Beyond Meat Shelves Full-Year Outlook After $7M Hit — CEO Warns Of 'Unforeseen' Economic Headwinds, But Downplays Tariff Threat

Beyond Meat Inc. (NASDAQ:BYND) missed analyst expectations in the first quarter of the ongoing fiscal year and withdrew its full-year revenue guidance, citing the ongoing economic uncertainties. However, the CEO forecasted a “relatively minimal” tariff impact on the firm.

What Happened: The plant-based meat company withdrew its full-year guidance and limited its revised outlook to the second quarter net revenue expectations only.

“As with many other companies, we are experiencing an elevated level of uncertainty in our operating environment as a result of the uncertain and volatile macroeconomic conditions, which could have unforeseen impacts on our actual realized results,” said the CEO, Lubi Kutua.

Meanwhile, while addressing tariff impact questions from the analysts during its earnings call, Kutua said, “We’ve done some analysis to try to understand what the implications might be. Look, there’s no guarantees, but I think at this point, we think the direct impact on our business is relatively minimal.”

The company incurred extraordinary or transient expenses worth $7 million during the first quarter, which included expenses related to the suspension of its operational activities in China.

“Gross profit and gross margin included approximately $5.2 million of extraordinary charges related to specific strategic inventory reduction initiatives and expenses related to the suspension of our operational activities in China,” said the CEO.

See Also: S&P 500 Chart Indicates Adding ‘Long’ Positions As Expert Says ‘Market Has Found Its Balance’

Why It Matters: Beyond Meat reported revenue of $68.73 million, which fell short of the estimated $75.01 million, after the market closed on Wednesday. The company also reported an adjusted loss of 67 cents per share, exceeding the anticipated loss of 48 cents.

At the close of the first quarter, Beyond Meat held $115.8 million in cash, cash equivalents, and restricted cash, while its total outstanding debt stood at $1.1 billion.

Beyond Meat expects second-quarter net revenue to be in the range of $80 million to $85 million versus estimates of $93.47 million, according to Benzinga Pro.

BYND shares have fallen by 34.03% on a year-to-date basis and 69.06% over a year. On Wednesday, the shares ended at $2.54 apiece and dropped by 4.72% in after-hours. Meanwhile, the Invesco QQQ Trust, Series 1 (NASDAQ:QQQ), tracking the Nasdaq 100 index, rose 0.39% in the same session. The stock was 1.97% lower in premarket on Thursday.

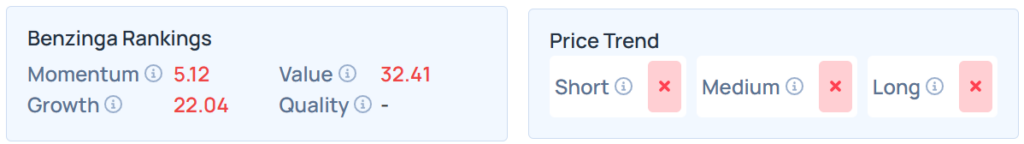

Benzinga Edge Stock Rankings shows that BYND had a weaker price trend over the short, medium, and long term. Its momentum ranking was weaker at 5.12th percentile, whereas its value ranking was also poor at 32.41th percentile; the details of other metrics are available here.

Read Next:

Photo: courtesy of Beyond Meat.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Earnings Earnings Misses Equities Market Summary News Broad U.S. Equity ETFs Guidance Futures