Deep Dive Into Pinterest Stock: Analyst Perspectives (22 Ratings)

Pinterest (NYSE:PINS) underwent analysis by 22 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 10 | 6 | 6 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 1 | 0 | 0 | 0 |

| 2M Ago | 3 | 3 | 3 | 0 | 0 |

| 3M Ago | 6 | 2 | 3 | 0 | 0 |

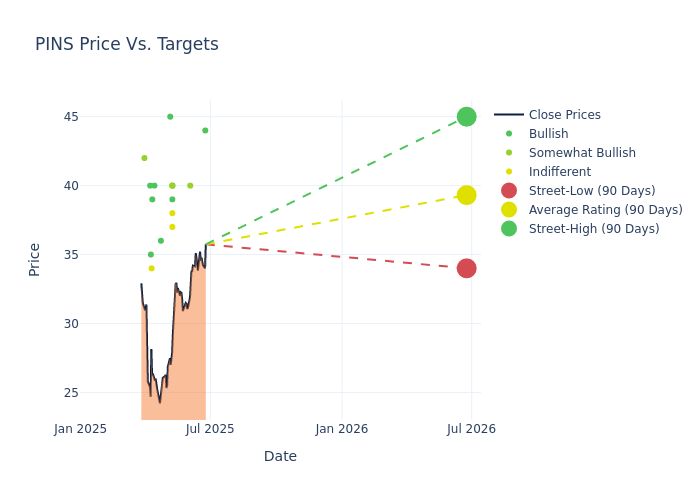

In the assessment of 12-month price targets, analysts unveil insights for Pinterest, presenting an average target of $38.09, a high estimate of $45.00, and a low estimate of $28.00. A negative shift in sentiment is evident as analysts have decreased the average price target by 8.81%.

Diving into Analyst Ratings: An In-Depth Exploration

An in-depth analysis of recent analyst actions unveils how financial experts perceive Pinterest. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Ronald Josey | Citigroup | Raises | Buy | $44.00 | $41.00 |

| Doug Anmuth | JP Morgan | Raises | Overweight | $40.00 | $35.00 |

| Doug Anmuth | JP Morgan | Raises | Neutral | $35.00 | $30.00 |

| Jason Helfstein | Oppenheimer | Raises | Outperform | $40.00 | $36.00 |

| Scott Devitt | Wedbush | Raises | Outperform | $40.00 | $38.00 |

| Michael Morris | Guggenheim | Lowers | Buy | $39.00 | $40.00 |

| Brian Nowak | Morgan Stanley | Raises | Equal-Weight | $37.00 | $28.00 |

| Ronald Josey | Citigroup | Raises | Buy | $41.00 | $38.00 |

| Ross Sandler | Barclays | Lowers | Equal-Weight | $38.00 | $42.00 |

| Justin Patterson | Keybanc | Raises | Overweight | $40.00 | $37.00 |

| Mark Zgutowicz | Benchmark | Lowers | Buy | $45.00 | $55.00 |

| Mark Kelley | Stifel | Lowers | Buy | $36.00 | $50.00 |

| Brian Nowak | Morgan Stanley | Lowers | Equal-Weight | $28.00 | $42.00 |

| Ronald Josey | Citigroup | Lowers | Buy | $38.00 | $47.00 |

| Eric Sheridan | Goldman Sachs | Lowers | Buy | $40.00 | $47.00 |

| Lloyd Walmsley | UBS | Lowers | Buy | $39.00 | $50.00 |

| Thomas Champion | Piper Sandler | Lowers | Neutral | $34.00 | $41.00 |

| Justin Patterson | Keybanc | Lowers | Overweight | $37.00 | $41.00 |

| Justin Post | B of A Securities | Lowers | Buy | $35.00 | $46.00 |

| John Blackledge | TD Cowen | Lowers | Buy | $40.00 | $46.00 |

| Doug Anmuth | JP Morgan | Lowers | Neutral | $30.00 | $42.00 |

| Ken Gawrelski | Wells Fargo | Lowers | Overweight | $42.00 | $47.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Pinterest. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Pinterest compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Pinterest's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

To gain a panoramic view of Pinterest's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Pinterest analyst ratings.

All You Need to Know About Pinterest

Pinterest is a social media platform with a focus on product and idea discovery. Pinterest users, or pinners, can leverage the platform as they go about gathering ideas on topics such as home improvement, fashion, cooking, and travel. The company has more than 500 million monthly active users, two thirds of whom are female. Pinterest generates revenue by selling digital ads on its platform. While the platform's user base spans the globe, the vast majority of its revenue stems from ads shown to North American users.

Unraveling the Financial Story of Pinterest

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Revenue Growth: Over the 3M period, Pinterest showcased positive performance, achieving a revenue growth rate of 15.54% as of 31 March, 2025. This reflects a substantial increase in the company's top-line earnings. When compared to others in the Communication Services sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Pinterest's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.04% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Pinterest's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 0.19%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Pinterest's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 0.17%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.03.

How Are Analyst Ratings Determined?

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for PINS

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Benchmark | Initiates Coverage On | Hold | |

| Feb 2022 | Credit Suisse | Maintains | Neutral | |

| Feb 2022 | UBS | Maintains | Neutral |

Posted-In: BZI-AARAnalyst Ratings