Breaking Down Gap: 14 Analysts Share Their Views

Gap (NYSE:GAP) underwent analysis by 14 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 5 | 6 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 2 | 2 | 3 | 0 | 0 |

| 3M Ago | 0 | 3 | 3 | 0 | 0 |

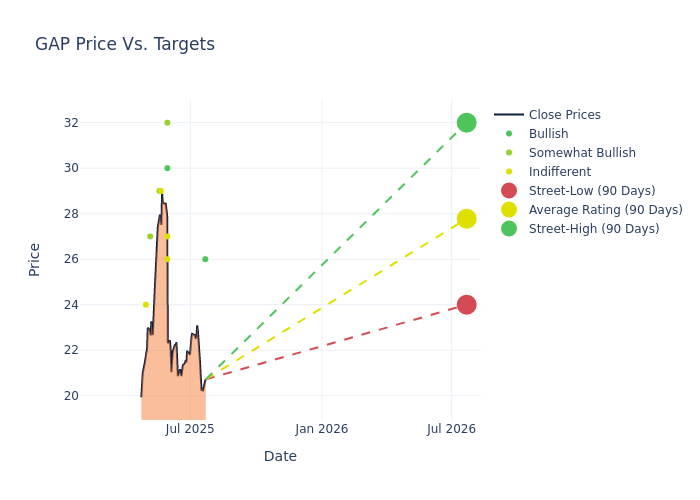

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $28.36, a high estimate of $33.00, and a low estimate of $24.00. This current average has increased by 2.87% from the previous average price target of $27.57.

Exploring Analyst Ratings: An In-Depth Overview

An in-depth analysis of recent analyst actions unveils how financial experts perceive Gap. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Brooke Roach | Goldman Sachs | Lowers | Buy | $26.00 | $28.00 |

| Paul Lejuez | Citigroup | Lowers | Buy | $30.00 | $33.00 |

| Adrienne Yih | Barclays | Lowers | Overweight | $32.00 | $33.00 |

| Jay Sole | UBS | Lowers | Neutral | $27.00 | $29.00 |

| Dana Telsey | Telsey Advisory Group | Maintains | Market Perform | $26.00 | $26.00 |

| Adrienne Yih | Barclays | Raises | Overweight | $33.00 | $26.00 |

| Paul Lejuez | Citigroup | Raises | Buy | $33.00 | $22.00 |

| Dana Telsey | Telsey Advisory Group | Maintains | Market Perform | $26.00 | $26.00 |

| Corey Tarlowe | Jefferies | Raises | Hold | $29.00 | $26.00 |

| Jay Sole | UBS | Raises | Neutral | $29.00 | $19.00 |

| Matthew Boss | JP Morgan | Raises | Overweight | $29.00 | $25.00 |

| Adrienne Yih | Barclays | Lowers | Overweight | $26.00 | $33.00 |

| Alex Straton | Morgan Stanley | Lowers | Overweight | $27.00 | $30.00 |

| Ike Boruchow | Wells Fargo | Lowers | Equal-Weight | $24.00 | $30.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Gap. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Gap compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Gap's stock. This comparison reveals trends in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Gap's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Gap analyst ratings.

About Gap

Gap retails apparel, accessories, and personal-care products under the Gap, Old Navy, Banana Republic, and Athleta brands. Old Navy generates more than half of Gap's sales. The firm also operates e-commerce sites, outlet stores, and specialty stores under various Gap names. Gap operates approximately 2,500 stores in North America, Europe, and Asia and franchises about 1,000 more in Asia, Europe, Latin America, and other regions. Gap was founded in 1969 and is based in San Francisco.

Breaking Down Gap's Financial Performance

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Growth: Gap's revenue growth over a period of 3M has been noteworthy. As of 30 April, 2025, the company achieved a revenue growth rate of approximately 2.21%. This indicates a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Consumer Discretionary sector.

Net Margin: Gap's net margin is impressive, surpassing industry averages. With a net margin of 5.57%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 5.86%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Gap's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.65% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 1.65, caution is advised due to increased financial risk.

The Core of Analyst Ratings: What Every Investor Should Know

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted-In: BZI-AARAnalyst Ratings