Sea Unusual Options Activity

Investors with a lot of money to spend have taken a bearish stance on Sea (NYSE:SE).

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with SE, it often means somebody knows something is about to happen.

Today, Benzinga's options scanner spotted 9 options trades for Sea.

This isn't normal.

The overall sentiment of these big-money traders is split between 33% bullish and 44%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $45,500, and 8, calls, for a total amount of $3,474,568.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $100.0 to $240.0 for Sea during the past quarter.

Get Matt Maley’s Strategy for Trading This Week’s Volatility

With global tensions escalating, rate cut bets rising, and defensive sectors gaining steam, the market is shifting fast. Matt Maley’s Inner Circle gives you real-time access to how he’s positioning—using 35 years of Wall Street experience to trade volatility, spot sector rotations, and capitalize on macro-driven moves. See what Matt’s targeting this week and get his next trade idea here.

Volume & Open Interest Development

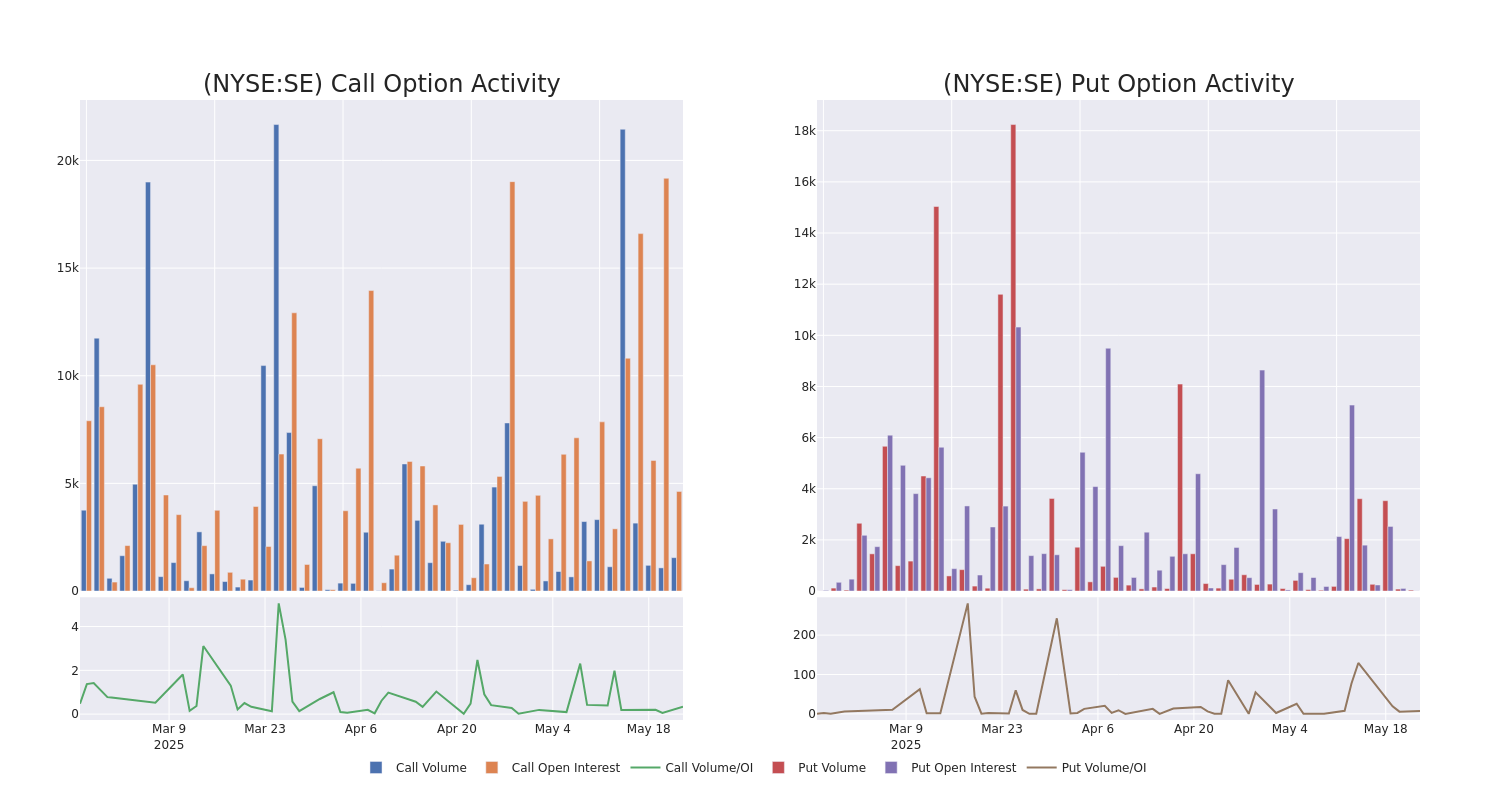

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Sea's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Sea's significant trades, within a strike price range of $100.0 to $240.0, over the past month.

Sea 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SE | CALL | SWEEP | BEARISH | 09/19/25 | $37.65 | $34.05 | $34.06 | $130.00 | $2.0M | 810 | 600 |

| SE | CALL | TRADE | BEARISH | 11/21/25 | $23.35 | $23.2 | $23.2 | $160.00 | $696.0K | 78 | 500 |

| SE | CALL | SWEEP | BEARISH | 11/21/25 | $23.25 | $23.2 | $23.2 | $160.00 | $464.0K | 78 | 0 |

| SE | CALL | TRADE | NEUTRAL | 01/16/26 | $6.15 | $5.7 | $5.9 | $240.00 | $88.5K | 36 | 200 |

| SE | PUT | TRADE | BEARISH | 11/21/25 | $18.2 | $18.05 | $18.2 | $160.00 | $45.5K | 5 | 36 |

About Sea

Sea started as a gaming business, Garena, but in 2015 expanded into e-commerce. Sea operates Southeast Asia's largest e-commerce company, Shopee, in terms of gross merchandise value. Shopee is a hybrid C2C and B2C marketplace platform operating in Indonesia, Taiwan, Vietnam, Thailand, Malaysia, the Philippines, and Brazil. For Garena, Free Fire is the key revenue generating game. Sea's third business, SeaMoney, provides lending, payment, digital banking, and insurance services.As of March 31, 2024, Forrest Xiaodong Li, the founder, chairman and CEO, owned 59.8% of voting power and 18.5% of issued shares. Tencent owned 18.2% of issued shares with no voting power.

Having examined the options trading patterns of Sea, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Sea Standing Right Now?

- With a trading volume of 2,085,374, the price of SE is down by -0.45%, reaching $159.96.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 81 days from now.

What The Experts Say On Sea

Over the past month, 4 industry analysts have shared their insights on this stock, proposing an average target price of $182.5.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Benchmark continues to hold a Buy rating for Sea, targeting a price of $180.

* In a positive move, an analyst from JP Morgan has upgraded their rating to Overweight and adjusted the price target to $190.

* An analyst from B of A Securities has revised its rating downward to Neutral, adjusting the price target to $160.

* Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on Sea with a target price of $200.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Sea, Benzinga Pro gives you real-time options trades alerts.

Volatility Watch: Matt Maley’s Strategy for Macro-Driven Moves

Two major economic reports drop just hours before this session—and they could ignite the next big market move. Join Matt Maley live Wednesday at 6 PM ET to see how he’s using macro pressure, mispriced volatility, and real-time signals to target fast trades across the market. The window of opportunity is open—learn how Matt’s trading it. Secure your free seat now