Beyond The Numbers: 6 Analysts Discuss Medtronic Stock

Medtronic (NYSE:MDT) underwent analysis by 6 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 3 | 3 | 0 | 0 |

| Last 30D | 0 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 1 | 0 | 0 | 0 |

| 2M Ago | 0 | 2 | 1 | 0 | 0 |

| 3M Ago | 0 | 0 | 2 | 0 | 0 |

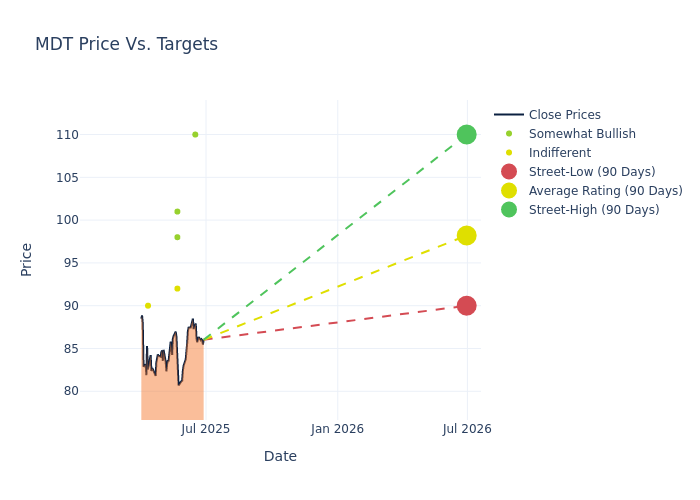

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $97.5, along with a high estimate of $110.00 and a low estimate of $90.00. This upward trend is evident, with the current average reflecting a 0.93% increase from the previous average price target of $96.60.

Breaking Down Analyst Ratings: A Detailed Examination

The perception of Medtronic by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Mike Kratky | Leerink Partners | Announces | Outperform | $110.00 | - |

| Anthony Petrone | Mizuho | Lowers | Outperform | $98.00 | $100.00 |

| Shagun Singh | RBC Capital | Lowers | Outperform | $101.00 | $105.00 |

| David Rescott | Baird | Lowers | Neutral | $92.00 | $94.00 |

| Richard Newitter | Truist Securities | Lowers | Hold | $90.00 | $93.00 |

| David Rescott | Baird | Raises | Neutral | $94.00 | $91.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Medtronic. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Medtronic compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Medtronic's stock. This analysis reveals shifts in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Medtronic's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Medtronic analyst ratings.

About Medtronic

One of the largest medical-device companies, Medtronic develops and manufactures therapeutic medical devices for chronic diseases. Its portfolio includes pacemakers, defibrillators, transcatheter heart valves, stents, insulin pumps, spinal fixation devices, neurovascular products, advanced energy, and surgical tools. The company primarily markets its products to healthcare institutions and physicians in the United States, Western Europe, and Japan. Foreign sales account for roughly 50% of the company's total sales.

Understanding the Numbers: Medtronic's Finances

Market Capitalization: Boasting an elevated market capitalization, the company surpasses industry averages. This signals substantial size and strong market recognition.

Revenue Growth: Medtronic's remarkable performance in 3M is evident. As of 30 April, 2025, the company achieved an impressive revenue growth rate of 3.94%. This signifies a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Health Care sector.

Net Margin: Medtronic's net margin is impressive, surpassing industry averages. With a net margin of 11.83%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Medtronic's ROE stands out, surpassing industry averages. With an impressive ROE of 2.17%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Medtronic's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.16% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Medtronic's debt-to-equity ratio is below the industry average at 0.59, reflecting a lower dependency on debt financing and a more conservative financial approach.

How Are Analyst Ratings Determined?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for MDT

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Credit Suisse | Maintains | Outperform | |

| Feb 2022 | Needham | Maintains | Buy | |

| Feb 2022 | Raymond James | Maintains | Outperform |

Posted-In: BZI-AARAnalyst Ratings