Where Mattel Stands With Analysts

Providing a diverse range of perspectives from bullish to bearish, 6 analysts have published ratings on Mattel (NASDAQ:MAT) in the last three months.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 0 | 2 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 0 | 0 | 0 | 0 |

| 3M Ago | 3 | 0 | 1 | 0 | 0 |

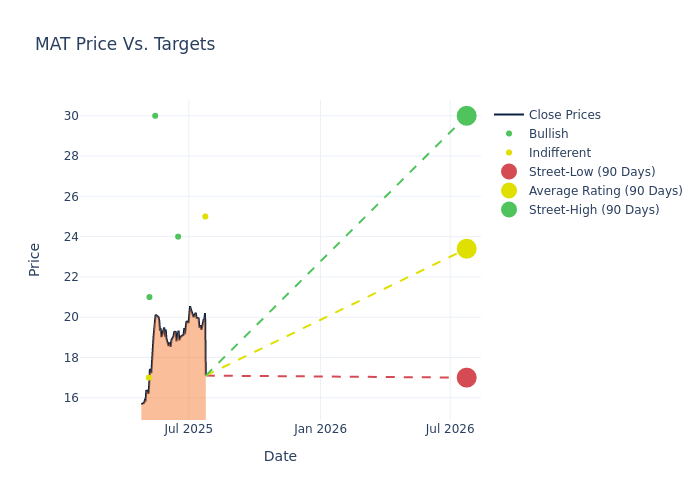

In the assessment of 12-month price targets, analysts unveil insights for Mattel, presenting an average target of $23.17, a high estimate of $30.00, and a low estimate of $17.00. Observing a 3.76% increase, the current average has risen from the previous average price target of $22.33.

Interpreting Analyst Ratings: A Closer Look

The perception of Mattel by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Christopher Horvers | JP Morgan | Raises | Neutral | $25.00 | $23.00 |

| James Hardiman | Citigroup | Raises | Buy | $24.00 | $22.00 |

| Michael Baker | DA Davidson | Maintains | Buy | $30.00 | $30.00 |

| Stephen Laszczyk | Goldman Sachs | Lowers | Buy | $21.00 | $24.00 |

| James Hardiman | Citigroup | Raises | Buy | $22.00 | $19.00 |

| Megan Alexander | Morgan Stanley | Raises | Equal-Weight | $17.00 | $16.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Mattel. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Mattel compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Mattel's stock. This examination reveals shifts in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Mattel's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Mattel analyst ratings.

About Mattel

Mattel manufactures and markets toy products that are sold to its wholesale customers and direct to retail consumers. The company offers products for children and families, including toys for infants and preschoolers, girls and boys, youth electronics, hand-held and other games, puzzles, educational toys, media-driven products, and plush and fashion-related toys. Mattel's owned portfolio includes Barbie, Hot Wheels, Fisher-Price, Thomas & Friends, and American Girl. In addition, it currently manufactures toy products for its segments both internally and externally (through manufacturing partners). Nearly 60% of its net sales were generated from North America in 2024, with the remainder stemming from international markets.

Mattel: A Financial Overview

Market Capitalization: Positioned above industry average, the company's market capitalization underscores its superiority in size, indicative of a strong market presence.

Revenue Growth: Over the 3M period, Mattel showcased positive performance, achieving a revenue growth rate of 2.11% as of 31 March, 2025. This reflects a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Net Margin: Mattel's net margin is impressive, surpassing industry averages. With a net margin of -4.88%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Mattel's ROE stands out, surpassing industry averages. With an impressive ROE of -1.84%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of -0.63%, the company showcases effective utilization of assets.

Debt Management: Mattel's debt-to-equity ratio stands notably higher than the industry average, reaching 1.26. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

What Are Analyst Ratings?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for MAT

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Stifel | Upgrades | Hold | Buy |

| Jan 2022 | DA Davidson | Maintains | Buy | |

| Jan 2022 | MKM Partners | Upgrades | Neutral | Buy |

Posted-In: BZI-AARAnalyst Ratings