Public Service Enterprise Stock: A Deep Dive Into Analyst Perspectives (8 Ratings)

In the latest quarter, 8 analysts provided ratings for Public Service Enterprise (NYSE:PEG), showcasing a mix of bullish and bearish perspectives.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 3 | 2 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 1 | 0 | 2 | 0 | 0 |

| 2M Ago | 0 | 1 | 0 | 0 | 0 |

| 3M Ago | 1 | 2 | 0 | 0 | 0 |

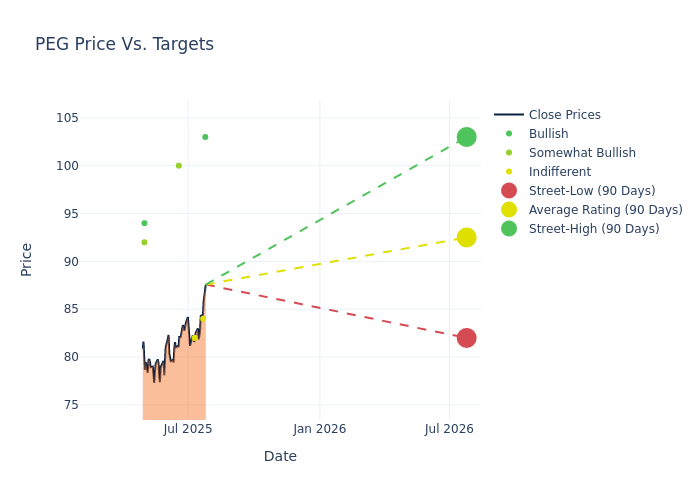

Analysts have set 12-month price targets for Public Service Enterprise, revealing an average target of $94.12, a high estimate of $103.00, and a low estimate of $82.00. Observing a 0.53% increase, the current average has risen from the previous average price target of $93.62.

Breaking Down Analyst Ratings: A Detailed Examination

A clear picture of Public Service Enterprise's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| William Appicelli | UBS | Raises | Buy | $103.00 | $97.00 |

| James Thalacker | BMO Capital | Raises | Market Perform | $84.00 | $83.00 |

| Nicholas Campanella | Barclays | Lowers | Equal-Weight | $82.00 | $83.00 |

| William Appicelli | UBS | Raises | Buy | $97.00 | $86.00 |

| David Arcaro | Morgan Stanley | Lowers | Overweight | $100.00 | $101.00 |

| David Arcaro | Morgan Stanley | Lowers | Overweight | $101.00 | $102.00 |

| Shahriar Pourreza | Guggenheim | Lowers | Buy | $94.00 | $98.00 |

| Greg Gordon | Evercore ISI Group | Lowers | Outperform | $92.00 | $99.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Public Service Enterprise. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Public Service Enterprise compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Public Service Enterprise's stock. This analysis reveals shifts in analysts' expectations over time.

Capture valuable insights into Public Service Enterprise's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Public Service Enterprise analyst ratings.

Discovering Public Service Enterprise: A Closer Look

Public Service Enterprise Group is the holding company for a regulated utility (PSE&G) and PSEG Power, which owns all or a share of three nuclear plans and clean energy projects. PSE&G provides regulated gas and electricity delivery services in New Jersey to a combined 4.3 million customers. Public Service Enterprise Group also operates the Long Island Power Authority system. In 2022, the company sold its gas and oil power plants in the mid-Atlantic, New York, and the Northeast.

A Deep Dive into Public Service Enterprise's Financials

Market Capitalization Analysis: The company's market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Revenue Growth: Public Service Enterprise displayed positive results in 3M. As of 31 March, 2025, the company achieved a solid revenue growth rate of approximately 16.74%. This indicates a notable increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Utilities sector.

Net Margin: Public Service Enterprise's net margin excels beyond industry benchmarks, reaching 18.28%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 3.88%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Public Service Enterprise's ROA stands out, surpassing industry averages. With an impressive ROA of 1.07%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Public Service Enterprise's debt-to-equity ratio is below the industry average at 1.44, reflecting a lower dependency on debt financing and a more conservative financial approach.

How Are Analyst Ratings Determined?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for PEG

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jan 2022 | Evercore ISI Group | Upgrades | In-Line | Outperform |

| Jan 2022 | Keybanc | Downgrades | Overweight | Sector Weight |

| Jan 2022 | JP Morgan | Upgrades | Neutral | Overweight |

Posted-In: BZI-AARAnalyst Ratings