Analyst Expectations For Cintas's Future

Cintas (NASDAQ:CTAS) underwent analysis by 6 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 1 | 4 | 0 | 0 |

| Last 30D | 0 | 0 | 2 | 0 | 0 |

| 1M Ago | 1 | 1 | 1 | 0 | 0 |

| 2M Ago | 0 | 0 | 1 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

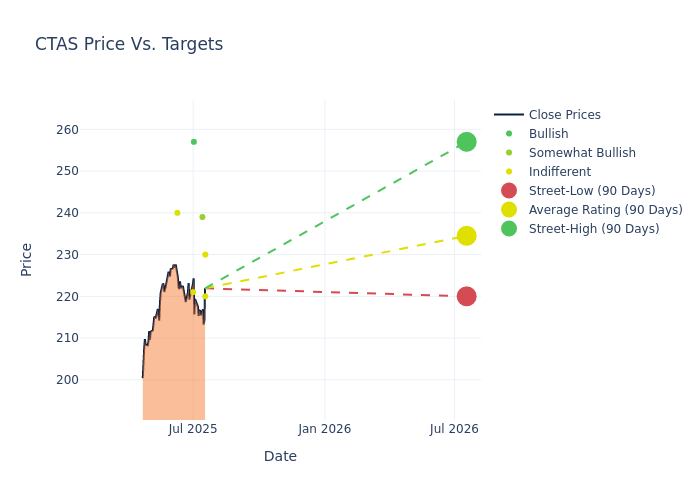

The 12-month price targets, analyzed by analysts, offer insights with an average target of $234.5, a high estimate of $257.00, and a low estimate of $220.00. This current average reflects an increase of 8.16% from the previous average price target of $216.80.

Diving into Analyst Ratings: An In-Depth Exploration

A clear picture of Cintas's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Andrew Wittmann | Baird | Raises | Neutral | $230.00 | $227.00 |

| Toni Kaplan | Morgan Stanley | Raises | Equal-Weight | $220.00 | $213.00 |

| Andrew Steinerman | JP Morgan | Announces | Overweight | $239.00 | - |

| George Tong | Goldman Sachs | Raises | Buy | $257.00 | $233.00 |

| Jason Haas | Wells Fargo | Raises | Equal-Weight | $221.00 | $196.00 |

| Ashish Sabadra | RBC Capital | Raises | Sector Perform | $240.00 | $215.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Cintas. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Cintas compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Cintas's stock. This analysis reveals shifts in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Cintas's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Cintas analyst ratings.

Delving into Cintas's Background

Cintas has roots tracing back to 1929, during which the Farmer family cleaned and re-sold dirty rags to manufacturing plants in Ohio. The firm has grown its business organically and through acquisitions, and today Cintas acts as a one-stop outsourcing partner for businesses. Cintas will design, manufacture, collect, and clean every employee uniform for a small weekly sum, taking on the upfront capital expense itself. In the same stop, Cintas can also replace soiled or depleted mats, mops, trash liners, towels, first aid, fire, and cleaning products. Businesses value an outsourcing partner like Cintas as it simplifies operations and leaves noncore tasks with high regulatory standards in the hands of professionals.

Cintas: A Financial Overview

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Revenue Growth: Cintas displayed positive results in 3M. As of 28 February, 2025, the company achieved a solid revenue growth rate of approximately 8.44%. This indicates a notable increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: Cintas's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 17.7%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Cintas's ROE excels beyond industry benchmarks, reaching 10.4%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Cintas's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 4.87% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Cintas's debt-to-equity ratio is below the industry average at 0.59, reflecting a lower dependency on debt financing and a more conservative financial approach.

The Core of Analyst Ratings: What Every Investor Should Know

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for CTAS

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jan 2022 | Morgan Stanley | Maintains | Equal-Weight | |

| Dec 2021 | Argus Research | Maintains | Buy | |

| Dec 2021 | Morgan Stanley | Maintains | Equal-Weight |

Posted-In: BZI-AARAnalyst Ratings