Market Whales and Their Recent Bets on ACHR Options

Deep-pocketed investors have adopted a bearish approach towards Archer Aviation (NYSE:ACHR), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in ACHR usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 15 extraordinary options activities for Archer Aviation. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 13% leaning bullish and 73% bearish. Among these notable options, 5 are puts, totaling $273,846, and 10 are calls, amounting to $402,190.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $9.5 to $16.0 for Archer Aviation over the recent three months.

Insights into Volume & Open Interest

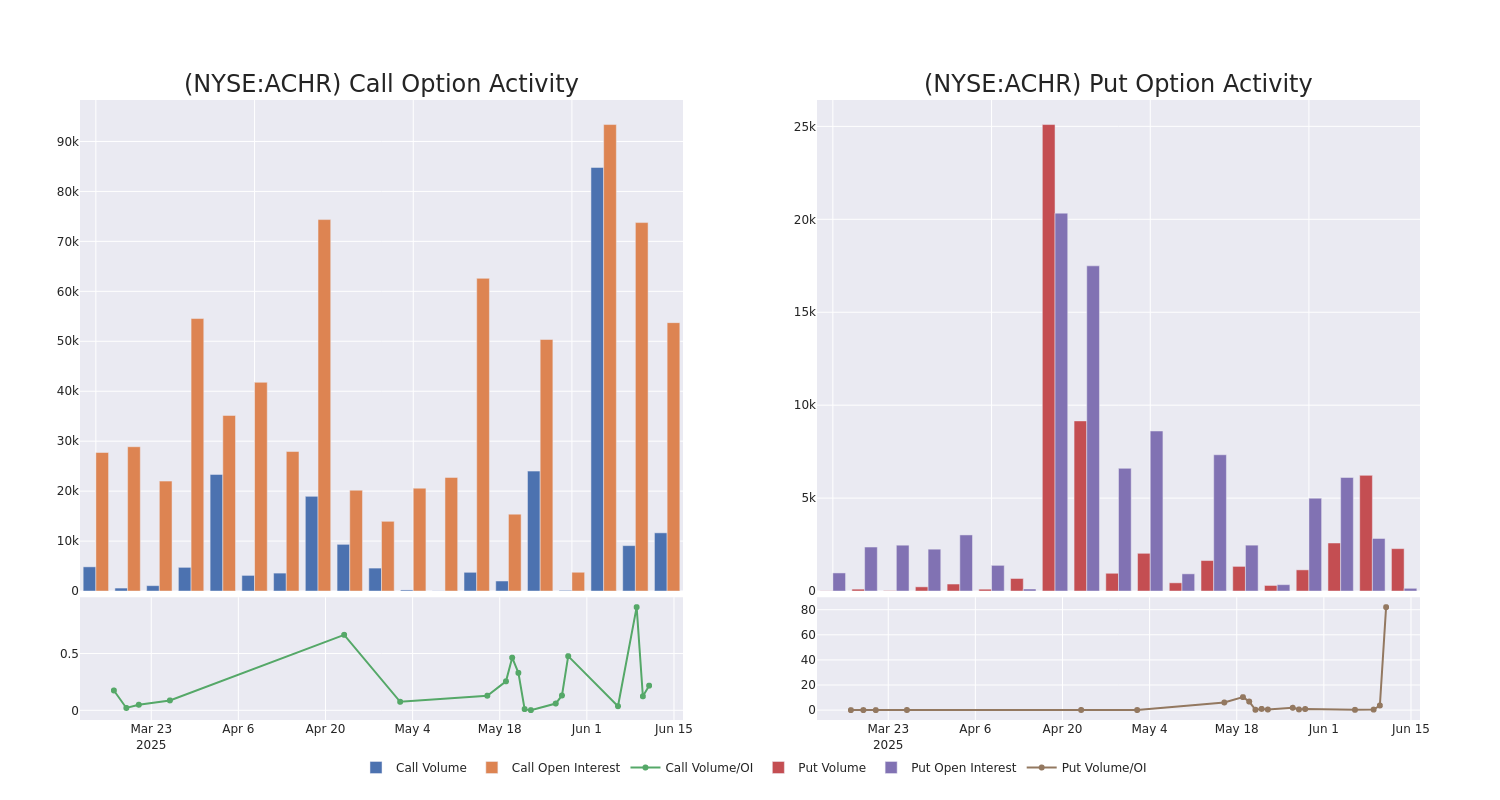

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

How Matt Maley Is Trading the Final Week of June—Live Sunday at 1 PM ET

With the Fed out of the way, traders are shifting focus to key macro data, tariff headlines, and rising geopolitical risk. Join Matt Maley as he shares the real trades he’s targeting this week—including how he plans to repeat his recent wins on SQQQ and GDX by staying nimble, tactical, and tuned into market signals. Register for free to attend.

This data can help you track the liquidity and interest for Archer Aviation's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Archer Aviation's whale activity within a strike price range from $9.5 to $16.0 in the last 30 days.

Archer Aviation Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ACHR | PUT | SWEEP | BULLISH | 01/16/26 | $5.65 | $5.6 | $5.6 | $16.00 | $146.7K | 4 | 272 |

| ACHR | CALL | TRADE | NEUTRAL | 01/16/26 | $3.85 | $3.75 | $3.8 | $10.00 | $114.0K | 19.2K | 341 |

| ACHR | CALL | SWEEP | NEUTRAL | 01/15/27 | $4.8 | $4.65 | $4.71 | $12.00 | $46.9K | 5.2K | 258 |

| ACHR | CALL | TRADE | BEARISH | 01/15/27 | $4.7 | $4.55 | $4.6 | $12.00 | $45.9K | 5.2K | 157 |

| ACHR | CALL | SWEEP | BEARISH | 06/20/25 | $0.35 | $0.34 | $0.34 | $13.00 | $36.7K | 8.5K | 5.0K |

About Archer Aviation

Archer Aviation Inc advances the benefits of sustainable air mobility. The company is engaged in designing and developing a fully electric vertical takeoff and landing eVTOL aircraft for use in UAM networks. It is creating an electric airline that moves people throughout cities in a quick, safe, sustainable, and cost-effective manner.

In light of the recent options history for Archer Aviation, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Archer Aviation Standing Right Now?

- With a trading volume of 19,249,950, the price of ACHR is up by 7.43%, reaching $12.22.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 57 days from now.

Professional Analyst Ratings for Archer Aviation

A total of 4 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $14.12.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from HC Wainwright & Co. persists with their Buy rating on Archer Aviation, maintaining a target price of $18.

* An analyst from Needham has revised its rating downward to Buy, adjusting the price target to $13.

* An analyst from HC Wainwright & Co. has revised its rating downward to Buy, adjusting the price target to $12.

* Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Overweight with a new price target of $13.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Archer Aviation, Benzinga Pro gives you real-time options trades alerts.

How Matt Maley Is Trading the Final Week of June—Live Sunday at 1 PM ET

With the Fed out of the way, traders are shifting focus to key macro data, tariff headlines, and rising geopolitical risk. Join Matt Maley as he shares the real trades he’s targeting this week—including how he plans to repeat his recent wins on SQQQ and GDX by staying nimble, tactical, and tuned into market signals. Register for free to attend.