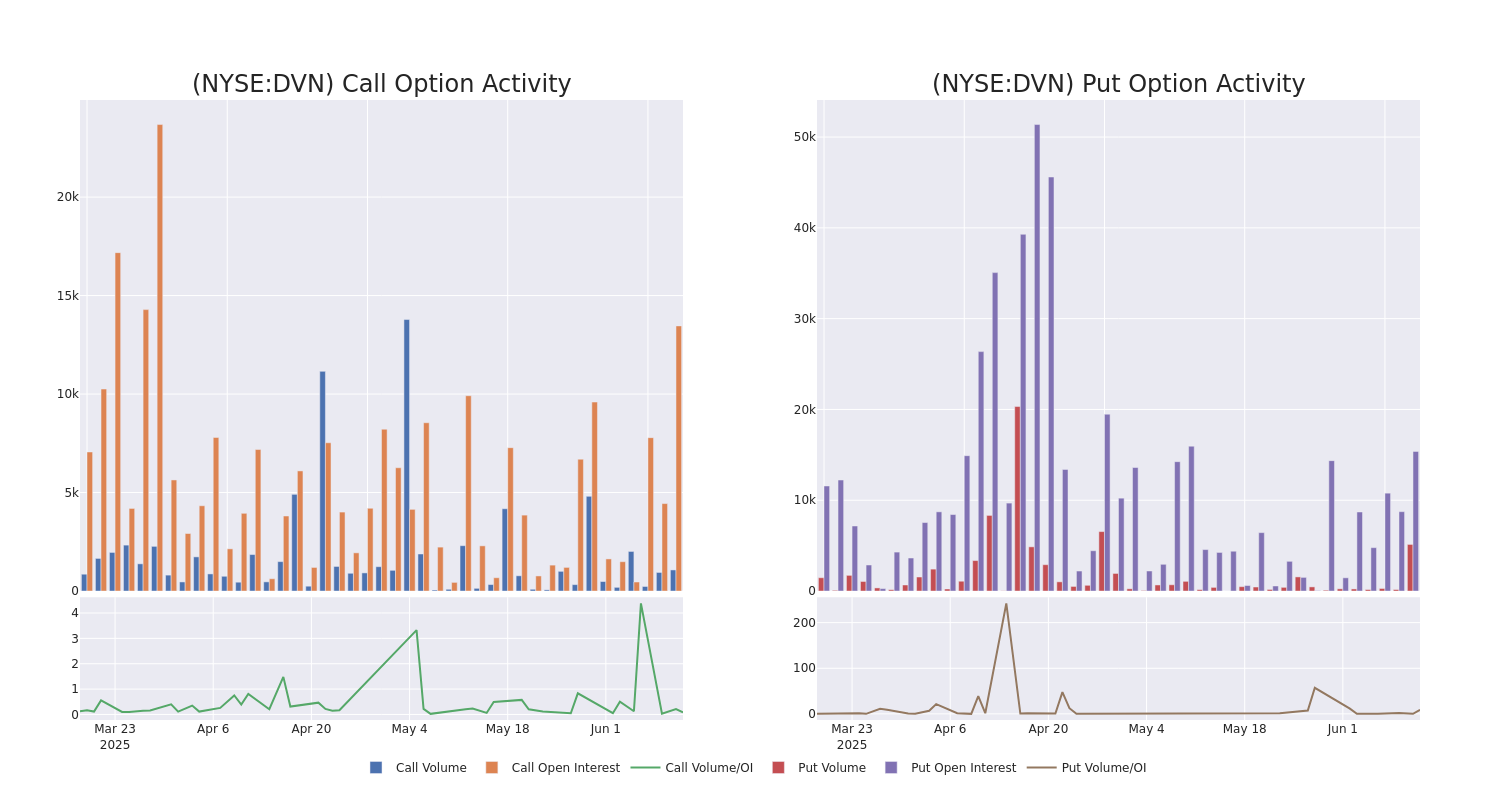

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Devon Energy's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Devon Energy's significant trades, within a strike price range of $22.5 to $40.0, over the past month.

Devon Energy Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DVN | PUT | TRADE | BULLISH | 11/21/25 | $0.43 | $0.35 | $0.35 | $22.50 | $140.3K | 4.2K | 4.0K |

| DVN | CALL | TRADE | BEARISH | 06/27/25 | $3.4 | $3.1 | $3.2 | $31.00 | $72.0K | 422 | 225 |

| DVN | PUT | SWEEP | BULLISH | 01/16/26 | $3.05 | $3.0 | $3.05 | $32.50 | $62.8K | 8.7K | 256 |

| DVN | PUT | SWEEP | BULLISH | 09/19/25 | $0.65 | $0.6 | $0.6 | $27.50 | $48.0K | 2.4K | 801 |

| DVN | PUT | TRADE | BEARISH | 06/18/26 | $6.7 | $6.6 | $6.7 | $37.50 | $44.2K | 9 | 67 |

About Devon Energy

Devon Energy is an oil and gas producer with acreage in several top US shale plays. While roughly two thirds of its production comes from the Permian Basin, it also holds a meaningful presence in the Anadarko, Eagle Ford, and Bakken basins. At the end of 2024, Devon reported net proved reserves of 2.2 billion barrels of oil equivalent. Net production averaged roughly 848,000 barrels of oil equivalent per day in 2024 at a ratio of 73% oil and natural gas liquids and 27% natural gas.

Following our analysis of the options activities associated with Devon Energy, we pivot to a closer look at the company's own performance.

Devon Energy's Current Market Status

- With a trading volume of 4,974,309, the price of DVN is down by -0.54%, reaching $34.28.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 54 days from now.

Professional Analyst Ratings for Devon Energy

In the last month, 3 experts released ratings on this stock with an average target price of $44.33.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from Wells Fargo keeps a Overweight rating on Devon Energy with a target price of $46.

* An analyst from Goldman Sachs has decided to maintain their Buy rating on Devon Energy, which currently sits at a price target of $43.

* Consistent in their evaluation, an analyst from Morgan Stanley keeps a Overweight rating on Devon Energy with a target price of $44.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Devon Energy, Benzinga Pro gives you real-time options trades alerts.