What 10 Analyst Ratings Have To Say About Maplebear

Throughout the last three months, 10 analysts have evaluated Maplebear (NASDAQ:CART), offering a diverse set of opinions from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 5 | 1 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 1 | 0 | 0 | 0 |

| 2M Ago | 0 | 1 | 1 | 0 | 0 |

| 3M Ago | 4 | 2 | 0 | 0 | 0 |

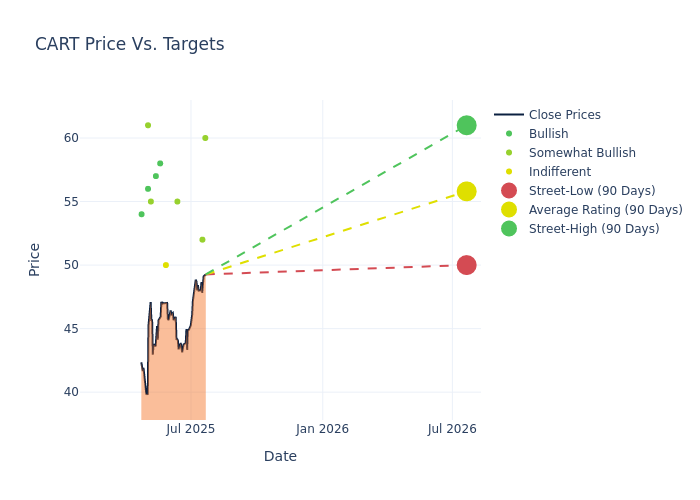

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $55.8, with a high estimate of $61.00 and a low estimate of $50.00. Observing a 3.72% increase, the current average has risen from the previous average price target of $53.80.

Understanding Analyst Ratings: A Comprehensive Breakdown

In examining recent analyst actions, we gain insights into how financial experts perceive Maplebear. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Nikhil Devnani | Bernstein | Raises | Outperform | $60.00 | $55.00 |

| Colin Sebastian | Baird | Raises | Outperform | $52.00 | $47.00 |

| Andrew Boone | JMP Securities | Maintains | Market Outperform | $55.00 | $55.00 |

| John Colantuoni | Jefferies | Raises | Hold | $50.00 | $48.00 |

| Rob Sanderson | Loop Capital | Raises | Buy | $58.00 | $52.00 |

| Ronald Josey | Citigroup | Raises | Buy | $57.00 | $55.00 |

| Ross Compton | Macquarie | Maintains | Outperform | $55.00 | $55.00 |

| Ross Sandler | Barclays | Raises | Overweight | $61.00 | $58.00 |

| Bernie McTernan | Needham | Maintains | Buy | $56.00 | $56.00 |

| Mark Kelley | Stifel | Lowers | Buy | $54.00 | $57.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Maplebear. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Maplebear compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Maplebear's stock. This comparison reveals trends in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Maplebear's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Maplebear analyst ratings.

Delving into Maplebear's Background

Maplebear (Instacart) operates a leading grocery delivery platform in the United States and Canada. The company partners with various regional and national grocers, which offer their selection of food and other goods to customers through Instacart's ubiquitous platform. Once an item is ordered through Instacart's site, the item is picked and delivered to the customer's home by one of the platform's 600,000 shoppers, who are classified as independent contractors. Instacart earns fees based on average order value and leverages its platform's high usage to sell advertising, mainly to consumer-packaged goods companies. Instacart currently has about 8 million monthly active users (or orderers) on its platform.

Maplebear's Economic Impact: An Analysis

Market Capitalization Analysis: The company's market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Revenue Growth: Maplebear displayed positive results in 3M. As of 31 March, 2025, the company achieved a solid revenue growth rate of approximately 9.39%. This indicates a notable increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Consumer Staples sector.

Net Margin: Maplebear's net margin is impressive, surpassing industry averages. With a net margin of 11.59%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Maplebear's ROE stands out, surpassing industry averages. With an impressive ROE of 3.32%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Maplebear's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 2.47% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Maplebear's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.01.

The Basics of Analyst Ratings

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted-In: BZI-AARAnalyst Ratings