14 Analysts Have This To Say About Intl Flavors & Fragrances

Intl Flavors & Fragrances (NYSE:IFF) has been analyzed by 14 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 7 | 3 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 1 | 3 | 1 | 0 | 0 |

| 2M Ago | 2 | 4 | 1 | 0 | 0 |

| 3M Ago | 0 | 0 | 1 | 0 | 0 |

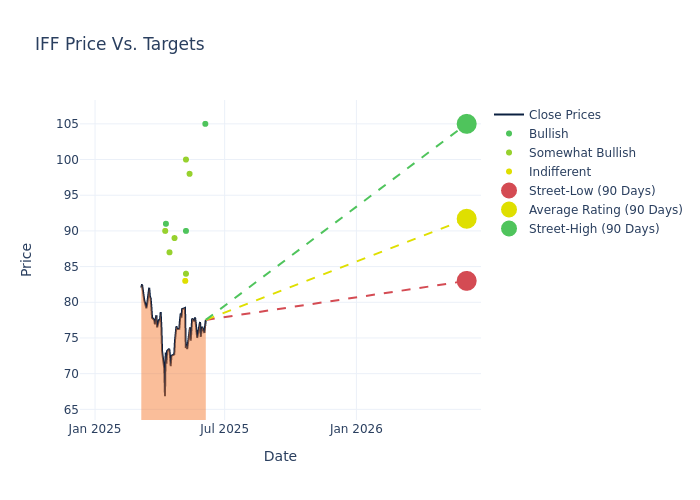

In the assessment of 12-month price targets, analysts unveil insights for Intl Flavors & Fragrances, presenting an average target of $89.93, a high estimate of $105.00, and a low estimate of $76.00. Highlighting a 5.03% decrease, the current average has fallen from the previous average price target of $94.69.

Investigating Analyst Ratings: An Elaborate Study

A comprehensive examination of how financial experts perceive Intl Flavors & Fragrances is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Ivan Feinseth | Tigress Financial | Announces | Buy | $105.00 | - |

| Lisa De Neve | Morgan Stanley | Lowers | Overweight | $98.00 | $100.00 |

| Patrick Cunningham | Citigroup | Raises | Buy | $90.00 | $84.00 |

| Ghansham Panjabi | Baird | Lowers | Outperform | $100.00 | $110.00 |

| Lauren Lieberman | Barclays | Raises | Overweight | $84.00 | $76.00 |

| Joshua Spector | UBS | Raises | Neutral | $83.00 | $82.00 |

| Kristen Owen | Oppenheimer | Lowers | Outperform | $89.00 | $104.00 |

| John Roberts | Mizuho | Lowers | Outperform | $87.00 | $95.00 |

| Lauren Lieberman | Barclays | Lowers | Equal-Weight | $76.00 | $82.00 |

| Lisa De Neve | Morgan Stanley | Lowers | Overweight | $100.00 | $106.00 |

| Mark Astrachan | Stifel | Lowers | Buy | $91.00 | $105.00 |

| Michael Sison | Wells Fargo | Lowers | Overweight | $90.00 | $105.00 |

| Patrick Cunningham | Citigroup | Lowers | Buy | $84.00 | $99.00 |

| Lauren Lieberman | Barclays | Lowers | Equal-Weight | $82.00 | $83.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Intl Flavors & Fragrances. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Intl Flavors & Fragrances compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Intl Flavors & Fragrances's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Intl Flavors & Fragrances's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Intl Flavors & Fragrances analyst ratings.

All You Need to Know About Intl Flavors & Fragrances

International Flavors & Fragrances is the largest specialty ingredients producer globally. It sells ingredients for the food, beverage, health, household goods, personal care, and pharmaceutical industries. The company makes proprietary formulations, partnering with customers to deliver custom solutions. The nourish segment, which generates roughly half of revenue, is a leading flavor producer and also sell texturants, plant-based proteins, and other ingredients. The health and biosciences business, which generates around one fourth of revenue, is a global leader in probiotics and enzymes. IFF is also one of the leading fragrance producers in the world.

Understanding the Numbers: Intl Flavors & Fragrances's Finances

Market Capitalization Highlights: Above the industry average, the company's market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Decline in Revenue: Over the 3M period, Intl Flavors & Fragrances faced challenges, resulting in a decline of approximately -1.93% in revenue growth as of 31 March, 2025. This signifies a reduction in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Materials sector.

Net Margin: Intl Flavors & Fragrances's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of -35.81%, the company may face hurdles in effective cost management.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of -7.53%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Intl Flavors & Fragrances's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of -3.58%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: Intl Flavors & Fragrances's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.75.

The Core of Analyst Ratings: What Every Investor Should Know

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for IFF

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Barclays | Maintains | Underweight | |

| Feb 2022 | Wells Fargo | Maintains | Overweight | |

| Jan 2022 | Stifel | Upgrades | Hold | Buy |

Posted-In: BZI-AARAnalyst Ratings