Analyst Expectations For Fabrinet's Future

Fabrinet (NYSE:FN) has been analyzed by 6 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 0 | 3 | 0 | 0 |

| Last 30D | 0 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 1 | 0 | 0 | 0 | 0 |

| 3M Ago | 2 | 0 | 2 | 0 | 0 |

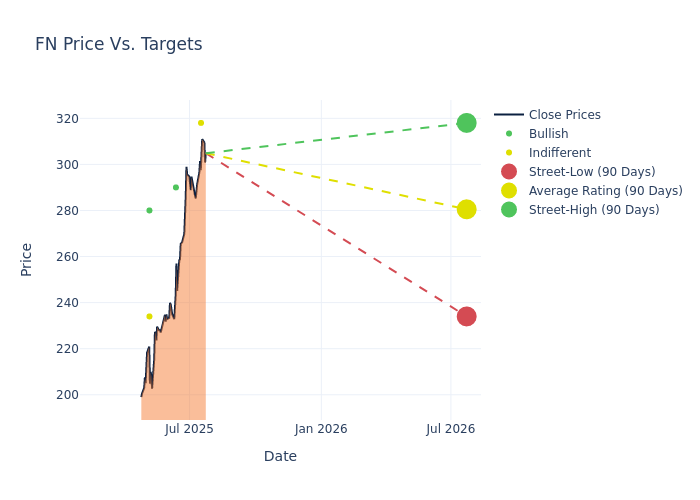

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $267.83, along with a high estimate of $318.00 and a low estimate of $234.00. This current average has increased by 10.07% from the previous average price target of $243.33.

Deciphering Analyst Ratings: An In-Depth Analysis

A clear picture of Fabrinet's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Samik Chatterjee | JP Morgan | Raises | Neutral | $318.00 | $235.00 |

| Mike Genovese | Rosenblatt | Raises | Buy | $290.00 | $250.00 |

| George Wang | Barclays | Lowers | Equal-Weight | $234.00 | $245.00 |

| Samik Chatterjee | JP Morgan | Raises | Neutral | $235.00 | $220.00 |

| Ryan Koontz | Needham | Maintains | Buy | $280.00 | $280.00 |

| Mike Genovese | Rosenblatt | Raises | Buy | $250.00 | $230.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Fabrinet. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Fabrinet compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Fabrinet's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Fabrinet analyst ratings.

Discovering Fabrinet: A Closer Look

Fabrinet provides advanced optical packaging and precision optical, electro-mechanical, and electronic manufacturing services to original equipment manufacturers of complex products, such as optical communication components, modules and sub-systems, industrial lasers, automotive components, medical devices, and sensors. The company offers a broad range of advanced optical and electro-mechanical capabilities across the entire manufacturing process, including process design and engineering, supply chain management, manufacturing, complex printed circuit board assembly, advanced packaging, integration, final assembly, and testing. The company generates the majority of its revenue from North America and Asia-Pacific, with the rest from Europe.

Unraveling the Financial Story of Fabrinet

Market Capitalization Analysis: With a profound presence, the company's market capitalization is above industry averages. This reflects substantial size and strong market recognition.

Revenue Growth: Fabrinet displayed positive results in 3M. As of 31 March, 2025, the company achieved a solid revenue growth rate of approximately 19.17%. This indicates a notable increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Information Technology sector.

Net Margin: Fabrinet's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 9.32%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Fabrinet's ROE stands out, surpassing industry averages. With an impressive ROE of 4.34%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Fabrinet's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 3.15% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.0.

What Are Analyst Ratings?

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for FN

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | RBC Capital | Maintains | Sector Perform | |

| Feb 2022 | B. Riley Securities | Maintains | Neutral | |

| Jan 2022 | JP Morgan | Maintains | Neutral |

Posted-In: BZI-AARAnalyst Ratings