Earnings Preview For PagerDuty

PagerDuty (NYSE:PD) is gearing up to announce its quarterly earnings on Thursday, 2025-05-29. Here's a quick overview of what investors should know before the release.

Analysts are estimating that PagerDuty will report an earnings per share (EPS) of $0.19.

The market awaits PagerDuty's announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It's important for new investors to understand that guidance can be a significant driver of stock prices.

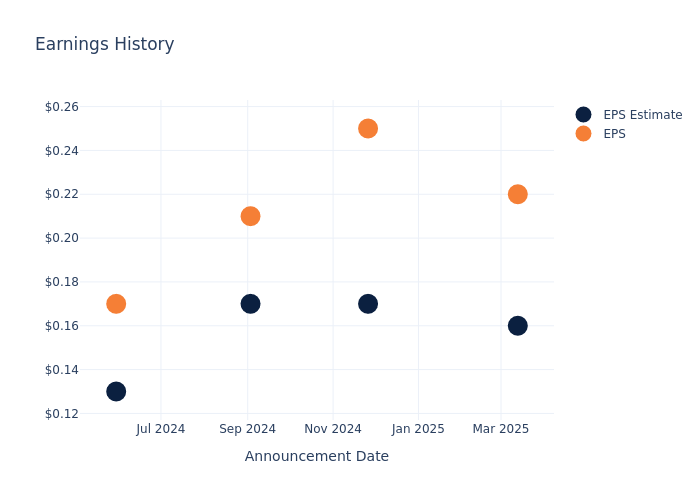

Performance in Previous Earnings

Last quarter the company beat EPS by $0.06, which was followed by a 17.75% increase in the share price the next day.

Here's a look at PagerDuty's past performance and the resulting price change:

| Quarter | Q4 2025 | Q3 2025 | Q2 2025 | Q1 2025 |

|---|---|---|---|---|

| EPS Estimate | 0.16 | 0.17 | 0.17 | 0.13 |

| EPS Actual | 0.22 | 0.25 | 0.21 | 0.17 |

| Price Change % | 18.0% | 0.0% | -1.0% | 6.0% |

Performance of PagerDuty Shares

Shares of PagerDuty were trading at $16.2 as of May 27. Over the last 52-week period, shares are down 10.78%. Given that these returns are generally negative, long-term shareholders are likely unhappy going into this earnings release.

Analyst Views on PagerDuty

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on PagerDuty.

Analysts have provided PagerDuty with 6 ratings, resulting in a consensus rating of Neutral. The average one-year price target stands at $20.67, suggesting a potential 27.59% upside.

Peer Ratings Comparison

This comparison focuses on the analyst ratings and average 1-year price targets of SEMrush Hldgs, Olo and TeraWulf, three major players in the industry, shedding light on their relative performance expectations and market positioning.

- Analysts currently favor an Outperform trajectory for SEMrush Hldgs, with an average 1-year price target of $13.67, suggesting a potential 15.62% downside.

- Analysts currently favor an Buy trajectory for Olo, with an average 1-year price target of $10.0, suggesting a potential 38.27% downside.

- Analysts currently favor an Buy trajectory for TeraWulf, with an average 1-year price target of $5.8, suggesting a potential 64.2% downside.

Analysis Summary for Peers

The peer analysis summary presents essential metrics for SEMrush Hldgs, Olo and TeraWulf, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| PagerDuty | Neutral | 9.30% | $101.47M | -8.78% |

| SEMrush Hldgs | Outperform | 22.38% | $85.15M | 0.32% |

| Olo | Buy | 21.30% | $44.31M | 0.26% |

| TeraWulf | Buy | -18.92% | $9.85M | -31.00% |

Key Takeaway:

PagerDuty ranks in the middle for consensus rating. It is at the bottom for revenue growth and gross profit, but at the top for return on equity among its peers.

Unveiling the Story Behind PagerDuty

PagerDuty Inc is a digital operations management platform that manages urgent and mission-critical work for a modern, digital business. Its PagerDuty Operations Cloud combines artificial intelligence (AI) operations (AIOps), automation, customer service operations, and incident management with a generative AI assistant to create a flexible, resilient, and scalable platform to protect revenue and improve customer experience, improve operational efficiency, and mitigate the risk of operational failures. The company generates revenue predominantly from cloud-hosted software subscription fees and term-license software subscription fees. Geographically, the firm derives a majority of its revenue from the United States and the rest from International markets.

Unraveling the Financial Story of PagerDuty

Market Capitalization: Positioned above industry average, the company's market capitalization underscores its superiority in size, indicative of a strong market presence.

Revenue Growth: PagerDuty displayed positive results in 3 months. As of 31 January, 2025, the company achieved a solid revenue growth rate of approximately 9.3%. This indicates a notable increase in the company's top-line earnings. When compared to others in the Information Technology sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: PagerDuty's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of -8.73%, the company may face hurdles in effective cost management.

Return on Equity (ROE): PagerDuty's ROE excels beyond industry benchmarks, reaching -8.78%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): PagerDuty's ROA excels beyond industry benchmarks, reaching -1.18%. This signifies efficient management of assets and strong financial health.

Debt Management: PagerDuty's debt-to-equity ratio stands notably higher than the industry average, reaching 3.57. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

To track all earnings releases for PagerDuty visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.