Alkermes Stock: A Deep Dive Into Analyst Perspectives (6 Ratings)

Alkermes (NASDAQ:ALKS) underwent analysis by 6 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 1 | 2 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 1 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 1 | 2 | 0 | 0 |

| 3M Ago | 1 | 0 | 0 | 0 | 0 |

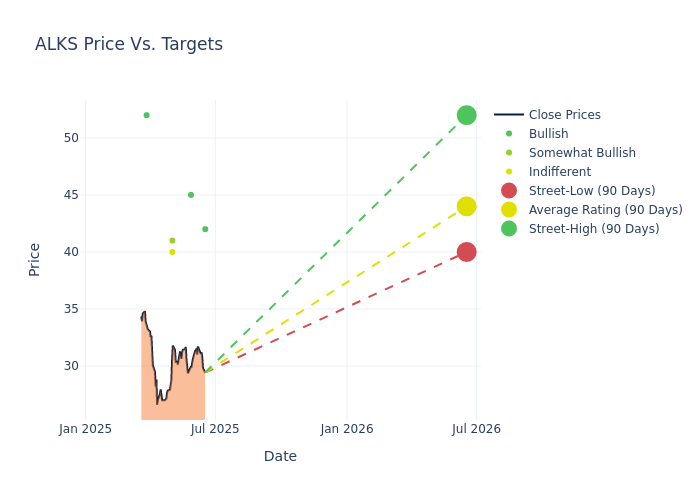

Analysts have recently evaluated Alkermes and provided 12-month price targets. The average target is $42.17, accompanied by a high estimate of $52.00 and a low estimate of $33.00. Observing a 12.15% increase, the current average has risen from the previous average price target of $37.60.

Understanding Analyst Ratings: A Comprehensive Breakdown

The analysis of recent analyst actions sheds light on the perception of Alkermes by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Ashwani Verma | UBS | Raises | Buy | $42.00 | $33.00 |

| Ami Fadia | Needham | Announces | Buy | $45.00 | - |

| Leonid Timashev | RBC Capital | Raises | Sector Perform | $40.00 | $39.00 |

| Joel Beatty | Baird | Raises | Outperform | $41.00 | $38.00 |

| Ashwani Verma | UBS | Lowers | Neutral | $33.00 | $38.00 |

| David Hoang | Deutsche Bank | Raises | Buy | $52.00 | $40.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Alkermes. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Alkermes compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Alkermes's stock. This examination reveals shifts in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Alkermes's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Alkermes analyst ratings.

Delving into Alkermes's Background

Alkermes PLC is a fully integrated biotechnology company that applies its proprietary technologies to research, develop, and commercialize pharmaceutical products designed for unmet medical needs in therapeutic areas. The company utilizes several to develop and commercialize products and, in so doing, access technological, financial, marketing, manufacturing, and other resources. Alkermes either purchases active drug products from third parties or receives them from its third-party licensees to formulate products using its technologies. It operates in U.S., which derives maximum revenue, Ireland and Rest of the world.

Key Indicators: Alkermes's Financial Health

Market Capitalization Analysis: The company's market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Revenue Growth: Alkermes's revenue growth over a period of 3M has faced challenges. As of 31 March, 2025, the company experienced a revenue decline of approximately -12.52%. This indicates a decrease in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: Alkermes's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 7.33% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Alkermes's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.51% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Alkermes's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.09% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.05.

Understanding the Relevance of Analyst Ratings

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for ALKS

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jan 2022 | Cantor Fitzgerald | Upgrades | Neutral | Overweight |

| Dec 2021 | Citigroup | Initiates Coverage On | Neutral | |

| Nov 2021 | SVB Leerink | Maintains | Market Perform |

Posted-In: BZI-AARAnalyst Ratings