Beyond The Numbers: 8 Analysts Discuss Northern Oil & Gas Stock

Throughout the last three months, 8 analysts have evaluated Northern Oil & Gas (NYSE:NOG), offering a diverse set of opinions from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 0 | 4 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 2 | 0 | 2 | 0 | 0 |

| 3M Ago | 1 | 0 | 2 | 0 | 0 |

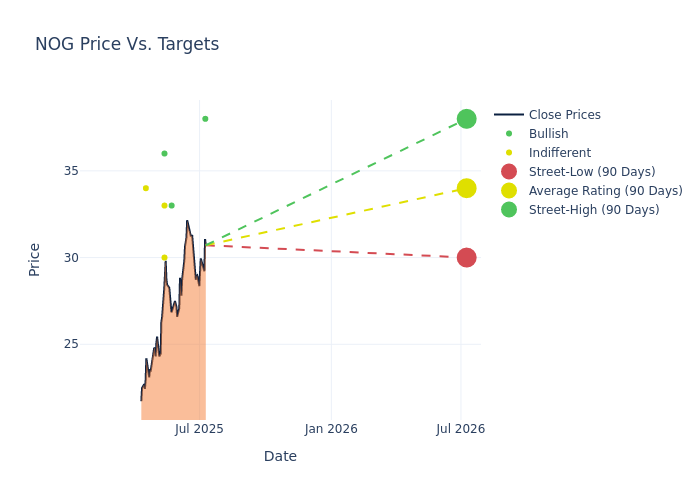

Insights from analysts' 12-month price targets are revealed, presenting an average target of $33.38, a high estimate of $38.00, and a low estimate of $29.00. A negative shift in sentiment is evident as analysts have decreased the average price target by 5.3%.

Deciphering Analyst Ratings: An In-Depth Analysis

The standing of Northern Oil & Gas among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Paul Diamond | Citigroup | Raises | Buy | $38.00 | $34.00 |

| Noah Hungness | B of A Securities | Raises | Buy | $33.00 | $29.00 |

| John Freeman | Raymond James | Raises | Strong Buy | $36.00 | $35.00 |

| Mark Lear | Piper Sandler | Lowers | Neutral | $30.00 | $34.00 |

| William Janela | Mizuho | Lowers | Neutral | $33.00 | $35.00 |

| Noah Hungness | B of A Securities | Lowers | Buy | $29.00 | $41.00 |

| Scott Hanold | RBC Capital | Maintains | Sector Perform | $34.00 | $34.00 |

| Scott Hanold | RBC Capital | Lowers | Sector Perform | $34.00 | $40.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Northern Oil & Gas. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Northern Oil & Gas compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Northern Oil & Gas's stock. This examination reveals shifts in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Northern Oil & Gas's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Northern Oil & Gas analyst ratings.

Delving into Northern Oil & Gas's Background

Northern Oil & Gas Inc is an independent energy company engaged in the acquisition, exploration, development, and production of crude oil and natural gas properties. Its principal business is crude oil and natural gas exploration, development, and production. The company's oil and natural gas sales come from three geographic areas in the United States: the Williston Basin (North Dakota and Montana), the Permian Basin (New Mexico and Texas), the Uinta Basin, and the Appalachian Basin (Pennsylvania and Ohio).

Northern Oil & Gas's Financial Performance

Market Capitalization Analysis: Below industry benchmarks, the company's market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: Northern Oil & Gas's revenue growth over a period of 3M has been noteworthy. As of 31 March, 2025, the company achieved a revenue growth rate of approximately 8.5%. This indicates a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Energy sector.

Net Margin: Northern Oil & Gas's net margin is impressive, surpassing industry averages. With a net margin of 23.95%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 5.89%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Northern Oil & Gas's ROA stands out, surpassing industry averages. With an impressive ROA of 2.46%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 0.96, caution is advised due to increased financial risk.

What Are Analyst Ratings?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for NOG

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | B of A Securities | Downgrades | Buy | Neutral |

| Mar 2022 | RBC Capital | Maintains | Outperform | |

| Dec 2021 | B of A Securities | Upgrades | Neutral | Buy |

Posted-In: BZI-AARAnalyst Ratings