A Glimpse Into The Expert Outlook On Atlantic Union Bankshares Through 4 Analysts

In the latest quarter, 4 analysts provided ratings for Atlantic Union Bankshares (NYSE:AUB), showcasing a mix of bullish and bearish perspectives.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 1 | 1 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 0 | 0 | 0 | 0 |

| 3M Ago | 1 | 0 | 1 | 0 | 0 |

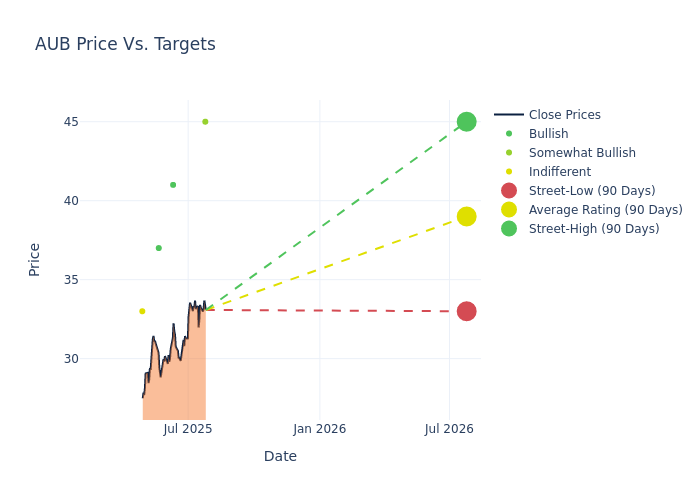

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $39.0, along with a high estimate of $45.00 and a low estimate of $33.00. A negative shift in sentiment is evident as analysts have decreased the average price target by 4.88%.

Analyzing Analyst Ratings: A Detailed Breakdown

An in-depth analysis of recent analyst actions unveils how financial experts perceive Atlantic Union Bankshares. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Stephen Scouten | Piper Sandler | Lowers | Overweight | $45.00 | $46.00 |

| Steve Moss | Raymond James | Raises | Strong Buy | $41.00 | $37.00 |

| David Chiaverini | Jefferies | Announces | Buy | $37.00 | - |

| Catherine Mealor | Keefe, Bruyette & Woods | Lowers | Market Perform | $33.00 | $40.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Atlantic Union Bankshares. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Atlantic Union Bankshares compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Atlantic Union Bankshares's stock. This comparison reveals trends in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Atlantic Union Bankshares's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Atlantic Union Bankshares analyst ratings.

Delving into Atlantic Union Bankshares's Background

Atlantic Union Bankshares Corp is a financial holding company and a bank holding company. Through its community bank subsidiary, the company provides financial services, including banking, trust, and wealth management. The bank is a full-service community bank offering consumers and businesses a wide range of banking and related financial services, including checking, savings, certificates of deposit, and other depository services, as well as loans for commercial, industrial, residential mortgage, and consumer purposes. The company operates through two reportable operating segments: Wholesale Banking and Consumer Banking, with corporate support functions such as corporate treasury and others included in Corporate Other. It derives maximum revenue from Wholesale Banking.

Breaking Down Atlantic Union Bankshares's Financial Performance

Market Capitalization Analysis: The company's market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Positive Revenue Trend: Examining Atlantic Union Bankshares's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 23.26% as of 31 March, 2025, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Financials sector.

Net Margin: Atlantic Union Bankshares's net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of 22.09%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Atlantic Union Bankshares's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 1.48%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Atlantic Union Bankshares's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 0.19%, the company may face hurdles in achieving optimal financial performance.

Debt Management: Atlantic Union Bankshares's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.13.

What Are Analyst Ratings?

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for AUB

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jan 2022 | Stephens & Co. | Maintains | Overweight | |

| Dec 2021 | Piper Sandler | Upgrades | Neutral | Overweight |

| Feb 2021 | Seaport Global | Initiates Coverage On | Buy |

Posted-In: BZI-AARAnalyst Ratings