Chipotle Stock Faces Bearish Charts Despite Upbeat Q1 Estimates And Price Target Revisions

Chipotle Mexican Grill Inc. (NYSE:CMG) will report its first-quarter earnings after market close on Wednesday. Here’s what its charts and recent price revisions by analysts indicate.

What Happened: Chipotle is expected to report earnings of $0.28 per share, representing a 12% increase from the fourth quarter EPS of $0.25 per share, according to Benzinga Pro data.

Also, Wall Street expects the fast-food chain to deliver a revenue of $2.97 billion, 4.21% higher than its fourth quarter revenue of $2.85 billion.

The company announced its entry into the Mexican market through a newly signed partnership with Latin American restaurant operator Alsea on Monday. The Chief Business Development Officer at Chipotle, Nate Lawton, said, "We are confident that our responsibly sourced, classically-cooked real food will resonate with guests in Mexico," said.

The company’s technical analysis shows that its stock price of $47.10, as of Tuesday’s close, was below its short and long-term simple daily moving averages.

Its relative strength index of 40.96 was in the neutral zone, whereas its momentum indicator, the MACD line, of negative 0.96, suggested that its 12-day exponential moving average was below its 26-day EMA, with a negative histogram value of 0.10.

These indicators hinted at an overall bearish trend in Chipotle’s stock.

See Also: GameStop Short Seller Andrew Left Goes Long On China And These 2 US Stocks Amid Market Correction

Why It Matters: According to the 26 analysts tracking the company and the data compiled by Benzinga, the stock received four price downgrades as of April 22nd.

Barclays reduced its price target from $60 to $56, maintaining an “equal-weight” rating. Truist Securities adjusted the price from $74 to $61, with a “buy” Guggenheim recorded the target from $56 to $48 with a “neutral” rating, whereas Wells Fargo adjusted the price by $10 from $70 to $60, still maintaining its “overweight” rating.

According to a report by Investing.com, Truist Card data analysis prompted the adjustment, projecting flat same-store sales (SSS) for the first quarter of 2025, below the 1.9% consensus forecast.

Guggenheim, on the other hand, issued a reduction in the target price, citing the soft trends in the early first quarter impacted by adverse weather conditions and calendar shifts, as per an Investing.com report.

Price Action: Chipotle has declined by 21.36% on a year-to-date basis, whereas it was down 19.21% over a year. The stock was up 2.12% in premarket on Wednesday.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, rose in premarket on Wednesday. The SPY was up 2.20% to $538.84, while the QQQ advanced 2.67% to $456.34, according to Benzinga Pro data.

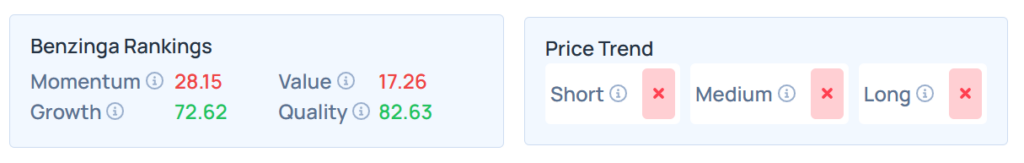

Benzinga Edge Stock Rankings shows that CMG has a weaker price trend over the short, medium, and long term. Its momentum ranking was weak at the 28.15th percentile, whereas its value ranking was also sluggish at 17.26th percentile; the details for which, along with other metrics, are available here.

Read Next:

Image Via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Analyst Color Equities News Technicals Markets Analyst Ratings Trading Ideas General