A Glimpse Into The Expert Outlook On Federal Realty Investment Through 8 Analysts

Analysts' ratings for Federal Realty Investment (NYSE:FRT) over the last quarter vary from bullish to bearish, as provided by 8 analysts.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 6 | 2 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 2 | 0 | 0 |

| 2M Ago | 0 | 4 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 0 | 0 | 0 |

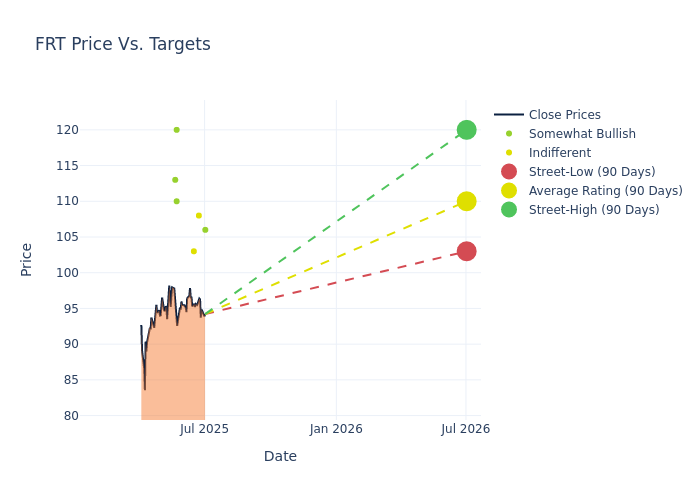

In the assessment of 12-month price targets, analysts unveil insights for Federal Realty Investment, presenting an average target of $109.88, a high estimate of $120.00, and a low estimate of $103.00. Observing a downward trend, the current average is 6.2% lower than the prior average price target of $117.14.

Exploring Analyst Ratings: An In-Depth Overview

The analysis of recent analyst actions sheds light on the perception of Federal Realty Investment by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Richard Hightower | Barclays | Announces | Overweight | $106.00 | - |

| Michael Mueller | JP Morgan | Maintains | Neutral | $108.00 | $108.00 |

| Michael Goldsmith | UBS | Lowers | Neutral | $103.00 | $118.00 |

| RJ Milligan | Raymond James | Lowers | Outperform | $110.00 | $117.00 |

| Alexander Goldfarb | Piper Sandler | Lowers | Overweight | $120.00 | $135.00 |

| Michael Mueller | JP Morgan | Lowers | Overweight | $108.00 | $114.00 |

| Nicholas Yulico | Scotiabank | Raises | Sector Outperform | $113.00 | $111.00 |

| Nicholas Yulico | Scotiabank | Lowers | Sector Outperform | $111.00 | $117.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Federal Realty Investment. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Federal Realty Investment compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Federal Realty Investment's stock. This comparison reveals trends in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Federal Realty Investment's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Federal Realty Investment analyst ratings.

Delving into Federal Realty Investment's Background

Federal Realty Investment Trust is a shopping center-focused retail real estate investment trust that owns high-quality properties in eight of the largest metropolitan markets. Its portfolio includes an interest in 102 properties, which includes 26.8 million square feet of retail space and over 3,100 multifamily units. Federal's retail portfolio includes grocery-anchored centers, superregional centers, power centers, and mixed-use urban centers. Federal Realty has focused on owning assets in highly desirable areas with significant growth, and as a result, the average population density and average median household income are higher for its portfolio than for any other retail REIT.

Breaking Down Federal Realty Investment's Financial Performance

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Revenue Growth: Over the 3M period, Federal Realty Investment showcased positive performance, achieving a revenue growth rate of 6.12% as of 31 March, 2025. This reflects a substantial increase in the company's top-line earnings. When compared to others in the Real Estate sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Federal Realty Investment's net margin is impressive, surpassing industry averages. With a net margin of 19.87%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Federal Realty Investment's ROE stands out, surpassing industry averages. With an impressive ROE of 2.03%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Federal Realty Investment's ROA excels beyond industry benchmarks, reaching 0.72%. This signifies efficient management of assets and strong financial health.

Debt Management: Federal Realty Investment's debt-to-equity ratio is below the industry average at 1.52, reflecting a lower dependency on debt financing and a more conservative financial approach.

Analyst Ratings: What Are They?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for FRT

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Mizuho | Maintains | Buy | |

| Feb 2022 | Capital One | Upgrades | Equal-Weight | Overweight |

| Jan 2022 | Deutsche Bank | Maintains | Buy |

Posted-In: BZI-AARAnalyst Ratings