Expert Outlook: Hasbro Through The Eyes Of 8 Analysts

During the last three months, 8 analysts shared their evaluations of Hasbro (NASDAQ:HAS), revealing diverse outlooks from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 3 | 1 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 1 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 1 | 0 | 0 | 0 |

| 3M Ago | 1 | 2 | 1 | 0 | 0 |

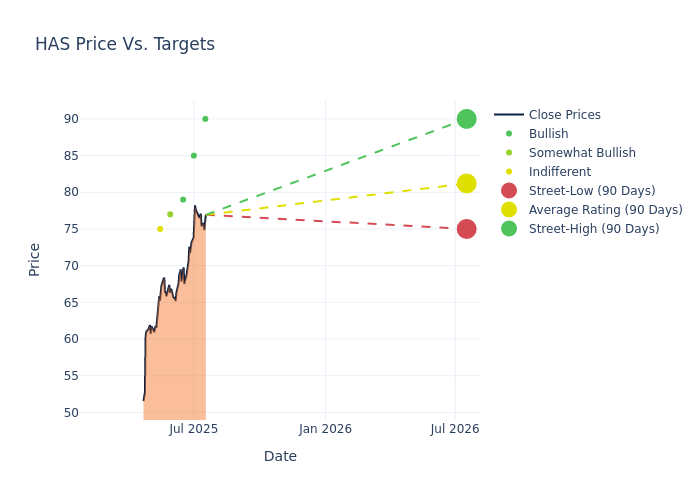

Insights from analysts' 12-month price targets are revealed, presenting an average target of $76.75, a high estimate of $90.00, and a low estimate of $65.00. This upward trend is evident, with the current average reflecting a 3.72% increase from the previous average price target of $74.00.

Interpreting Analyst Ratings: A Closer Look

The analysis of recent analyst actions sheds light on the perception of Hasbro by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Alexander Perry | B of A Securities | Raises | Buy | $90.00 | $85.00 |

| Stephen Laszczyk | Goldman Sachs | Raises | Buy | $85.00 | $66.00 |

| James Hardiman | Citigroup | Raises | Buy | $79.00 | $72.00 |

| Megan Alexander | Morgan Stanley | Raises | Overweight | $77.00 | $71.00 |

| Keegan Cox | DA Davidson | Maintains | Neutral | $75.00 | $75.00 |

| Megan Alexander | Morgan Stanley | Raises | Overweight | $71.00 | $65.00 |

| James Hardiman | Citigroup | Announces | Buy | $72.00 | - |

| Megan Alexander | Morgan Stanley | Lowers | Overweight | $65.00 | $84.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Hasbro. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Hasbro compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Hasbro's stock. This comparison reveals trends in analysts' expectations over time.

For valuable insights into Hasbro's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Hasbro analyst ratings.

Discovering Hasbro: A Closer Look

Hasbro is a branded play company providing children and families around the world with entertainment offerings based on a world-class brand portfolio. From toys and games to television programming, motion pictures, and a licensing program, Hasbro reaches customers by leveraging its well-known brands such as Transformers, Nerf, and Magic: The Gathering. The firm acquired EOne in 2019, bolting on popular family properties like Peppa Pig and PJ Masks, and since has divested noncore lines from the tie-up. Furthermore, the addition of Dungeons & Dragons Beyond in 2022, offers the firm access to 19 million digital tabletop players.

Financial Insights: Hasbro

Market Capitalization Analysis: Above industry benchmarks, the company's market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Revenue Growth: Hasbro's revenue growth over a period of 3M has been noteworthy. As of 31 March, 2025, the company achieved a revenue growth rate of approximately 17.14%. This indicates a substantial increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 11.11%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Hasbro's ROE excels beyond industry benchmarks, reaching 8.47%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Hasbro's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.59% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Hasbro's debt-to-equity ratio surpasses industry norms, standing at 2.87. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

What Are Analyst Ratings?

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for HAS

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | DA Davidson | Maintains | Buy | |

| Jan 2022 | DA Davidson | Maintains | Buy | |

| Oct 2021 | DA Davidson | Maintains | Buy |

Posted-In: BZI-AARAnalyst Ratings