A Peek at SAP's Future Earnings

SAP (NYSE:SAP) is set to give its latest quarterly earnings report on Tuesday, 2025-07-22. Here's what investors need to know before the announcement.

Analysts estimate that SAP will report an earnings per share (EPS) of $1.63.

The announcement from SAP is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It's worth noting for new investors that guidance can be a key determinant of stock price movements.

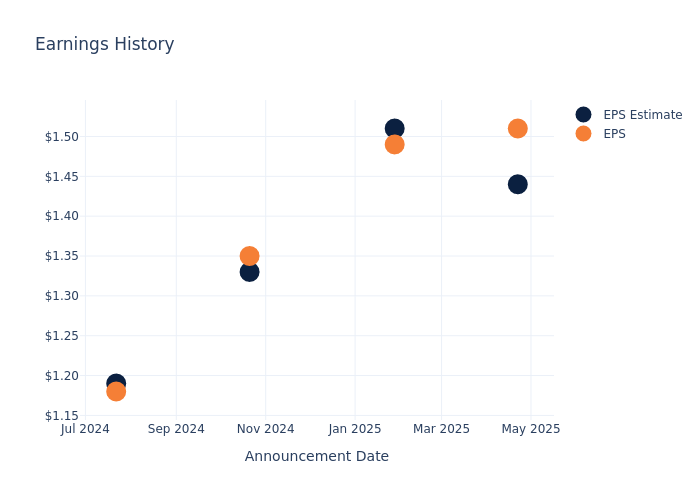

Earnings Track Record

Last quarter the company beat EPS by $0.07, which was followed by a 7.56% increase in the share price the next day.

Here's a look at SAP's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 1.44 | 1.51 | 1.33 | 1.19 |

| EPS Actual | 1.51 | 1.49 | 1.35 | 1.18 |

| Price Change % | 8.0% | 1.0% | 1.0% | 7.000000000000001% |

Stock Performance

Shares of SAP were trading at $305.97 as of July 18. Over the last 52-week period, shares are up 42.49%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Observations about SAP

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on SAP.

The consensus rating for SAP is Outperform, derived from 4 analyst ratings. An average one-year price target of $322.0 implies a potential 5.24% upside.

Peer Ratings Comparison

This comparison focuses on the analyst ratings and average 1-year price targets of Palantir Technologies, Salesforce and Intuit, three major players in the industry, shedding light on their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Palantir Technologies, with an average 1-year price target of $106.64, suggesting a potential 65.15% downside.

- Analysts currently favor an Outperform trajectory for Salesforce, with an average 1-year price target of $332.86, suggesting a potential 8.79% upside.

- Analysts currently favor an Outperform trajectory for Intuit, with an average 1-year price target of $817.19, suggesting a potential 167.08% upside.

Peer Analysis Summary

In the peer analysis summary, key metrics for Palantir Technologies, Salesforce and Intuit are highlighted, providing an understanding of their respective standings within the industry and offering insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| SAP | Outperform | 12.09% | $6.61B | 3.91% |

| Palantir Technologies | Neutral | 39.34% | $710.88M | 4.11% |

| Salesforce | Outperform | 7.62% | $7.56B | 2.53% |

| Intuit | Outperform | 15.10% | $6.56B | 14.81% |

Key Takeaway:

SAP ranks at the top for Gross Profit and Return on Equity among its peers. It is in the middle for Revenue Growth.

Delving into SAP's Background

Founded in Germany in 1972 by former IBM employees, SAP is the world's largest provider of enterprise application software. Known as the leader in enterprise resource planning software, SAP's portfolio also includes software for supply chain management, procurement, travel and expense management, and customer relationship management, among others. The company operates in more than 180 countries and has more than 400,000 customers, approximately 80% of which are small to medium-size enterprises.

Financial Milestones: SAP's Journey

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Revenue Growth: SAP displayed positive results in 3 months. As of 31 March, 2025, the company achieved a solid revenue growth rate of approximately 12.09%. This indicates a notable increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: SAP's net margin is impressive, surpassing industry averages. With a net margin of 19.75%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 3.91%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): SAP's ROA stands out, surpassing industry averages. With an impressive ROA of 2.38%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.22.

To track all earnings releases for SAP visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.