Apellis Pharmaceuticals Stock: A Deep Dive Into Analyst Perspectives (15 Ratings)

Apellis Pharmaceuticals (NASDAQ:APLS) underwent analysis by 15 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 4 | 9 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 2 | 0 | 0 |

| 2M Ago | 1 | 0 | 1 | 0 | 0 |

| 3M Ago | 1 | 3 | 6 | 0 | 0 |

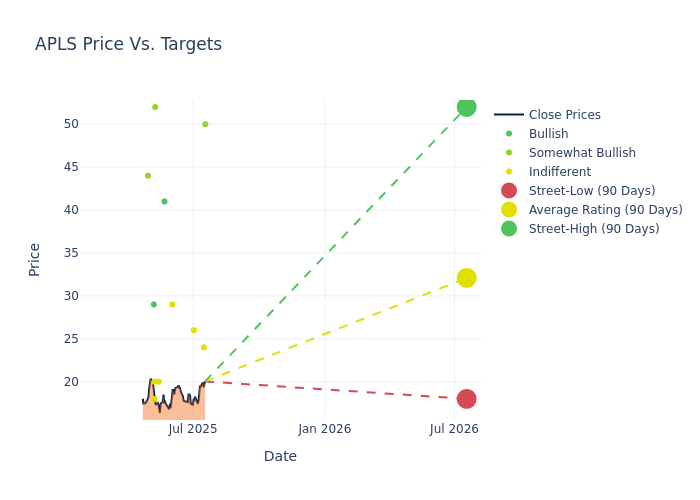

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $31.33, a high estimate of $52.00, and a low estimate of $18.00. This current average has decreased by 14.66% from the previous average price target of $36.71.

Deciphering Analyst Ratings: An In-Depth Analysis

The standing of Apellis Pharmaceuticals among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Colleen Kusy | Baird | Raises | Outperform | $50.00 | $47.00 |

| Tazeen Ahmad | B of A Securities | Raises | Neutral | $24.00 | $23.00 |

| Judah Frommer | Morgan Stanley | Raises | Equal-Weight | $26.00 | $25.00 |

| Derek Archila | Wells Fargo | Raises | Equal-Weight | $29.00 | $26.00 |

| Yigal Nochomovitz | Citigroup | Lowers | Buy | $41.00 | $49.00 |

| Graig Suvannavejh | Mizuho | Lowers | Neutral | $20.00 | $30.00 |

| Ryan Deschner | Raymond James | Lowers | Outperform | $52.00 | $75.00 |

| Tazeen Ahmad | B of A Securities | Lowers | Neutral | $23.00 | $41.00 |

| Luca Issi | RBC Capital | Lowers | Sector Perform | $18.00 | $21.00 |

| Greg Harrison | Scotiabank | Lowers | Sector Perform | $20.00 | $28.00 |

| Derek Archila | Wells Fargo | Lowers | Equal-Weight | $26.00 | $30.00 |

| Colleen Kusy | Baird | Lowers | Outperform | $47.00 | $55.00 |

| Joseph Stringer | Needham | Lowers | Buy | $29.00 | $40.00 |

| Eliana Merle | Cantor Fitzgerald | Announces | Overweight | $44.00 | - |

| Luca Issi | RBC Capital | Lowers | Sector Perform | $21.00 | $24.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Apellis Pharmaceuticals. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Apellis Pharmaceuticals compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Apellis Pharmaceuticals's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Apellis Pharmaceuticals's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Apellis Pharmaceuticals analyst ratings.

Get to Know Apellis Pharmaceuticals Better

Apellis Pharmaceuticals Inc is a commercial-stage biopharmaceutical company focused on the discovery, development, and commercialization of novel therapeutic compounds to treat diseases with high unmet needs through the inhibition of the complement system, which is an integral component of the immune system, at the level of C3, the central protein in the complement cascade.

Apellis Pharmaceuticals's Financial Performance

Market Capitalization Analysis: The company's market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Decline in Revenue: Over the 3M period, Apellis Pharmaceuticals faced challenges, resulting in a decline of approximately -3.21% in revenue growth as of 31 March, 2025. This signifies a reduction in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of -55.29%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of -46.96%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of -10.9%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: Apellis Pharmaceuticals's debt-to-equity ratio surpasses industry norms, standing at 2.86. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

Analyst Ratings: Simplified

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for APLS

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Goldman Sachs | Maintains | Buy | |

| Mar 2022 | Raymond James | Maintains | Strong Buy | |

| Jan 2022 | Raymond James | Maintains | Strong Buy |

Posted-In: BZI-AARAnalyst Ratings