Assessing Henry Schein: Insights From 6 Financial Analysts

Henry Schein (NASDAQ:HSIC) underwent analysis by 6 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 2 | 4 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 2 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 2 | 1 | 0 | 0 |

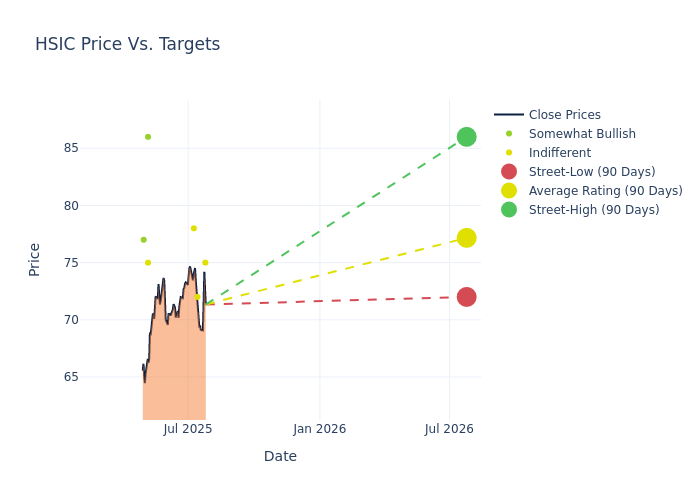

In the assessment of 12-month price targets, analysts unveil insights for Henry Schein, presenting an average target of $77.17, a high estimate of $86.00, and a low estimate of $72.00. This current average has decreased by 4.93% from the previous average price target of $81.17.

Analyzing Analyst Ratings: A Detailed Breakdown

In examining recent analyst actions, we gain insights into how financial experts perceive Henry Schein. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Jonathan Block | Stifel | Lowers | Hold | $75.00 | $80.00 |

| Jeff Johnson | Baird | Lowers | Neutral | $72.00 | $82.00 |

| Ross Muken | Evercore ISI Group | Raises | In-Line | $78.00 | $72.00 |

| Vik Chopra | Wells Fargo | Lowers | Equal-Weight | $75.00 | $80.00 |

| Michael Petusky | Barrington Research | Lowers | Outperform | $86.00 | $90.00 |

| Jason Bednar | Piper Sandler | Lowers | Overweight | $77.00 | $83.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Henry Schein. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Henry Schein compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Henry Schein's stock. This comparison reveals trends in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Henry Schein's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Henry Schein analyst ratings.

All You Need to Know About Henry Schein

Henry Schein Inc is a solutions company for healthcare professionals powered by a network of people and technology. The company is a provider of healthcare products and services to office-based dental and medical practitioners, as well as alternate sites of care. The company's reportable segments are Global Distribution and Value-Added Services; Global Specialty Products; and Global Technology. It generates the majority of its revenue from the Global Distribution and Value-Added Services segment, which includes distribution to the dental and medical markets of national brand and corporate brand merchandise, as well as equipment and related technical services.

Understanding the Numbers: Henry Schein's Finances

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Revenue Growth: Henry Schein's revenue growth over a period of 3M has faced challenges. As of 31 March, 2025, the company experienced a revenue decline of approximately -0.13%. This indicates a decrease in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Health Care sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 3.47%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Henry Schein's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 3.28%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Henry Schein's ROA excels beyond industry benchmarks, reaching 1.06%. This signifies efficient management of assets and strong financial health.

Debt Management: Henry Schein's debt-to-equity ratio is below the industry average. With a ratio of 0.97, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

The Basics of Analyst Ratings

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for HSIC

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Morgan Stanley | Maintains | Underweight | |

| Feb 2022 | Credit Suisse | Maintains | Outperform | |

| Jan 2022 | Morgan Stanley | Initiates Coverage On | Underweight |

Posted-In: BZI-AARAnalyst Ratings