Analyst Expectations For Twilio's Future

During the last three months, 19 analysts shared their evaluations of Twilio (NYSE:TWLO), revealing diverse outlooks from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 6 | 10 | 3 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 1 | 0 | 0 | 0 |

| 3M Ago | 5 | 8 | 3 | 0 | 0 |

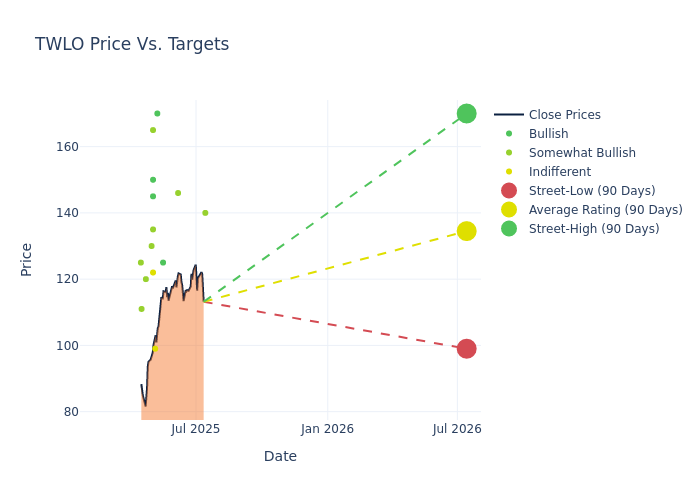

Analysts have recently evaluated Twilio and provided 12-month price targets. The average target is $133.26, accompanied by a high estimate of $170.00 and a low estimate of $99.00. Experiencing a 5.82% decline, the current average is now lower than the previous average price target of $141.50.

Interpreting Analyst Ratings: A Closer Look

In examining recent analyst actions, we gain insights into how financial experts perceive Twilio. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| James Fish | Piper Sandler | Raises | Overweight | $140.00 | $121.00 |

| Thomas Blakey | Keybanc | Announces | Overweight | $146.00 | - |

| Joshua Reilly | Needham | Maintains | Buy | $125.00 | $125.00 |

| Ivan Feinseth | Tigress Financial | Maintains | Buy | $170.00 | $170.00 |

| Stephen Bersey | HSBC | Raises | Hold | $99.00 | $77.00 |

| Taylor McGinnis | UBS | Lowers | Buy | $150.00 | $175.00 |

| Samad Samana | Jefferies | Raises | Hold | $122.00 | $108.00 |

| Kash Rangan | Goldman Sachs | Raises | Buy | $145.00 | $130.00 |

| James Fish | Piper Sandler | Raises | Overweight | $121.00 | $106.00 |

| Nick Altmann | Scotiabank | Raises | Sector Outperform | $135.00 | $130.00 |

| Matthew Carletti | JMP Securities | Maintains | Market Outperform | $165.00 | $165.00 |

| Joshua Reilly | Needham | Maintains | Buy | $125.00 | $125.00 |

| William Power | Baird | Lowers | Outperform | $130.00 | $160.00 |

| Greg Miller | JMP Securities | Maintains | Market Outperform | $165.00 | $165.00 |

| Joshua Reilly | Needham | Lowers | Buy | $125.00 | $165.00 |

| Samad Samana | Jefferies | Lowers | Hold | $108.00 | $145.00 |

| Nick Altmann | Scotiabank | Lowers | Sector Outperform | $130.00 | $160.00 |

| Michael Turrin | Wells Fargo | Lowers | Overweight | $120.00 | $160.00 |

| Meta Marshall | Morgan Stanley | Lowers | Overweight | $111.00 | $160.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Twilio. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Twilio compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Twilio's stock. This examination reveals shifts in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Twilio's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Twilio analyst ratings.

About Twilio

Twilio is a cloud-based communications platform-as-a-service company offering communication building blocks that allow for a fully customized customer engagement experience spanning voice, video, chat, and SMS messaging. It does this through various application programming interfaces and prebuilt solution applications aimed at improving customer engagement. The company leverages its Super Network, a global network of carrier relationships, to facilitate high-speed, cost-effective communication.

Twilio: Delving into Financials

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Revenue Growth: Twilio's remarkable performance in 3M is evident. As of 31 March, 2025, the company achieved an impressive revenue growth rate of 11.98%. This signifies a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Information Technology sector.

Net Margin: Twilio's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 1.71%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Twilio's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 0.25%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 0.2%, the company showcases effective utilization of assets.

Debt Management: Twilio's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.14.

The Significance of Analyst Ratings Explained

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for TWLO

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Mizuho | Maintains | Buy | |

| Feb 2022 | Macquarie | Maintains | Outperform | |

| Feb 2022 | Needham | Maintains | Buy |

Posted-In: BZI-AARAnalyst Ratings