Floor & Decor Hldgs Stock: A Deep Dive Into Analyst Perspectives (12 Ratings)

Floor & Decor Hldgs (NYSE:FND) has been analyzed by 12 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 3 | 5 | 0 | 2 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 1 | 0 | 0 |

| 3M Ago | 2 | 2 | 4 | 0 | 2 |

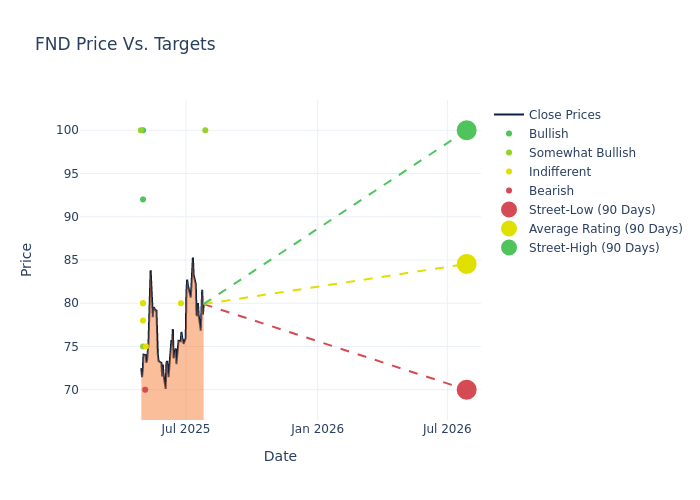

In the assessment of 12-month price targets, analysts unveil insights for Floor & Decor Hldgs, presenting an average target of $83.33, a high estimate of $100.00, and a low estimate of $70.00. Experiencing a 12.51% decline, the current average is now lower than the previous average price target of $95.25.

Diving into Analyst Ratings: An In-Depth Exploration

The standing of Floor & Decor Hldgs among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Joseph Feldman | Telsey Advisory Group | Maintains | Outperform | $100.00 | $100.00 |

| Greg Melich | Evercore ISI Group | Lowers | In-Line | $80.00 | $85.00 |

| Anthony Chukumba | Loop Capital | Lowers | Hold | $75.00 | $95.00 |

| Kate McShane | Goldman Sachs | Lowers | Sell | $70.00 | $81.00 |

| Seth Sigman | Barclays | Lowers | Equal-Weight | $78.00 | $91.00 |

| Zachary Fadem | Wells Fargo | Lowers | Overweight | $75.00 | $80.00 |

| David Bellinger | Mizuho | Lowers | Neutral | $80.00 | $100.00 |

| Kate McShane | Goldman Sachs | Lowers | Sell | $70.00 | $81.00 |

| Steven Forbes | Guggenheim | Lowers | Buy | $100.00 | $115.00 |

| Peter Keith | Piper Sandler | Lowers | Neutral | $80.00 | $90.00 |

| W. Andrew Carter | Stifel | Lowers | Buy | $92.00 | $110.00 |

| Joseph Feldman | Telsey Advisory Group | Lowers | Outperform | $100.00 | $115.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Floor & Decor Hldgs. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Floor & Decor Hldgs compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Floor & Decor Hldgs's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Floor & Decor Hldgs's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Floor & Decor Hldgs analyst ratings.

Get to Know Floor & Decor Hldgs Better

Floor & Decor Holdings Inc operates as a specialty retailer in the hard surface flooring market. Its stores offer a range of tile, wood, laminate, and natural stone flooring products, as well as decorative and installation accessories at everyday low prices. It appeals to a variety of customers including professional installers, commercial businesses, Do It Yourself (DIY) customers, and customers who buy the products for professional installation. Geographically, the group has a presence in the United States region and also offers its product through an e-commerce site.

Floor & Decor Hldgs's Economic Impact: An Analysis

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Revenue Growth: Floor & Decor Hldgs displayed positive results in 3M. As of 31 March, 2025, the company achieved a solid revenue growth rate of approximately 5.78%. This indicates a notable increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Consumer Discretionary sector.

Net Margin: Floor & Decor Hldgs's net margin is impressive, surpassing industry averages. With a net margin of 4.21%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 2.23%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Floor & Decor Hldgs's ROA stands out, surpassing industry averages. With an impressive ROA of 0.94%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: With a below-average debt-to-equity ratio of 0.88, Floor & Decor Hldgs adopts a prudent financial strategy, indicating a balanced approach to debt management.

What Are Analyst Ratings?

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for FND

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Loop Capital | Maintains | Hold | |

| Feb 2022 | Telsey Advisory Group | Maintains | Outperform | |

| Feb 2022 | Wells Fargo | Maintains | Overweight |

Posted-In: BZI-AARAnalyst Ratings