Assessing Sarepta Therapeutics: Insights From 35 Financial Analysts

In the latest quarter, 35 analysts provided ratings for Sarepta Therapeutics (NASDAQ:SRPT), showcasing a mix of bullish and bearish perspectives.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 6 | 18 | 9 | 0 | 2 |

| Last 30D | 1 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 6 | 3 | 0 | 1 |

| 2M Ago | 2 | 2 | 4 | 0 | 1 |

| 3M Ago | 3 | 9 | 2 | 0 | 0 |

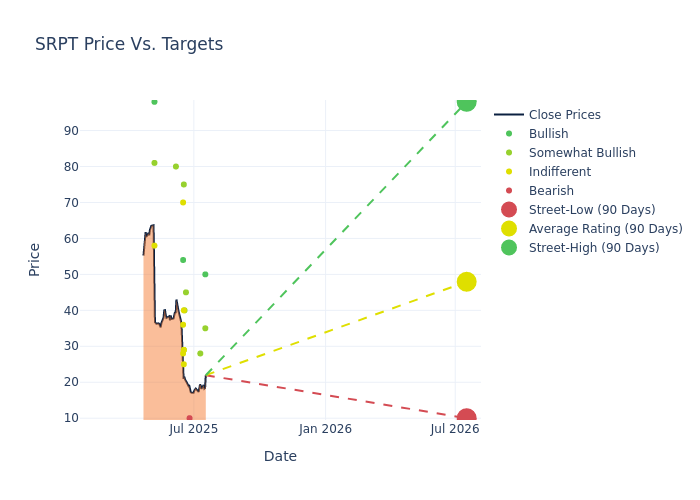

Analysts have set 12-month price targets for Sarepta Therapeutics, revealing an average target of $61.14, a high estimate of $125.00, and a low estimate of $10.00. This current average has decreased by 44.81% from the previous average price target of $110.79.

Decoding Analyst Ratings: A Detailed Look

The analysis of recent analyst actions sheds light on the perception of Sarepta Therapeutics by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Brian Skorney | Baird | Raises | Outperform | $35.00 | $30.00 |

| Gil Blum | Needham | Maintains | Buy | $50.00 | $50.00 |

| Anupam Rama | JP Morgan | Lowers | Overweight | $28.00 | $30.00 |

| Mitchell Kapoor | HC Wainwright & Co. | Lowers | Sell | $10.00 | $40.00 |

| Hartaj Singh | Oppenheimer | Lowers | Outperform | $45.00 | $123.00 |

| Uy Ear | Mizuho | Lowers | Outperform | $40.00 | $85.00 |

| David Hoang | Deutsche Bank | Lowers | Hold | $25.00 | $50.00 |

| Salveen Richter | Goldman Sachs | Announces | Neutral | $29.00 | - |

| Matthew Harrison | Morgan Stanley | Lowers | Equal-Weight | $40.00 | $113.00 |

| Brian Skorney | Baird | Lowers | Outperform | $30.00 | $60.00 |

| Yanan Zhu | Wells Fargo | Lowers | Overweight | $75.00 | $100.00 |

| Gena Wang | Barclays | Lowers | Overweight | $29.00 | $89.00 |

| Andrew Tsai | Jefferies | Lowers | Buy | $54.00 | $125.00 |

| Tazeen Ahmad | B of A Securities | Lowers | Neutral | $28.00 | $76.00 |

| Kostas Biliouris | BMO Capital | Lowers | Market Perform | $70.00 | $120.00 |

| Biren Amin | Piper Sandler | Lowers | Neutral | $36.00 | $70.00 |

| Gil Blum | Needham | Lowers | Buy | $50.00 | $125.00 |

| Mitchell Kapoor | HC Wainwright & Co. | Lowers | Sell | $10.00 | $40.00 |

| Louise Chen | Scotiabank | Maintains | Sector Outperform | $80.00 | $80.00 |

| Raghuram Selvaraju | HC Wainwright & Co. | Maintains | Neutral | $40.00 | $40.00 |

| Anupam Rama | JP Morgan | Lowers | Overweight | $84.00 | $169.00 |

| Uy Ear | Mizuho | Lowers | Outperform | $85.00 | $179.00 |

| Yanan Zhu | Wells Fargo | Lowers | Overweight | $100.00 | $115.00 |

| Brian Skorney | Baird | Lowers | Outperform | $60.00 | $193.00 |

| Gena Wang | Barclays | Lowers | Overweight | $89.00 | $209.00 |

| Brian Abrahams | RBC Capital | Lowers | Sector Perform | $58.00 | $87.00 |

| Salveen Richter | Goldman Sachs | Lowers | Buy | $100.00 | $178.00 |

| Debjit Chattopadhyay | Guggenheim | Lowers | Buy | $98.00 | $112.00 |

| Biren Amin | Piper Sandler | Lowers | Overweight | $70.00 | $110.00 |

| Hartaj Singh | Oppenheimer | Lowers | Outperform | $123.00 | $184.00 |

| Kristen Kluska | Cantor Fitzgerald | Lowers | Overweight | $81.00 | $163.00 |

| Mitchell Kapoor | HC Wainwright & Co. | Lowers | Neutral | $40.00 | $75.00 |

| Matthew Harrison | Morgan Stanley | Lowers | Overweight | $113.00 | $182.00 |

| Gil Blum | Needham | Lowers | Buy | $125.00 | $183.00 |

| Biren Amin | Piper Sandler | Lowers | Overweight | $110.00 | $182.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Sarepta Therapeutics. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Sarepta Therapeutics compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Sarepta Therapeutics's stock. This comparison reveals trends in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Sarepta Therapeutics's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Sarepta Therapeutics analyst ratings.

All You Need to Know About Sarepta Therapeutics

Sarepta Therapeutics Inc is a biotechnology company focused on treating rare, infectious, and other diseases. It targets a broad range of diseases while focusing on the rapid development of its drug candidates. Sarepta's involves proprietary RNA-targeted technology platforms to be used for developing novel pharmaceutical products to treat a broad range of diseases and address key unmet medical needs. The company uses third-party contractors to manufacture its product candidates. Majority of company's product candidates are at an early stage of development.

Sarepta Therapeutics: A Financial Overview

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Revenue Growth: Sarepta Therapeutics's revenue growth over a period of 3M has been noteworthy. As of 31 March, 2025, the company achieved a revenue growth rate of approximately 80.15%. This indicates a substantial increase in the company's top-line earnings. When compared to others in the Health Care sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Sarepta Therapeutics's net margin is impressive, surpassing industry averages. With a net margin of -60.08%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Sarepta Therapeutics's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of -33.52%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Sarepta Therapeutics's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of -12.05%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: Sarepta Therapeutics's debt-to-equity ratio is below the industry average. With a ratio of 1.18, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

What Are Analyst Ratings?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for SRPT

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Morgan Stanley | Maintains | Equal-Weight | |

| Mar 2022 | RBC Capital | Maintains | Outperform | |

| Feb 2022 | Morgan Stanley | Maintains | Equal-Weight |

Posted-In: BZI-AARAnalyst Ratings