Beyond The Numbers: 6 Analysts Discuss Spire Stock

6 analysts have expressed a variety of opinions on Spire (NYSE:SR) over the past quarter, offering a diverse set of opinions from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 3 | 3 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 0 | 0 | 1 | 0 | 0 |

| 3M Ago | 0 | 2 | 1 | 0 | 0 |

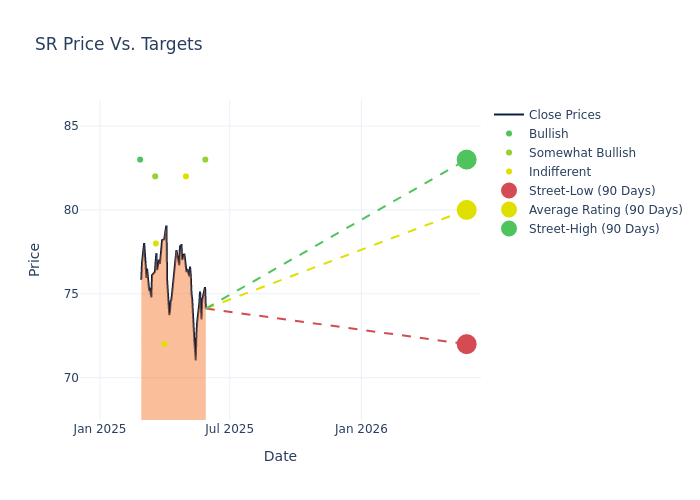

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $80.33, a high estimate of $85.00, and a low estimate of $72.00. This current average has increased by 7.11% from the previous average price target of $75.00.

Interpreting Analyst Ratings: A Closer Look

In examining recent analyst actions, we gain insights into how financial experts perceive Spire. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Richard Sunderland | JP Morgan | Lowers | Overweight | $83.00 | $85.00 |

| Sarah Akers | Wells Fargo | Raises | Equal-Weight | $82.00 | $75.00 |

| Shahriar Pourreza | Guggenheim | Raises | Neutral | $72.00 | $67.00 |

| Stephen Byrd | Morgan Stanley | Raises | Equal-Weight | $78.00 | $75.00 |

| Richard Sunderland | JP Morgan | Raises | Overweight | $85.00 | $72.00 |

| Gabriel Moreen | Mizuho | Raises | Outperform | $82.00 | $76.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Spire. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Spire compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Spire's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Spire's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Spire analyst ratings.

Unveiling the Story Behind Spire

Spire Inc is a public utility holding company with three reportable business segments: Gas Utility, Gas Marketing and Midstream. The Gas Utility segment includes the regulated operations of Laclede Gas, Alabama Gas Corporation ('Alagasco') changed its name to Spire Alabama Inc. effective September 1, 2017, and Laclede Gas Company changed its name to Spire Missouri Inc. effective August 30, 2017. The Gas Utility segment generates a majority of the company's revenue but is subject to seasonal fluctuations. The Gas Marketing segment includes Laclede Energy Resources, Inc, whose operations include the marketing of natural gas and related activities on a non-regulated basis and the Midstream segment includes transportation and storage of natural gas. Maximum revenue from residential area.

Spire's Financial Performance

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Challenges: Spire's revenue growth over 3M faced difficulties. As of 31 March, 2025, the company experienced a decline of approximately -6.84%. This indicates a decrease in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Utilities sector.

Net Margin: Spire's net margin is impressive, surpassing industry averages. With a net margin of 19.53%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Spire's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 6.47%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Spire's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 1.81%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: Spire's debt-to-equity ratio is notably higher than the industry average. With a ratio of 1.46, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

The Significance of Analyst Ratings Explained

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for SR

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Morgan Stanley | Maintains | Equal-Weight | |

| Jan 2022 | Guggenheim | Downgrades | Buy | Neutral |

| Jan 2022 | Guggenheim | Downgrades | Buy | Neutral |

Posted-In: BZI-AARAnalyst Ratings