A Glimpse Into The Expert Outlook On Deckers Outdoor Through 23 Analysts

During the last three months, 23 analysts shared their evaluations of Deckers Outdoor (NYSE:DECK), revealing diverse outlooks from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 8 | 5 | 9 | 0 | 1 |

| Last 30D | 0 | 0 | 0 | 0 | 1 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 6 | 4 | 6 | 0 | 0 |

| 3M Ago | 2 | 1 | 3 | 0 | 0 |

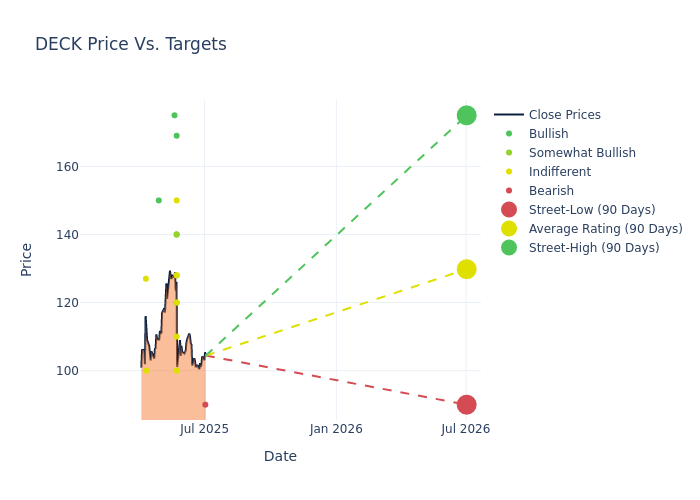

In the assessment of 12-month price targets, analysts unveil insights for Deckers Outdoor, presenting an average target of $137.35, a high estimate of $240.00, and a low estimate of $90.00. A 24.65% drop is evident in the current average compared to the previous average price target of $182.29.

Interpreting Analyst Ratings: A Closer Look

The perception of Deckers Outdoor by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Brooke Roach | Goldman Sachs | Announces | Sell | $90.00 | - |

| Christopher Nardone | B of A Securities | Lowers | Neutral | $128.00 | $154.00 |

| Jonathan Komp | Baird | Lowers | Outperform | $140.00 | $160.00 |

| Ike Boruchow | Wells Fargo | Lowers | Equal-Weight | $100.00 | $120.00 |

| Jay Sole | UBS | Raises | Buy | $169.00 | $158.00 |

| Rick Patel | Raymond James | Lowers | Strong Buy | $140.00 | $150.00 |

| Adrienne Yih | Barclays | Lowers | Overweight | $128.00 | $129.00 |

| Ashley Owens | Keybanc | Maintains | Sector Weight | $150.00 | $150.00 |

| JESALYN Wong | Evercore ISI Group | Lowers | In-Line | $110.00 | $235.00 |

| Dana Telsey | Telsey Advisory Group | Lowers | Market Perform | $120.00 | $240.00 |

| Tom Nikic | Needham | Lowers | Buy | $120.00 | $150.00 |

| Tom Nikic | Needham | Lowers | Buy | $150.00 | $246.00 |

| John Kernan | TD Securities | Raises | Buy | $175.00 | $150.00 |

| Dana Telsey | Telsey Advisory Group | Maintains | Outperform | $240.00 | $240.00 |

| Ike Boruchow | Wells Fargo | Raises | Equal-Weight | $120.00 | $115.00 |

| Adrienne Yih | Barclays | Lowers | Overweight | $129.00 | $231.00 |

| Jay Sole | UBS | Raises | Buy | $158.00 | $150.00 |

| Ike Boruchow | Wells Fargo | Lowers | Equal-Weight | $115.00 | $210.00 |

| Ashley Owens | Keybanc | Lowers | Overweight | $150.00 | $230.00 |

| Paul Lejuez | Citigroup | Lowers | Buy | $150.00 | $215.00 |

| Anna Andreeva | Piper Sandler | Lowers | Neutral | $100.00 | $210.00 |

| Rick Patel | Raymond James | Announces | Strong Buy | $150.00 | - |

| Jim Duffy | Stifel | Lowers | Hold | $127.00 | $185.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Deckers Outdoor. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Deckers Outdoor compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Deckers Outdoor's stock. This analysis reveals shifts in analysts' expectations over time.

For valuable insights into Deckers Outdoor's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Deckers Outdoor analyst ratings.

Discovering Deckers Outdoor: A Closer Look

Founded in 1973, California-based Deckers designs and sells casual and performance footwear, apparel, and accessories. In fiscal 2025, Ugg and Hoka accounted for 51% and 45% of total sales, respectively. The firm also markets niche brands Teva and Ahnu. Deckers produces most of its sales through wholesale partnerships but also operates e-commerce in more than 50 countries and about 180 company-operated stores. It generated 64% of its fiscal 2025 sales in the United States.

Key Indicators: Deckers Outdoor's Financial Health

Market Capitalization Analysis: Below industry benchmarks, the company's market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Positive Revenue Trend: Examining Deckers Outdoor's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 6.46% as of 31 March, 2025, showcasing a substantial increase in top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Consumer Discretionary sector.

Net Margin: Deckers Outdoor's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 14.82% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Deckers Outdoor's ROE excels beyond industry benchmarks, reaching 5.89%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Deckers Outdoor's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 4.02% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: With a below-average debt-to-equity ratio of 0.11, Deckers Outdoor adopts a prudent financial strategy, indicating a balanced approach to debt management.

Analyst Ratings: What Are They?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for DECK

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Telsey Advisory Group | Maintains | Outperform | |

| Jan 2022 | Seaport Global | Initiates Coverage On | Buy | |

| Oct 2021 | Wedbush | Initiates Coverage On | Neutral |

Posted-In: BZI-AARAnalyst Ratings