The Analyst Verdict: Spire In The Eyes Of 4 Experts

Throughout the last three months, 4 analysts have evaluated Spire (NYSE:SR), offering a diverse set of opinions from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 1 | 3 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 1 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 1 | 0 | 0 |

| 3M Ago | 0 | 0 | 1 | 0 | 0 |

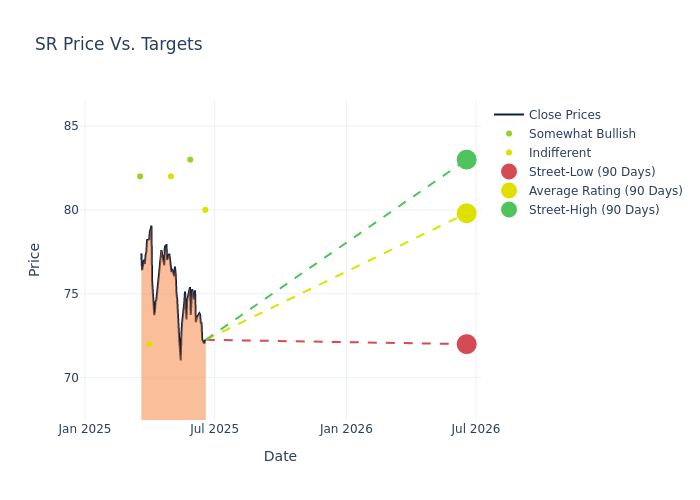

Analysts have set 12-month price targets for Spire, revealing an average target of $79.25, a high estimate of $83.00, and a low estimate of $72.00. Marking an increase of 3.93%, the current average surpasses the previous average price target of $76.25.

Understanding Analyst Ratings: A Comprehensive Breakdown

The standing of Spire among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Stephen Byrd | Morgan Stanley | Raises | Equal-Weight | $80.00 | $78.00 |

| Richard Sunderland | JP Morgan | Lowers | Overweight | $83.00 | $85.00 |

| Sarah Akers | Wells Fargo | Raises | Equal-Weight | $82.00 | $75.00 |

| Shahriar Pourreza | Guggenheim | Raises | Neutral | $72.00 | $67.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Spire. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Spire compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Spire's stock. This comparison reveals trends in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Spire's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Spire analyst ratings.

Discovering Spire: A Closer Look

Spire Inc is a public utility holding company with three reportable business segments: Gas Utility, Gas Marketing and Midstream. The Gas Utility segment includes the regulated operations of Laclede Gas, Alabama Gas Corporation ('Alagasco') changed its name to Spire Alabama Inc. effective September 1, 2017, and Laclede Gas Company changed its name to Spire Missouri Inc. effective August 30, 2017. The Gas Utility segment generates a majority of the company's revenue but is subject to seasonal fluctuations. The Gas Marketing segment includes Laclede Energy Resources, Inc, whose operations include the marketing of natural gas and related activities on a non-regulated basis and the Midstream segment includes transportation and storage of natural gas. Maximum revenue from residential area.

Financial Milestones: Spire's Journey

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Revenue Challenges: Spire's revenue growth over 3M faced difficulties. As of 31 March, 2025, the company experienced a decline of approximately -6.84%. This indicates a decrease in top-line earnings. When compared to others in the Utilities sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Spire's net margin is impressive, surpassing industry averages. With a net margin of 19.53%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Spire's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 6.47%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Spire's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of 1.81%, the company may face hurdles in achieving optimal financial returns.

Debt Management: With a high debt-to-equity ratio of 1.46, Spire faces challenges in effectively managing its debt levels, indicating potential financial strain.

The Core of Analyst Ratings: What Every Investor Should Know

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for SR

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Morgan Stanley | Maintains | Equal-Weight | |

| Jan 2022 | Guggenheim | Downgrades | Buy | Neutral |

| Jan 2022 | Guggenheim | Downgrades | Buy | Neutral |

Posted-In: BZI-AARAnalyst Ratings