Expert Outlook: Advance Auto Parts Through The Eyes Of 18 Analysts

Ratings for Advance Auto Parts (NYSE:AAP) were provided by 18 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 0 | 16 | 1 | 1 |

| Last 30D | 0 | 0 | 3 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 0 | 0 | 4 | 0 | 1 |

| 3M Ago | 0 | 0 | 8 | 1 | 0 |

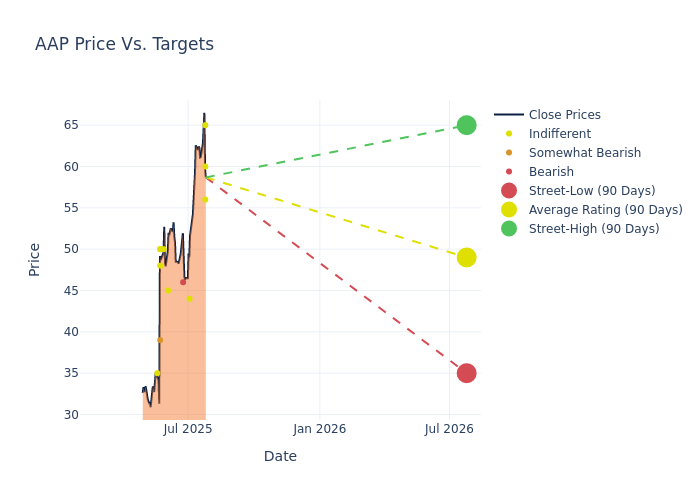

Analysts have set 12-month price targets for Advance Auto Parts, revealing an average target of $48.11, a high estimate of $65.00, and a low estimate of $35.00. Observing a 14.55% increase, the current average has risen from the previous average price target of $42.00.

Diving into Analyst Ratings: An In-Depth Exploration

A comprehensive examination of how financial experts perceive Advance Auto Parts is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Steven Zaccone | Citigroup | Raises | Neutral | $60.00 | $49.00 |

| Michael Baker | DA Davidson | Raises | Neutral | $65.00 | $47.00 |

| Greg Melich | Evercore ISI Group | Raises | In-Line | $56.00 | $52.00 |

| David Bellinger | Mizuho | Raises | Neutral | $44.00 | $38.00 |

| Greg Melich | Evercore ISI Group | Raises | In-Line | $52.00 | $50.00 |

| Kate McShane | Goldman Sachs | Lowers | Sell | $46.00 | $48.00 |

| Greg Melich | Evercore ISI Group | Raises | In-Line | $50.00 | $45.00 |

| Sam Hudson | Redburn Atlantic | Raises | Neutral | $45.00 | $28.00 |

| Scott Stember | Roth Capital | Raises | Neutral | $50.00 | $40.00 |

| Michael Lasser | UBS | Raises | Neutral | $50.00 | $36.00 |

| Michael Baker | DA Davidson | Raises | Neutral | $47.00 | $45.00 |

| Elizabeth Suzuki | B of A Securities | Raises | Underperform | $39.00 | $33.00 |

| Kate McShane | Goldman Sachs | Raises | Neutral | $48.00 | $43.00 |

| Tristan Thomas-Martin | BMO Capital | Raises | Market Perform | $50.00 | $40.00 |

| Simeon Gutman | Morgan Stanley | Raises | Equal-Weight | $48.00 | $45.00 |

| Greg Melich | Evercore ISI Group | Raises | In-Line | $45.00 | $35.00 |

| Zachary Fadem | Wells Fargo | Lowers | Equal-Weight | $35.00 | $40.00 |

| Michael Lasser | UBS | Lowers | Neutral | $36.00 | $42.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Advance Auto Parts. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Advance Auto Parts compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Advance Auto Parts's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Advance Auto Parts's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Advance Auto Parts analyst ratings.

Get to Know Advance Auto Parts Better

Advance Auto Parts is a leading auto-parts retailer in North America with more than 4,000 store and branch locations. About half of the firm's sales are geared toward the professional channel, with the remaining sales in the do-it-yourself market. Through its vast store footprint and distribution network, Advance manages thousands of stock-keeping units for various vehicle makes and models. The retailer primarily competes on the basis of inventory availability and service speed, making the operating efficiency of its hub-and-spoke distribution model critical to meeting customer needs.

Unraveling the Financial Story of Advance Auto Parts

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Decline in Revenue: Over the 3M period, Advance Auto Parts faced challenges, resulting in a decline of approximately -6.82% in revenue growth as of 31 March, 2025. This signifies a reduction in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Consumer Discretionary sector.

Net Margin: Advance Auto Parts's net margin is impressive, surpassing industry averages. With a net margin of 0.93%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Advance Auto Parts's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.1% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Advance Auto Parts's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 0.22% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 1.67.

Analyst Ratings: What Are They?

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for AAP

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Citigroup | Maintains | Buy | |

| Feb 2022 | Morgan Stanley | Maintains | Equal-Weight | |

| Feb 2022 | Wells Fargo | Maintains | Equal-Weight |

Posted-In: BZI-AARAnalyst Ratings