Jim Cramer Warns Market Could Be In Trouble If Apple, Nvidia Stocks Slide This Week: 'Really Bad Sign'

Veteran financial commentator, CNBC’s Jim Cramer, is sounding an alarm for investors, suggesting that the performance of tech giants Apple Inc. (NASDAQ:AAPL) and Nvidia Corp. (NASDAQ:NVDA) this week will be a critical indicator for the broader market’s health.

What Happened: In a recent post on X, Cramer urged followers to “Watch Apple. If it doesn’t go up as much as the market, really bad sign for key holding.” His warning extends to Nvidia, which is set to report earnings this week on Wednesday, stating, “Same with Nvidia as it reports this week.”

Cramer’s comments highlight the significant influence these two companies, often considered market “bellwethers,” wield over overall investor sentiment and portfolio performance.

On Friday, Trump demanded that iPhones sold in the U.S. be manufactured domestically, threatening a 25% tariff otherwise.

These remarks directly targeted Apple’s growing presence in India, specifically Foxconn or Hon Hai Precision Industry Co. Ltd.’s (OTCPK: HNHPF) construction of a $1.5 billion display module facility near Chennai.

Meanwhile, according to Benzinga Pro, analysts expect Nvidia to report earnings per share of $0.88 for the first quarter, a 43% increase from the prior year, while its revenue is projected at $43.4 billion, up 65% from a year ago.

Why It Matters: Adding to the cautious tone, Cramer also noted a challenging environment for new investments, stating, “Now the futures are officially so high that you can’t buy anything that’s up big.”

This suggests that current market valuations are stretched, making it difficult for investors to find attractive entry points for stocks that have already seen significant gains.

Price Action: Nvidia’s shares closed 1.16% lower on Friday. The stock was down 5.08% on a year-to-date basis, and 15.27% higher over a year. In pre-market on Tuesday, the stock was up 2.56%

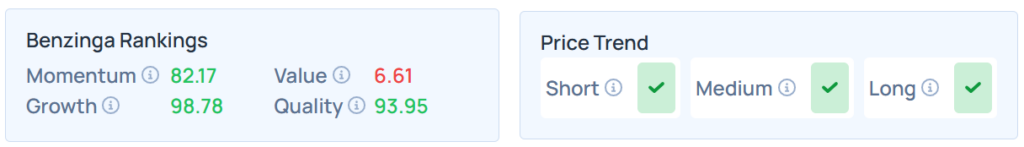

Benzinga Edge Stock Rankings shows that Nvidia had a stronger price trend over the short, medium, and long term. Its momentum ranking was solid, however, its value ranking was poor at the 6.61th percentile. The details of other metrics are available here.

Meanwhile, Apple’s shares closed 3.20% lower on Friday. The stock was down 19.92% on a year-to-date basis, and 2.78% higher over a year. In pre-market on Tuesday, the stock was up 1.74%

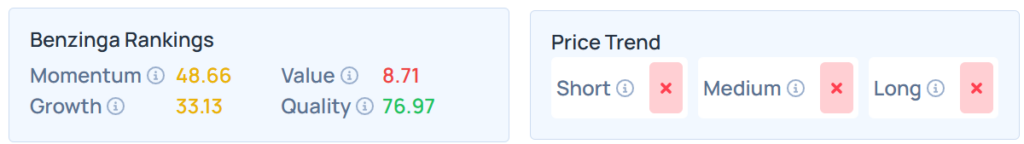

Benzinga Edge Stock Rankings shows that Apple had a weaker price trend over the short, medium, and long term. Its momentum ranking was moderate, and its value ranking was poor at the 8.71th percentile. The details of other metrics are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, rose in premarket on Tuesday. The SPY was up 1.51% to $587.87, while the QQQ advanced 1.58% to $517.31, according to Benzinga Pro data.

Read Next:

Quantum Computing Stocks In Focus: Pure Play Vs. Large Caps – Here’s A Look At The Valuations

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo Courtesy: hanohiki via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Analyst Color Equities Market Summary News Broad U.S. Equity ETFs Futures Markets Analyst Ratings