Demystifying General Motors: Insights From 9 Analyst Reviews

Throughout the last three months, 9 analysts have evaluated General Motors (NYSE:GM), offering a diverse set of opinions from bullish to bearish.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 4 | 4 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 1 | 1 | 0 | 0 |

| 3M Ago | 1 | 3 | 2 | 0 | 0 |

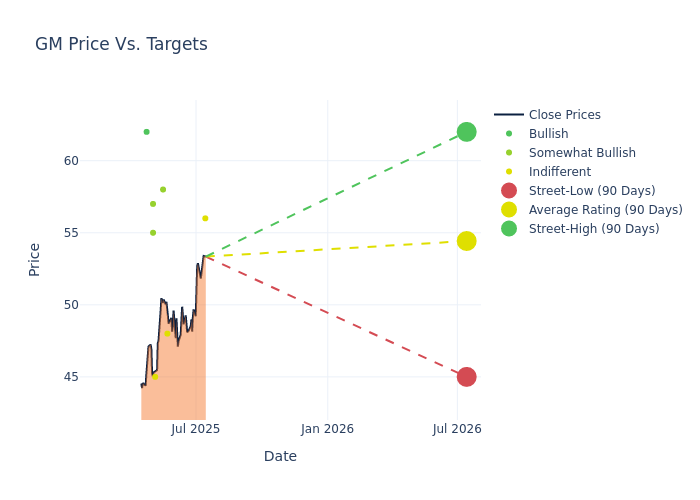

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $53.78, with a high estimate of $62.00 and a low estimate of $45.00. This current average reflects an increase of 5.7% from the previous average price target of $50.88.

Deciphering Analyst Ratings: An In-Depth Analysis

In examining recent analyst actions, we gain insights into how financial experts perceive General Motors. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Joseph Spak | UBS | Raises | Neutral | $56.00 | $50.00 |

| Alexander Potter | Piper Sandler | Raises | Neutral | $48.00 | $43.00 |

| Vijay Rakesh | Mizuho | Raises | Outperform | $58.00 | $53.00 |

| Dan Levy | Barclays | Raises | Equal-Weight | $45.00 | $40.00 |

| Joseph Spak | UBS | Lowers | Neutral | $50.00 | $51.00 |

| Tom Narayan | RBC Capital | Raises | Outperform | $57.00 | $55.00 |

| Vijay Rakesh | Mizuho | Lowers | Outperform | $53.00 | $55.00 |

| Daniel Ives | Wedbush | Lowers | Outperform | $55.00 | $60.00 |

| Michael Ward | Citigroup | Announces | Buy | $62.00 | - |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to General Motors. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of General Motors compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

For valuable insights into General Motors's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on General Motors analyst ratings.

Delving into General Motors's Background

General Motors Co. emerged from the bankruptcy of General Motors Corp. (old GM) in July 2009. GM has eight brands and operates under three segments: GM North America, GM International, and GM Financial. The United States now has four brands instead of eight under old GM. The company regained its US market share leadership in 2022, after losing it to Toyota due to the chip shortage in 2021. 2024's share was 17.0%. The Cruise autonomous vehicle arm, which GM now owns outright, previously operated driverless geofenced AV robotaxi services in San Francisco and other cities, but after a 2023 accident, GM decided that it will focus on personal AVs. GM Financial became the company's captive finance arm in 2010 via the purchase of AmeriCredit.

General Motors: Delving into Financials

Market Capitalization: Indicating a reduced size compared to industry averages, the company's market capitalization poses unique challenges.

Revenue Growth: General Motors displayed positive results in 3M. As of 31 March, 2025, the company achieved a solid revenue growth rate of approximately 2.34%. This indicates a notable increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 7.64%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): General Motors's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 5.27% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): General Motors's ROA stands out, surpassing industry averages. With an impressive ROA of 1.2%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: General Motors's debt-to-equity ratio is notably higher than the industry average. With a ratio of 2.06, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

How Are Analyst Ratings Determined?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for GM

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Benchmark | Maintains | Buy | |

| Feb 2022 | Nomura Instinet | Downgrades | Buy | Neutral |

| Feb 2022 | Morgan Stanley | Downgrades | Overweight | Equal-Weight |

Posted-In: BZI-AARAnalyst Ratings