Gordon Johnson Of Axiom Capital Not A Believer In U.S. Steel Rally

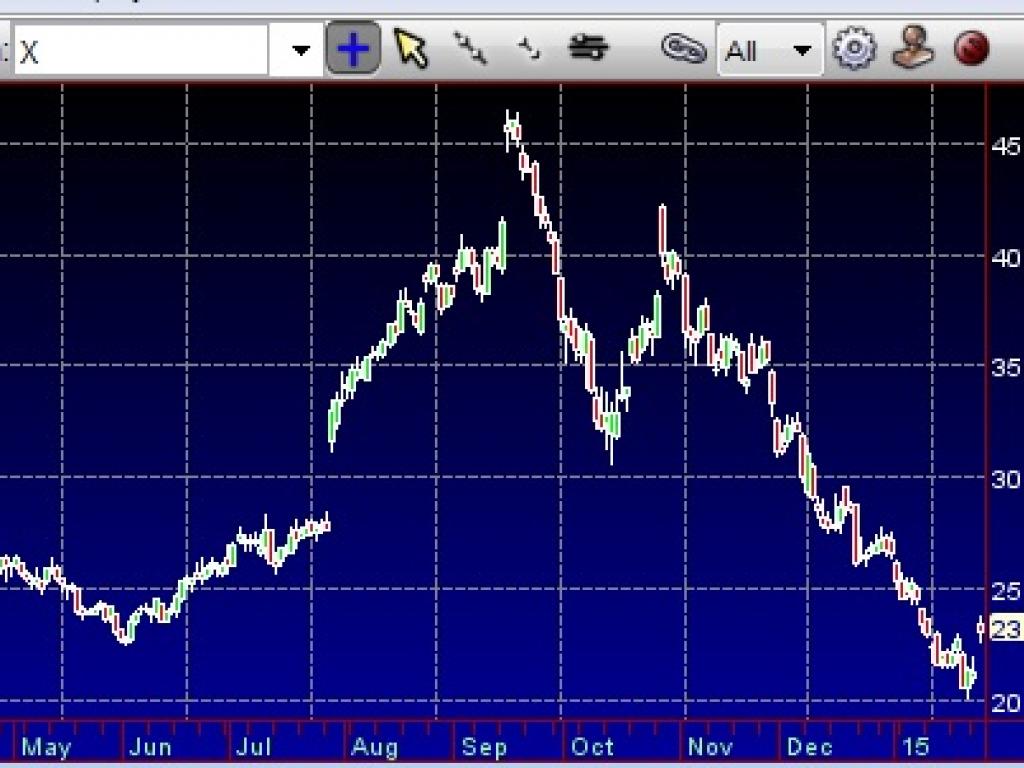

Back in September, Benzinga reached out to Gordon Johnson of Axiom Capital to weigh in on the parabolic rally in shares of United States Steel Corporation (NYSE: X) as the issue approached the $46.00 level. To say the least, he was skeptical of the rally and could not come up with a scenario that would validate the move. Since that time, U.S. Steel has been decimated, bottoming on January 23 at $20.55.

Upside Surprise

However, an upside surprise in Q4 earnings (EPS of $1.63 versus $0.87) on lower revenue of $4.07B versus $4.27 has the issue currently trading at the mid-$23.00 level.

When asked if he was a believer in Wednesday's rally, Johnson told Benzinga, “Not at all."

He went on to explain his rationale in detail and cited three main reasons why he thinks the rally in the issue will fade. At this time, Johnson has a $21.00 price target, but stated it is under review. He noted the target was set when crude was $90.00, and needs to be revisited as other factors must be calculated into the equation.

Concern 1: Change In Guidance Policy

To begin with, Johnson is leary of the fact that the company has suddenly switched from providing quarterly guidance to yearly guidance. This deviates from its long-standing policy and may be done to mask weakness in the second half of the year.

With respect to the actual numbers, a big boost was provided by contracts that inked at the end of 2013, with HRC prices at $685.00. Now with HRC ending the year at $603.00, the margins on the new yearly contracts are going to be much lower.

More importantly, each $5.00 decline in HRC prices has a “massive impact” on earnings. Therefore, the decline in revenue from the yearly contracts will not surface until later in the year.

Concern 2: Inventory Buildup

Johnson went on to highlight the effects of service-center inventory buildup. He cited the company using the weather as a concern at the end of 2013, and the low service-center inventory level of 2.3 days to put fear into the end-users.

At this time, service-center inventory levels are at record highs of 3.2 days. This puts it at levels higher than at the peak of HRC prices in 2008 and 2012.

Concern 3: Record Number Of Imports

Another important factor in his case for lower prices in HRC prices as well as the share price of U.S. Steel is the rapid increase in the pace of steel imports. With inventories already at record levels, the steady stream of more supply will only drive HRC prices lower.

Also, Johnson dismissed the notion that the World Trade Organization was going to act on the trade cases that address the dumping of steel from foreign countries. He stated the claims were “preposterous” and doubts much will come out of the cases.

Johnson pointed out that is difficult to argue for sanctions while U.S. Steel is operating at peak margins. In fact, the opposite point could be argued, that HRC prices stand at artificially high levels that protect companies domiciled in the United States.

All of the aforementioned factors complete Johnson's thesis for U.S. Steel. Despite the issue's recent earnings-driven rally, Johnson's assessment of the issue back in September 2014 and current opinion remains unaffected.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: axiom capital Gordon Johnson HRCTechnicals Movers & Shakers Exclusives Trading Ideas General Best of Benzinga