15 Analysts Assess Costco Wholesale: What You Need To Know

During the last three months, 15 analysts shared their evaluations of Costco Wholesale (NASDAQ:COST), revealing diverse outlooks from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

How Matt Maley Is Trading the Final Week of June—Live Sunday at 1 PM ET

With the Fed out of the way, traders are shifting focus to key macro data, tariff headlines, and rising geopolitical risk. Join Matt Maley as he shares the real trades he’s targeting this week—including how he plans to repeat his recent wins on SQQQ and GDX by staying nimble, tactical, and tuned into market signals. Register for free to attend.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 10 | 2 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 4 | 1 | 0 | 0 |

| 2M Ago | 0 | 3 | 0 | 0 | 0 |

| 3M Ago | 2 | 2 | 1 | 0 | 0 |

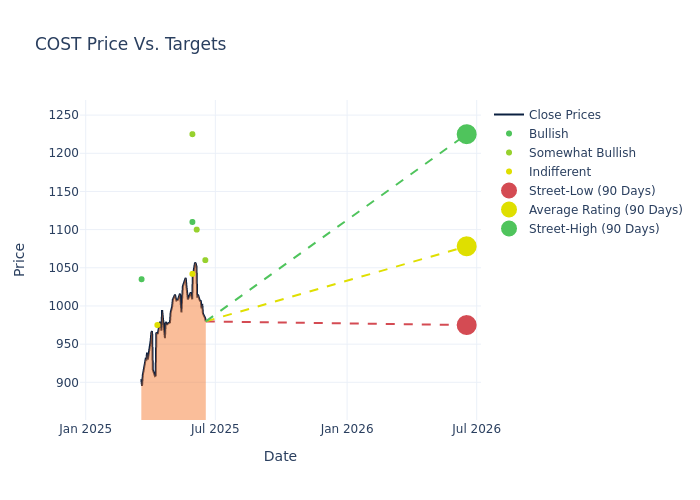

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $1084.47, a high estimate of $1225.00, and a low estimate of $975.00. Experiencing a 0.96% decline, the current average is now lower than the previous average price target of $1095.00.

Understanding Analyst Ratings: A Comprehensive Breakdown

The standing of Costco Wholesale among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Greg Melich | Evercore ISI Group | Lowers | Outperform | $1060.00 | $1075.00 |

| Joseph Feldman | Telsey Advisory Group | Maintains | Outperform | $1100.00 | $1100.00 |

| Simeon Gutman | Morgan Stanley | Raises | Overweight | $1225.00 | $1150.00 |

| Laura Champine | Loop Capital | Lowers | Buy | $1110.00 | $1115.00 |

| Greg Melich | Evercore ISI Group | Raises | Outperform | $1075.00 | $1070.00 |

| Scot Ciccarelli | Truist Securities | Raises | Hold | $1042.00 | $995.00 |

| Joseph Feldman | Telsey Advisory Group | Maintains | Outperform | $1100.00 | $1100.00 |

| Joseph Feldman | Telsey Advisory Group | Maintains | Outperform | $1100.00 | $1100.00 |

| Joseph Feldman | Telsey Advisory Group | Maintains | Outperform | $1100.00 | $1100.00 |

| Joseph Feldman | Telsey Advisory Group | Maintains | Outperform | $1100.00 | $1100.00 |

| David Belinger | Mizuho | Announces | Neutral | $975.00 | - |

| Joseph Feldman | Telsey Advisory Group | Maintains | Outperform | $1100.00 | $1100.00 |

| Laura Champine | Loop Capital | Lowers | Buy | $1045.00 | $1150.00 |

| Joseph Feldman | Telsey Advisory Group | Maintains | Outperform | $1100.00 | $1100.00 |

| Mark Astrachan | Stifel | Lowers | Buy | $1035.00 | $1075.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Costco Wholesale. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Costco Wholesale compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Costco Wholesale's stock. This comparison reveals trends in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Costco Wholesale's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Costco Wholesale analyst ratings.

Unveiling the Story Behind Costco Wholesale

Costco operates a membership-based, no-frills retail model predicated on offering a select product assortment in bulk quantities at bargain prices. The firm avoids maintaining costly product displays by keeping inventory on pallets and limits distribution expenses by storing its inventory at point of sale in the warehouse. Given its frugal cost structure, the firm is able to price its merchandise below that of competing retailers, driving high sales volume per warehouse and generating strong profits on thin margins. Costco operates over 600 warehouses in the United States and has over 60% share in the domestic warehouse club industry. Internationally, Costco operates about 280 warehouses, primarily in Canada, Mexico, Japan, and the UK.

Costco Wholesale's Economic Impact: An Analysis

Market Capitalization Analysis: With a profound presence, the company's market capitalization is above industry averages. This reflects substantial size and strong market recognition.

Positive Revenue Trend: Examining Costco Wholesale's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 8.02% as of 31 May, 2025, showcasing a substantial increase in top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Consumer Staples sector.

Net Margin: Costco Wholesale's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 3.01%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Costco Wholesale's ROE excels beyond industry benchmarks, reaching 7.22%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Costco Wholesale's ROA stands out, surpassing industry averages. With an impressive ROA of 2.56%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: With a below-average debt-to-equity ratio of 0.3, Costco Wholesale adopts a prudent financial strategy, indicating a balanced approach to debt management.

The Significance of Analyst Ratings Explained

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for COST

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Deutsche Bank | Maintains | Hold | |

| Mar 2022 | BMO Capital | Maintains | Outperform | |

| Mar 2022 | Telsey Advisory Group | Maintains | Outperform |

NEW: Get Access to The Leaderboards That Reveal Tomorrow’s Top Stocks

Updated daily, Benzinga’s Top Stock Leaderboards highlight our best buys right now. Spot breakout opportunities before the crowd catches on—without the noise. Get access now and start using the same research trusted by hedge funds, analysts, and serious traders. Get started here.

Posted-In: BZI-AARAnalyst Ratings