What Analysts Are Saying About EPAM Systems Stock

Providing a diverse range of perspectives from bullish to bearish, 11 analysts have published ratings on EPAM Systems (NYSE:EPAM) in the last three months.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 4 | 3 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 4 | 4 | 2 | 0 | 0 |

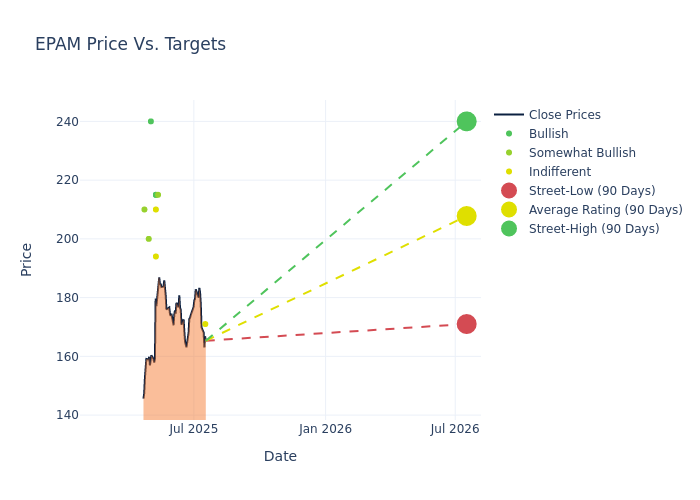

The 12-month price targets, analyzed by analysts, offer insights with an average target of $207.27, a high estimate of $240.00, and a low estimate of $171.00. Highlighting a 12.36% decrease, the current average has fallen from the previous average price target of $236.50.

Diving into Analyst Ratings: An In-Depth Exploration

The analysis of recent analyst actions sheds light on the perception of EPAM Systems by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Bryan Keane | Deutsche Bank | Announces | Hold | $171.00 | - |

| Ramsey El-Assal | Barclays | Raises | Overweight | $215.00 | $200.00 |

| Mayank Tandon | Needham | Raises | Buy | $215.00 | $185.00 |

| Jonathan Lee | Guggenheim | Raises | Buy | $215.00 | $210.00 |

| James Faucette | Morgan Stanley | Lowers | Equal-Weight | $210.00 | $250.00 |

| Arvind Ramnani | Piper Sandler | Raises | Neutral | $194.00 | $170.00 |

| David Grossman | Stifel | Lowers | Buy | $240.00 | $275.00 |

| Divya Goyal | Scotiabank | Lowers | Sector Outperform | $200.00 | $250.00 |

| Jonathan Lee | Guggenheim | Lowers | Buy | $210.00 | $285.00 |

| Ramsey El-Assal | Barclays | Lowers | Overweight | $200.00 | $270.00 |

| James Friedman | Susquehanna | Lowers | Positive | $210.00 | $270.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to EPAM Systems. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of EPAM Systems compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of EPAM Systems's stock. This comparison reveals trends in analysts' expectations over time.

Capture valuable insights into EPAM Systems's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on EPAM Systems analyst ratings.

Unveiling the Story Behind EPAM Systems

EPAM Systems is a global IT services firm that offers platform engineering, software development, and consulting services. EPAM's largest market is North America, which represents approximately 60% of revenue. Offerings span assisting companies with new technologies, such as artificial intelligence, virtual reality, and robotics.

Unraveling the Financial Story of EPAM Systems

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Positive Revenue Trend: Examining EPAM Systems's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 11.69% as of 31 March, 2025, showcasing a substantial increase in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Information Technology sector.

Net Margin: EPAM Systems's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 5.65% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 2.02%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): EPAM Systems's ROA excels beyond industry benchmarks, reaching 1.55%. This signifies efficient management of assets and strong financial health.

Debt Management: EPAM Systems's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.04.

The Significance of Analyst Ratings Explained

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for EPAM

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Needham | Maintains | Buy | |

| Mar 2022 | Stifel | Maintains | Buy | |

| Feb 2022 | Piper Sandler | Downgrades | Overweight | Neutral |

Posted-In: BZI-AARAnalyst Ratings