Deep Dive Into Caterpillar Stock: Analyst Perspectives (15 Ratings)

Providing a diverse range of perspectives from bullish to bearish, 15 analysts have published ratings on Caterpillar (NYSE:CAT) in the last three months.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 5 | 4 | 6 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 2 | 1 | 0 | 0 | 0 |

| 2M Ago | 0 | 1 | 2 | 0 | 0 |

| 3M Ago | 2 | 2 | 4 | 0 | 0 |

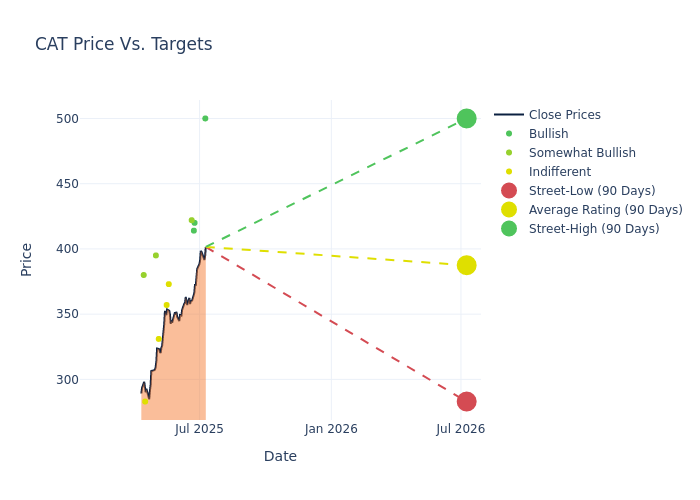

Analysts have set 12-month price targets for Caterpillar, revealing an average target of $378.0, a high estimate of $500.00, and a low estimate of $283.00. Marking an increase of 6.87%, the current average surpasses the previous average price target of $353.69.

Exploring Analyst Ratings: An In-Depth Overview

The perception of Caterpillar by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Rob Wertheimer | Melius Research | Announces | Buy | $500.00 | - |

| Kyle Menges | Citigroup | Raises | Buy | $420.00 | $370.00 |

| Jamie Cook | Truist Securities | Raises | Buy | $414.00 | $396.00 |

| Mircea Dobre | Baird | Raises | Outperform | $422.00 | $395.00 |

| David Raso | Evercore ISI Group | Lowers | In-Line | $373.00 | $375.00 |

| Steven Fisher | UBS | Raises | Neutral | $357.00 | $272.00 |

| Mircea Dobre | Baird | Raises | Outperform | $395.00 | $309.00 |

| Kyle Menges | Citigroup | Raises | Buy | $370.00 | $320.00 |

| Michael Shlisky | DA Davidson | Raises | Neutral | $331.00 | $325.00 |

| Jamie Cook | Truist Securities | Raises | Buy | $396.00 | $389.00 |

| Kristen Owen | Oppenheimer | Announces | Outperform | $395.00 | - |

| Mircea Dobre | Baird | Raises | Neutral | $309.00 | $300.00 |

| Michael Shlisky | DA Davidson | Lowers | Neutral | $325.00 | $357.00 |

| Angel Castillo | Morgan Stanley | Lowers | Equal-Weight | $283.00 | $300.00 |

| Tami Zakaria | JP Morgan | Lowers | Overweight | $380.00 | $490.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Caterpillar. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Caterpillar compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Caterpillar's stock. This comparison reveals trends in analysts' expectations over time.

For valuable insights into Caterpillar's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Caterpillar analyst ratings.

Unveiling the Story Behind Caterpillar

Caterpillar is the world's leading manufacturer of construction and mining equipment, off-highway diesel and natural gas engines, industrial gas turbines and diesel-electric locomotives. Its reporting segments are: construction industries (40% sales/47% operating profit, or OP), resource industries (20% sales/19% OP), and energy & transportation (40% sales/34% OP). Market share approaches 20% across many products. Caterpillar operates a captive finance subsidiary to facilitate sales. The firm has global reach (46% US sales/54% ex-US). Construction skews more domestic, while the other divisions are more geographically diversified. An independent network of 156 dealers operates approximately 2,800 facilities, giving Caterpillar reach into about 190 countries for sales and support services.

Caterpillar's Economic Impact: An Analysis

Market Capitalization Analysis: The company's market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Revenue Challenges: Caterpillar's revenue growth over 3M faced difficulties. As of 31 March, 2025, the company experienced a decline of approximately -9.81%. This indicates a decrease in top-line earnings. When compared to others in the Industrials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Caterpillar's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 14.06%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Caterpillar's ROE excels beyond industry benchmarks, reaching 10.67%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 2.32%, the company showcases effective utilization of assets.

Debt Management: Caterpillar's debt-to-equity ratio is notably higher than the industry average. With a ratio of 2.14, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

The Core of Analyst Ratings: What Every Investor Should Know

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for CAT

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Wells Fargo | Initiates Coverage On | Equal-Weight | |

| Mar 2022 | Jefferies | Upgrades | Hold | Buy |

| Feb 2022 | Tigress Financial | Maintains | Buy |

Posted-In: BZI-AARAnalyst Ratings