7 Analysts Assess Sonic Automotive: What You Need To Know

Providing a diverse range of perspectives from bullish to bearish, 7 analysts have published ratings on Sonic Automotive (NYSE:SAH) in the last three months.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 0 | 2 | 1 | 0 |

| Last 30D | 0 | 0 | 1 | 1 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 2 | 0 | 0 | 0 | 0 |

| 3M Ago | 2 | 0 | 1 | 0 | 0 |

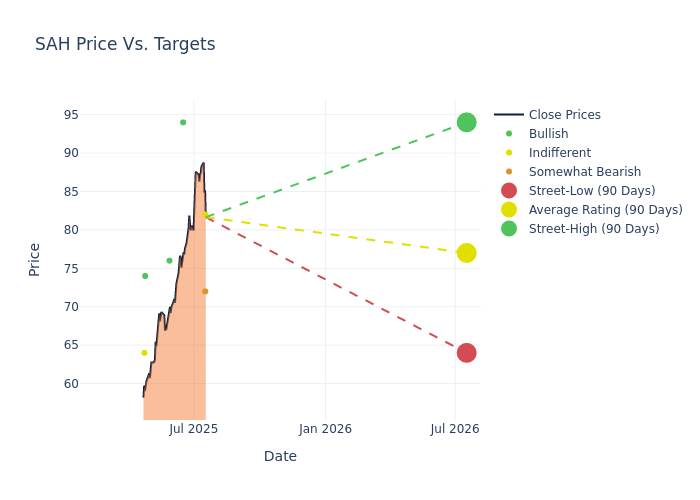

Analysts have recently evaluated Sonic Automotive and provided 12-month price targets. The average target is $77.43, accompanied by a high estimate of $94.00 and a low estimate of $64.00. A decline of 1.99% from the prior average price target is evident in the current average.

Deciphering Analyst Ratings: An In-Depth Analysis

A clear picture of Sonic Automotive's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Rajat Gupta | JP Morgan | Raises | Underweight | $72.00 | $65.00 |

| Jeff Lick | Stephens & Co. | Raises | Equal-Weight | $82.00 | $72.00 |

| John Murphy | B of A Securities | Raises | Buy | $94.00 | $80.00 |

| Michael Albanese | Benchmark | Announces | Buy | $76.00 | - |

| Chris Pierce | Needham | Lowers | Buy | $74.00 | $93.00 |

| Michael Ward | Citigroup | Announces | Neutral | $64.00 | - |

| John Murphy | B of A Securities | Lowers | Buy | $80.00 | $85.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Sonic Automotive. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Sonic Automotive compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Sonic Automotive's stock. This comparison reveals trends in analysts' expectations over time.

For valuable insights into Sonic Automotive's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Sonic Automotive analyst ratings.

Discovering Sonic Automotive: A Closer Look

Sonic Automotive is one of the largest auto dealership groups in the United States. The company has 108 franchised stores in 18 states, primarily in metropolitan areas in California, Texas, and the Southeast, plus 18 EchoPark used-vehicle stores, 16 collision centers, and 15 powersports locations. The franchise stores derive revenue from new and used vehicles plus parts and collision repair, finance, insurance, and wholesale auctions. Luxury and import dealerships make up about 86% of franchise new-vehicle revenue, while Honda, BMW, Mercedes, and Toyota constitute about 59% of new-vehicle revenue. BMW is the largest brand at about 25%. 2024's revenue was $14.2 billion, with Texas and California comprising 51% of the total. EchoPark's portion was $2.1 billion.

Sonic Automotive: Delving into Financials

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Growth: Sonic Automotive's revenue growth over a period of 3M has been noteworthy. As of 31 March, 2025, the company achieved a revenue growth rate of approximately 7.9%. This indicates a substantial increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Consumer Discretionary sector.

Net Margin: Sonic Automotive's net margin is impressive, surpassing industry averages. With a net margin of 1.93%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Sonic Automotive's ROE excels beyond industry benchmarks, reaching 6.56%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Sonic Automotive's ROA excels beyond industry benchmarks, reaching 1.2%. This signifies efficient management of assets and strong financial health.

Debt Management: Sonic Automotive's debt-to-equity ratio is below the industry average. With a ratio of 3.71, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

The Basics of Analyst Ratings

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for SAH

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Morgan Stanley | Maintains | Underweight | |

| Nov 2021 | Morgan Stanley | Downgrades | Equal-Weight | Underweight |

| Aug 2021 | Morgan Stanley | Maintains | Equal-Weight |

Posted-In: BZI-AARAnalyst Ratings