What 17 Analyst Ratings Have To Say About BILL Holdings

Across the recent three months, 17 analysts have shared their insights on BILL Holdings (NYSE:BILL), expressing a variety of opinions spanning from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 5 | 4 | 6 | 2 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 1 | 0 | 2 | 0 | 0 |

| 2M Ago | 1 | 0 | 2 | 0 | 0 |

| 3M Ago | 3 | 4 | 1 | 2 | 0 |

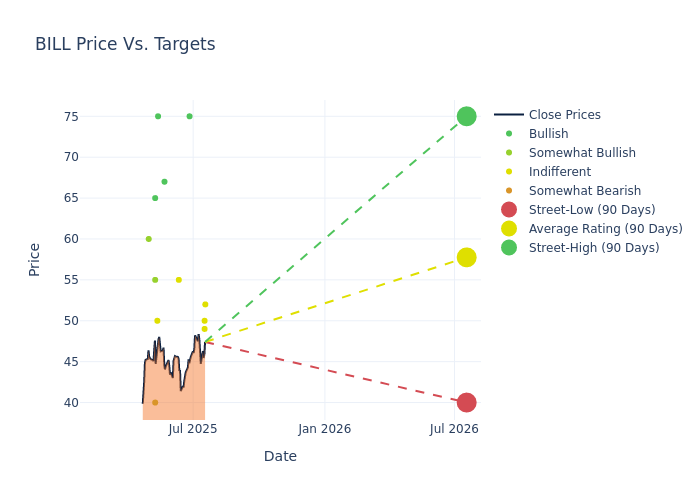

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $56.94, a high estimate of $75.00, and a low estimate of $40.00. This current average has decreased by 16.1% from the previous average price target of $67.87.

Interpreting Analyst Ratings: A Closer Look

A clear picture of BILL Holdings's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| David Koning | Baird | Lowers | Neutral | $52.00 | $55.00 |

| Bryan Keane | Deutsche Bank | Announces | Hold | $49.00 | - |

| Matthew Coad | Truist Securities | Raises | Hold | $50.00 | $47.00 |

| Scott Berg | Needham | Maintains | Buy | $75.00 | $75.00 |

| Keith Weiss | Morgan Stanley | Lowers | Equal-Weight | $55.00 | $60.00 |

| Matthew Coad | Truist Securities | Announces | Hold | $47.00 | - |

| Andrew Schmitt | Citigroup | Lowers | Buy | $67.00 | $88.00 |

| Joseph Vafi | Canaccord Genuity | Lowers | Buy | $75.00 | $105.00 |

| Siti Panigrahi | Mizuho | Lowers | Neutral | $50.00 | $53.00 |

| Taylor McGinnis | UBS | Raises | Buy | $65.00 | $60.00 |

| Ken Wong | Oppenheimer | Raises | Outperform | $55.00 | $50.00 |

| Andrew Bauch | Wells Fargo | Lowers | Underweight | $40.00 | $43.00 |

| Keith Weiss | Morgan Stanley | Lowers | Overweight | $60.00 | $65.00 |

| Scott Berg | Needham | Lowers | Buy | $75.00 | $100.00 |

| Alex Markgraff | Keybanc | Lowers | Overweight | $60.00 | $70.00 |

| Ken Wong | Oppenheimer | Lowers | Outperform | $50.00 | $90.00 |

| Andrew Bauch | Wells Fargo | Lowers | Underweight | $43.00 | $57.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to BILL Holdings. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of BILL Holdings compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for BILL Holdings's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of BILL Holdings's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on BILL Holdings analyst ratings.

Discovering BILL Holdings: A Closer Look

BILL Holdings Inc is a provider of software-as-a-service, cloud-based payments and spend and expense management products, which allow users to automate accounts payable and accounts receivable transactions, enable businesses to easily connect with their suppliers or customers to do business, eliminate expense reports, manage cash flows and improve back office efficiency. Initial Public Offering and Follow-on Offering.

Breaking Down BILL Holdings's Financial Performance

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: BILL Holdings displayed positive results in 3M. As of 31 March, 2025, the company achieved a solid revenue growth rate of approximately 10.89%. This indicates a notable increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: BILL Holdings's net margin is impressive, surpassing industry averages. With a net margin of -3.24%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): BILL Holdings's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of -0.3%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): BILL Holdings's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of -0.12%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 0.46, caution is advised due to increased financial risk.

Analyst Ratings: What Are They?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for BILL

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Oppenheimer | Maintains | Outperform | |

| Feb 2022 | Keybanc | Maintains | Overweight | |

| Feb 2022 | Keybanc | Maintains | Overweight |

Posted-In: BZI-AARAnalyst Ratings