Check Out What Whales Are Doing With HPE

Deep-pocketed investors have adopted a bearish approach towards Hewlett Packard (NYSE:HPE), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in HPE usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 15 extraordinary options activities for Hewlett Packard. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 46% leaning bullish and 53% bearish. Among these notable options, 2 are puts, totaling $54,600, and 13 are calls, amounting to $730,435.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $12.0 to $18.0 for Hewlett Packard over the recent three months.

Live on Wednesday: Strategy That Delivered 195% Profit in a Crashing Market

Traders are scrambling as volatility surges and recession warnings flash. Join Chris Capre live on April 9 at 6 PM ET as he explains how he’s trading through this unraveling market—including the setup that just returned 195% profit. Register today.

Volume & Open Interest Development

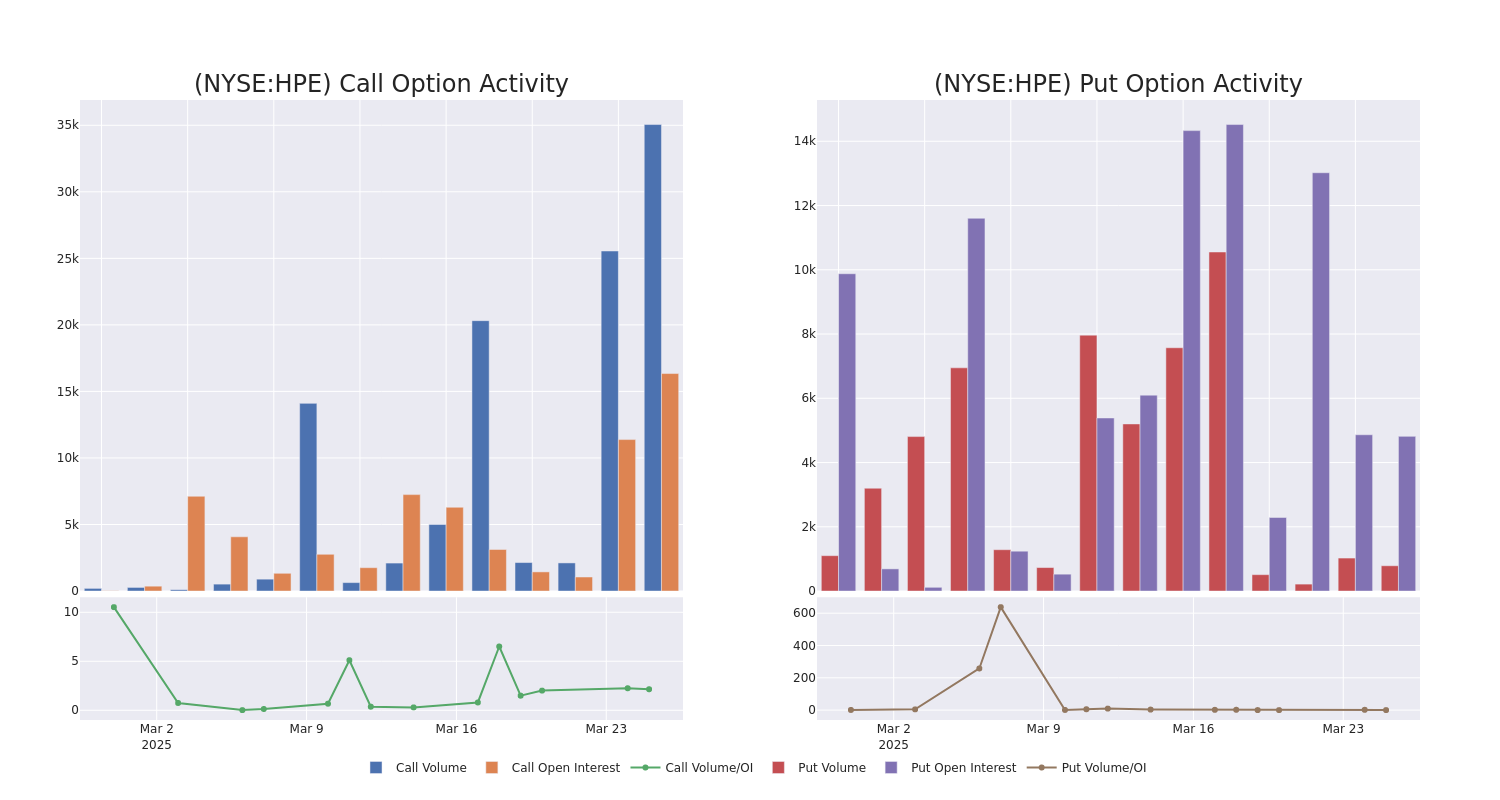

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Hewlett Packard's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Hewlett Packard's whale trades within a strike price range from $12.0 to $18.0 in the last 30 days.

Hewlett Packard Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HPE | CALL | TRADE | BEARISH | 05/16/25 | $0.41 | $0.38 | $0.39 | $18.00 | $308.1K | 13.4K | 15.9K |

| HPE | CALL | SWEEP | BEARISH | 06/18/26 | $5.55 | $5.45 | $5.45 | $12.00 | $74.6K | 28 | 138 |

| HPE | CALL | SWEEP | BEARISH | 09/19/25 | $1.31 | $1.3 | $1.3 | $18.00 | $40.3K | 2.8K | 936 |

| HPE | CALL | TRADE | BULLISH | 09/19/25 | $1.32 | $1.31 | $1.32 | $18.00 | $39.3K | 2.8K | 2.2K |

| HPE | CALL | TRADE | BEARISH | 04/11/25 | $1.67 | $1.66 | $1.66 | $15.00 | $33.0K | 89 | 400 |

About Hewlett Packard

Hewlett Packard Enterprise is an information technology vendor that provides hardware and software to enterprises. Its primary product lines are compute servers, storage arrays, and networking equipment; it also has a high-performance computing business. HPE's stated goal is to be a complete edge-to-cloud company. Its portfolio enables hybrid clouds and hyperconverged infrastructure. It uses a primarily outsourced manufacturing model and employs 60,000 people worldwide.

After a thorough review of the options trading surrounding Hewlett Packard, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Hewlett Packard

- Trading volume stands at 15,796,825, with HPE's price up by 0.27%, positioned at $16.52.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 70 days.

What The Experts Say On Hewlett Packard

5 market experts have recently issued ratings for this stock, with a consensus target price of $18.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from B of A Securities keeps a Buy rating on Hewlett Packard with a target price of $20.

* An analyst from Loop Capital has decided to maintain their Hold rating on Hewlett Packard, which currently sits at a price target of $16.

* Maintaining their stance, an analyst from Morgan Stanley continues to hold a Overweight rating for Hewlett Packard, targeting a price of $24.

* Consistent in their evaluation, an analyst from Wells Fargo keeps a Equal-Weight rating on Hewlett Packard with a target price of $17.

* Consistent in their evaluation, an analyst from Susquehanna keeps a Neutral rating on Hewlett Packard with a target price of $15.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Hewlett Packard, Benzinga Pro gives you real-time options trades alerts.

Turn Market Uncertainty Into Your Advantage

Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Just this month, he’s locked in trades with 100%–450% gains in a matter of days. Now, you can follow his trades for free for the next 7 days. Get Started Right Here.