General Dynamics Earnings Preview

General Dynamics (NYSE:GD) is gearing up to announce its quarterly earnings on Wednesday, 2025-07-23. Here's a quick overview of what investors should know before the release.

Analysts are estimating that General Dynamics will report an earnings per share (EPS) of $3.50.

The announcement from General Dynamics is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It's worth noting for new investors that guidance can be a key determinant of stock price movements.

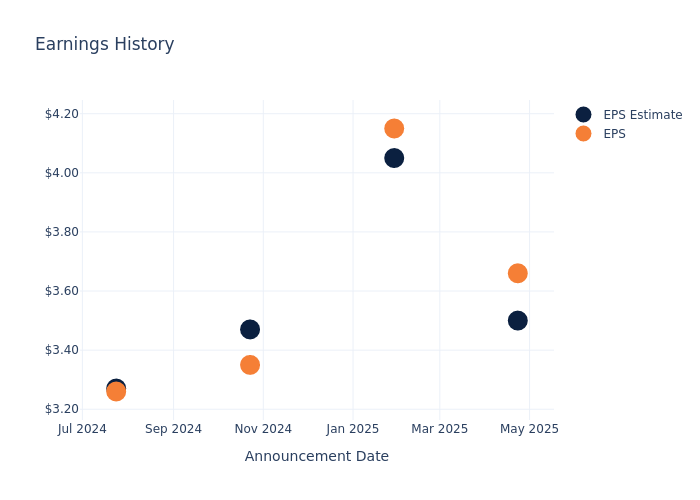

Earnings Track Record

Last quarter the company beat EPS by $0.16, which was followed by a 2.25% increase in the share price the next day.

Here's a look at General Dynamics's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 3.50 | 4.05 | 3.47 | 3.27 |

| EPS Actual | 3.66 | 4.15 | 3.35 | 3.26 |

| Price Change % | 2.0% | 2.0% | -1.0% | 2.0% |

General Dynamics Share Price Analysis

Shares of General Dynamics were trading at $297.05 as of July 21. Over the last 52-week period, shares are up 4.61%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Views on General Dynamics

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on General Dynamics.

Analysts have given General Dynamics a total of 6 ratings, with the consensus rating being Buy. The average one-year price target is $309.83, indicating a potential 4.3% upside.

Analyzing Ratings Among Peers

In this analysis, we delve into the analyst ratings and average 1-year price targets of Howmet Aerospace, Northrop Grumman and Axon Enterprise, three key industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Outperform trajectory for Howmet Aerospace, with an average 1-year price target of $179.75, suggesting a potential 39.49% downside.

- Analysts currently favor an Outperform trajectory for Northrop Grumman, with an average 1-year price target of $546.33, suggesting a potential 83.92% upside.

- Analysts currently favor an Buy trajectory for Axon Enterprise, with an average 1-year price target of $788.12, suggesting a potential 165.32% upside.

Analysis Summary for Peers

The peer analysis summary offers a detailed examination of key metrics for Howmet Aerospace, Northrop Grumman and Axon Enterprise, providing valuable insights into their respective standings within the industry and their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| General Dynamics | Buy | 13.90% | $1.89B | 4.49% |

| Howmet Aerospace | Outperform | 6.47% | $583M | 7.43% |

| Northrop Grumman | Outperform | -6.56% | $1.58B | 3.18% |

| Axon Enterprise | Buy | 31.26% | $365.74M | 3.60% |

Key Takeaway:

General Dynamics ranks at the top for Gross Profit and Return on Equity among its peers. It is in the middle for Revenue Growth.

About General Dynamics

General Dynamics is a defense contractor and business jet manufacturer. The firm's segments are aerospace, marine, combat systems, and technologies. General Dynamics' aerospace segment manufactures Gulfstream business jets and operates a global aircraft servicing operation. Combat systems produces land-based combat vehicles such as the M1 Abrams tank and Stryker armored personnel carrier, as well as munitions. The marine segment builds and services nuclear-powered submarines, destroyers, and other ships. The technologies segment contains two main units: an IT business that primarily serves the government market and a mission systems business that focuses on products that provide command, control, computing, intelligence, surveillance, and reconnaissance capabilities to the military.

General Dynamics: A Financial Overview

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Revenue Growth: General Dynamics's revenue growth over a period of 3 months has been noteworthy. As of 31 March, 2025, the company achieved a revenue growth rate of approximately 13.9%. This indicates a substantial increase in the company's top-line earnings. When compared to others in the Industrials sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: General Dynamics's net margin excels beyond industry benchmarks, reaching 8.13%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): General Dynamics's ROE excels beyond industry benchmarks, reaching 4.49%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): General Dynamics's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 1.77%, the company showcases efficient use of assets and strong financial health.

Debt Management: General Dynamics's debt-to-equity ratio is below the industry average at 0.52, reflecting a lower dependency on debt financing and a more conservative financial approach.

To track all earnings releases for General Dynamics visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.