Beyond The Numbers: 9 Analysts Discuss Wintrust Financial Stock

Analysts' ratings for Wintrust Financial (NASDAQ:WTFC) over the last quarter vary from bullish to bearish, as provided by 9 analysts.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 5 | 3 | 1 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 3 | 3 | 1 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 1 | 0 | 0 | 0 | 0 |

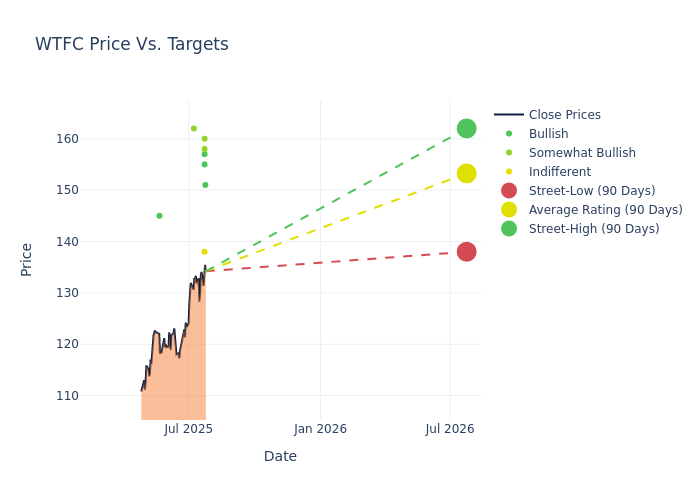

Insights from analysts' 12-month price targets are revealed, presenting an average target of $153.44, a high estimate of $162.00, and a low estimate of $138.00. This upward trend is apparent, with the current average reflecting a 9.3% increase from the previous average price target of $140.38.

Understanding Analyst Ratings: A Comprehensive Breakdown

A clear picture of Wintrust Financial's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Brandon King | Truist Securities | Raises | Buy | $151.00 | $137.00 |

| Nathan Race | Piper Sandler | Raises | Overweight | $160.00 | $141.00 |

| David Long | Raymond James | Raises | Strong Buy | $157.00 | $155.00 |

| Christopher Mcgratty | Keefe, Bruyette & Woods | Raises | Market Perform | $138.00 | $130.00 |

| Jeff Rulis | DA Davidson | Raises | Buy | $155.00 | $135.00 |

| Jon Arfstrom | RBC Capital | Raises | Outperform | $158.00 | $137.00 |

| Jared Shaw | Barclays | Raises | Overweight | $162.00 | $145.00 |

| Daniel Tamayo | Raymond James | Raises | Strong Buy | $155.00 | $143.00 |

| David Chiaverini | Jefferies | Announces | Buy | $145.00 | - |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Wintrust Financial. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Wintrust Financial compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Wintrust Financial's stock. This comparison reveals trends in analysts' expectations over time.

To gain a panoramic view of Wintrust Financial's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Wintrust Financial analyst ratings.

Delving into Wintrust Financial's Background

Wintrust Financial Corp is a financial holding company that provides community-oriented, personal, and commercial banking services to customers generally located in the Chicago metropolitan area, southern Wisconsin, northwest Indiana, and western Michigan. The company provides specialty finance services, including financing for the payment of property and casualty insurance premiums and life insurance premiums, and wealth management services to customers in its market area. The company's operations consist of three primary segments: community banking, specialty finance, and wealth management. The company generates the majority of its revenue from the community banking segment.

Wintrust Financial: A Financial Overview

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: Wintrust Financial's revenue growth over a period of 3M has been noteworthy. As of 30 June, 2025, the company achieved a revenue growth rate of approximately 4.31%. This indicates a substantial increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Financials sector.

Net Margin: Wintrust Financial's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of 28.1%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Wintrust Financial's ROE stands out, surpassing industry averages. With an impressive ROE of 3.0%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Wintrust Financial's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 0.28%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: Wintrust Financial's debt-to-equity ratio stands notably higher than the industry average, reaching 0.68. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

What Are Analyst Ratings?

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for WTFC

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Janney Montgomery Scott | Upgrades | Neutral | Buy |

| Jan 2022 | Raymond James | Maintains | Strong Buy | |

| Nov 2021 | Raymond James | Maintains | Strong Buy |

Posted-In: BZI-AARAnalyst Ratings