A Peek at Medpace Hldgs's Future Earnings

Medpace Hldgs (NASDAQ:MEDP) will release its quarterly earnings report on Monday, 2025-07-21. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate Medpace Hldgs to report an earnings per share (EPS) of $2.99.

The announcement from Medpace Hldgs is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It's worth noting for new investors that guidance can be a key determinant of stock price movements.

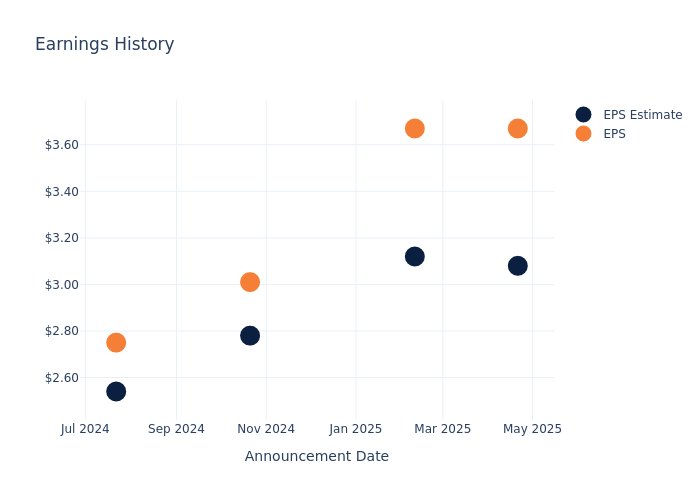

Overview of Past Earnings

The company's EPS beat by $0.59 in the last quarter, leading to a 2.32% drop in the share price on the following day.

Here's a look at Medpace Hldgs's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 3.08 | 3.12 | 2.78 | 2.54 |

| EPS Actual | 3.67 | 3.67 | 3.01 | 2.75 |

| Price Change % | -2.0% | -8.0% | -7.000000000000001% | -18.0% |

Medpace Hldgs Share Price Analysis

Shares of Medpace Hldgs were trading at $319.16 as of July 17. Over the last 52-week period, shares are down 28.02%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

Analysts' Perspectives on Medpace Hldgs

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Medpace Hldgs.

A total of 3 analyst ratings have been received for Medpace Hldgs, with the consensus rating being Neutral. The average one-year price target stands at $304.33, suggesting a potential 4.65% downside.

Comparing Ratings Among Industry Peers

The following analysis focuses on the analyst ratings and average 1-year price targets of Avantor, Bio-Techne and Tempus AI, three prominent industry players, providing insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Avantor, with an average 1-year price target of $15.83, suggesting a potential 95.04% downside.

- Analysts currently favor an Buy trajectory for Bio-Techne, with an average 1-year price target of $67.75, suggesting a potential 78.77% downside.

- Analysts currently favor an Buy trajectory for Tempus AI, with an average 1-year price target of $68.5, suggesting a potential 78.54% downside.

Insights: Peer Analysis

The peer analysis summary provides a snapshot of key metrics for Avantor, Bio-Techne and Tempus AI, illuminating their respective standings within the industry. These metrics offer valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Medpace Hldgs | Neutral | 9.30% | $178.35M | 16.15% |

| Avantor | Neutral | -5.86% | $534.90M | 1.07% |

| Bio-Techne | Buy | 4.20% | $214.56M | 1.10% |

| Tempus AI | Buy | 75.38% | $155.20M | -35.57% |

Key Takeaway:

Medpace Hldgs ranks highest in Gross Profit among its peers. It is in the middle for Revenue Growth and Return on Equity.

Discovering Medpace Hldgs: A Closer Look

Medpace is a late-stage contract research organization that provides full-service drug-development and clinical trial services to small and midsize biotechnology, pharmaceutical, and medical-device firms. It also offers ancillary services such as bioanalytical laboratory services and imaging capabilities. The company was founded over 30 years ago and has over 5,400 employees across 40 countries. Medpace is headquartered in Cincinnati and its operations are principally based in the US, but it also operates in Europe, Asia, South America, Africa, and Australia. Cinven, a global private equity firm, acquired Medpace for $915 million in 2014 and exited its investment in 2018.

Financial Milestones: Medpace Hldgs's Journey

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Positive Revenue Trend: Examining Medpace Hldgs's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 9.3% as of 31 March, 2025, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Health Care sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 20.52%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Medpace Hldgs's ROE stands out, surpassing industry averages. With an impressive ROE of 16.15%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Medpace Hldgs's ROA stands out, surpassing industry averages. With an impressive ROA of 5.73%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Medpace Hldgs's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.21.

To track all earnings releases for Medpace Hldgs visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.