A Look at Robert Half's Upcoming Earnings Report

Robert Half (NYSE:RHI) is set to give its latest quarterly earnings report on Wednesday, 2025-07-23. Here's what investors need to know before the announcement.

Analysts estimate that Robert Half will report an earnings per share (EPS) of $0.40.

Investors in Robert Half are eagerly awaiting the company's announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It's worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

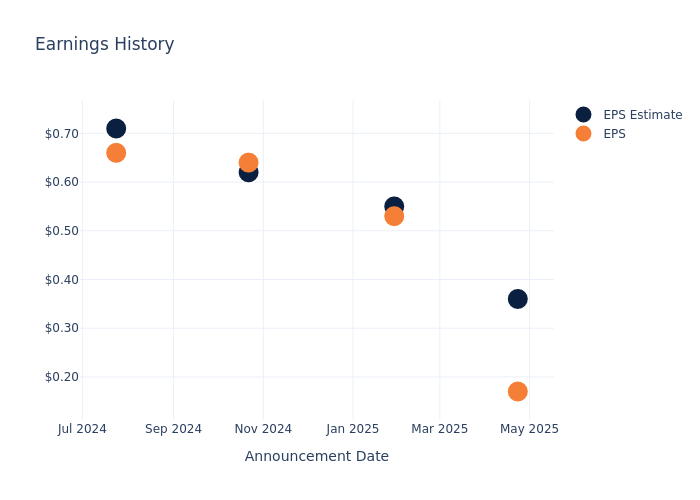

Earnings History Snapshot

During the last quarter, the company reported an EPS missed by $0.19, leading to a 3.1% drop in the share price on the subsequent day.

Here's a look at Robert Half's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.36 | 0.55 | 0.62 | 0.71 |

| EPS Actual | 0.17 | 0.53 | 0.64 | 0.66 |

| Price Change % | -3.0% | -7.000000000000001% | 3.0% | -8.0% |

Robert Half Share Price Analysis

Shares of Robert Half were trading at $41.8 as of July 21. Over the last 52-week period, shares are down 33.92%. Given that these returns are generally negative, long-term shareholders are likely a little upset going into this earnings release.

Analysts' Perspectives on Robert Half

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Robert Half.

Analysts have given Robert Half a total of 4 ratings, with the consensus rating being Neutral. The average one-year price target is $46.75, indicating a potential 11.84% upside.

Comparing Ratings with Peers

The analysis below examines the analyst ratings and average 1-year price targets of Korn Ferry, Trinet Group and First Advantage, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Korn Ferry, with an average 1-year price target of $78.0, suggesting a potential 86.6% upside.

- Analysts currently favor an Underperform trajectory for Trinet Group, with an average 1-year price target of $76.0, suggesting a potential 81.82% upside.

- Analysts currently favor an Neutral trajectory for First Advantage, with an average 1-year price target of $18.0, suggesting a potential 56.94% downside.

Summary of Peers Analysis

The peer analysis summary presents essential metrics for Korn Ferry, Trinet Group and First Advantage, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Robert Half | Neutral | -8.40% | $499.05M | 1.29% |

| Korn Ferry | Neutral | 2.84% | $637.22M | 3.47% |

| Trinet Group | Underperform | 0.78% | $279M | 128.79% |

| First Advantage | Neutral | 109.30% | $162.02M | -3.19% |

Key Takeaway:

Robert Half is positioned in the middle among its peers for Consensus rating. It ranks at the bottom for Revenue Growth, with a negative growth rate. In terms of Gross Profit, it falls in the middle range. However, it has the lowest Return on Equity compared to its peers.

Delving into Robert Half's Background

Robert Half Inc was founded in 1948, Robert Half provides temporary, permanent, and outcome-based staffing for both in-person and remote positions in the finance and accounting, technology, legal, marketing, and administrative fields. Its subsidiary consulting arm, Protiviti, specializes in technology, risk, auditing, and compliance matters. The firm generates its sales inside the U.S. and is one of the specialized firms in the fragmented U.S. staffing industry. The firm generates annual revenue of around $7 billion.

Robert Half's Economic Impact: An Analysis

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Negative Revenue Trend: Examining Robert Half's financials over 3 months reveals challenges. As of 31 March, 2025, the company experienced a decline of approximately -8.4% in revenue growth, reflecting a decrease in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Industrials sector.

Net Margin: Robert Half's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 1.28%, the company may face hurdles in effective cost management.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 1.29%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Robert Half's ROA stands out, surpassing industry averages. With an impressive ROA of 0.63%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Robert Half's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.18.

To track all earnings releases for Robert Half visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.