Demystifying Zoom Communications: Insights From 21 Analyst Reviews

Providing a diverse range of perspectives from bullish to bearish, 21 analysts have published ratings on Zoom Communications (NASDAQ:ZM) in the last three months.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 6 | 3 | 11 | 1 | 0 |

| Last 30D | 0 | 0 | 0 | 1 | 0 |

| 1M Ago | 4 | 1 | 8 | 0 | 0 |

| 2M Ago | 1 | 1 | 2 | 0 | 0 |

| 3M Ago | 1 | 1 | 1 | 0 | 0 |

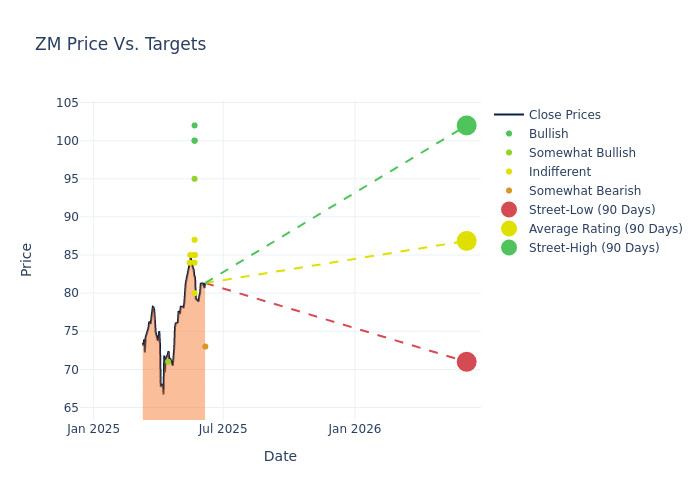

Analysts have recently evaluated Zoom Communications and provided 12-month price targets. The average target is $86.14, accompanied by a high estimate of $102.00 and a low estimate of $71.00. This current average represents a 1.7% decrease from the previous average price target of $87.63.

Interpreting Analyst Ratings: A Closer Look

An in-depth analysis of recent analyst actions unveils how financial experts perceive Zoom Communications. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Jackson Ader | Keybanc | Announces | Underweight | $73.00 | - |

| Nikolay Beliov | B of A Securities | Raises | Neutral | $84.00 | $79.00 |

| Rishi Jaluria | RBC Capital | Maintains | Outperform | $95.00 | $95.00 |

| Thomas Blakey | Cantor Fitzgerald | Maintains | Neutral | $87.00 | $87.00 |

| Mark Murphy | JP Morgan | Raises | Neutral | $85.00 | $80.00 |

| James Fish | Piper Sandler | Raises | Neutral | $85.00 | $77.00 |

| Matthew Harrigan | Benchmark | Raises | Buy | $102.00 | $97.00 |

| Michael Turrin | Wells Fargo | Raises | Equal-Weight | $80.00 | $75.00 |

| Meta Marshall | Morgan Stanley | Raises | Equal-Weight | $85.00 | $79.00 |

| Catharine Trebnick | Rosenblatt | Raises | Buy | $100.00 | $90.00 |

| Joshua Reilly | Needham | Announces | Buy | $100.00 | - |

| Allan Verkhovski | Scotiabank | Raises | Sector Perform | $85.00 | $75.00 |

| Tyler Radke | Citigroup | Lowers | Neutral | $84.00 | $85.00 |

| Catharine Trebnick | Rosenblatt | Maintains | Buy | $90.00 | $90.00 |

| Catharine Trebnick | Rosenblatt | Lowers | Buy | $90.00 | $95.00 |

| Michael Turrin | Wells Fargo | Lowers | Equal-Weight | $75.00 | $85.00 |

| Meta Marshall | Morgan Stanley | Lowers | Equal-Weight | $73.00 | $96.00 |

| Siti Panigrahi | Mizuho | Lowers | Outperform | $71.00 | $105.00 |

| Rishi Jaluria | RBC Capital | Maintains | Outperform | $95.00 | $95.00 |

| Catharine Trebnick | Rosenblatt | Maintains | Buy | $95.00 | $95.00 |

| Allan Verkhovski | Scotiabank | Lowers | Sector Perform | $75.00 | $85.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Zoom Communications. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Zoom Communications compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Zoom Communications's stock. This comparison reveals trends in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Zoom Communications's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Zoom Communications analyst ratings.

Unveiling the Story Behind Zoom Communications

Zoom Video Communications provides a communications platform that connects people through video, voice, chat, and content sharing. The company's cloud-native platform enables face-to-face video and connects users across various devices and locations in a single meeting. Zoom, which was founded in 2011 and is headquartered in San Jose, California, serves companies of all sizes from all industries around the world.

Key Indicators: Zoom Communications's Financial Health

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Revenue Growth: Over the 3M period, Zoom Communications showcased positive performance, achieving a revenue growth rate of 2.93% as of 30 April, 2025. This reflects a substantial increase in the company's top-line earnings. When compared to others in the Information Technology sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Zoom Communications's net margin excels beyond industry benchmarks, reaching 21.67%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Zoom Communications's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 2.85%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Zoom Communications's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 2.32% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.01.

The Core of Analyst Ratings: What Every Investor Should Know

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for ZM

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Wolfe Research | Downgrades | Outperform | Peer Perform |

| Mar 2022 | RBC Capital | Maintains | Outperform | |

| Mar 2022 | Wells Fargo | Maintains | Equal-Weight |

Posted-In: BZI-AARAnalyst Ratings