Ahead Of GameStop's Bitcoin Purchase Plans, BlackRock, Morgan Stanley, Goldman Sachs, And Other Billion Dollar Funds Load Up On GME Stock In Q4

Big billion-dollar funds increased their stakes in GameStop Corp. (NYSE:GME) during the fourth quarter of 2024, following a third quarter in which it held $4.616 billion in cash and cash equivalents. This comes as recent reports suggest the video game retailer is planning to buy Bitcoin (CRYPTO: BTC) and other cryptocurrencies.

What Happened: GameStop, which has $4.616 billion in cash and cash equivalents, according to its third quarter 10-Q filing was added to the portfolios of many large funds.

- As of the fourth quarter 13F filings, about 143 million shares of GME valued at $4.5 billion were held by 356 funds.

- UBS Group AG increased its stake in the company by 1635% during the fourth quarter.

- Ken Griffin‘s Citadel Advisors added 52%, whereas BlackRock just added 8%, valuing its total stake in the company at $1.091 billion

- Renaissance Technologies and JPMorgan Chase reduced their stakes by 57% and 56%, respectively.

Funds

Holdings (as of Sept. 30)

Holdings (as of Dec. 31)

Change (in %)

Value As Of Dec. 31

UBS Group AG

183,949

3,190,980

1635%

$100 million

Citadel Advisors LLC

2,400,543

3,658,769

52%

$114.665 million

BlackRock Inc

32,241,728

34,821,144

8%

$1.091 billion

Morgan Stanley

1,272,904

1,626,720

28%

$50.981 million

Goldman Sachs Group Inc

165,434

196,818

19%

$6.168 million

Renaissance Technologies LLC

1,896,464

817,848

-57%

$25.631 million

JPMorgan Chase & Co.

1,548,192

678,433

-56%

$21.262 million

Why It Matters: The chairman and CEO of GME, Ryan Cohen sparked controversy following the Feb. 8 X post where he posed with Strategy Inc. (NASDAQ:MSTR), formerly MicroStrategy’s founder and CEO, Michael Saylor. The following week CNBC reported that GameStop is likely to invest in cryptocurrencies.

Saylor has positioned Strategy as a treasury or a levered play on Bitcoin as it purchases BTC by issuing 0% convertible debt and preferred shares (NASDAQ:STRK). GME’s Cohen is likely to follow in MSTR’s path and possibly purchase other coins too.

Economist Peter Schiff criticized GameStop‘s potential Bitcoin investment as a “Hail Mary” move by a company lacking a “viable business plan”. He argues that Bitcoin is even more overvalued than GameStop stock, and compared the move to Strategy’s Bitcoin treasury strategy.

Price Action: GME rose by 2.62% on Friday and advanced further by 0.26% in the after-hours, whereas the exchange-traded fun tracking Russell 200 index, iShares Russell 2000 ETF (NYSE:IWM) fell 0.075%.

GME shares have fallen 11.94% on a year-to-date basis, whereas it was up by 100.15% over the last year.

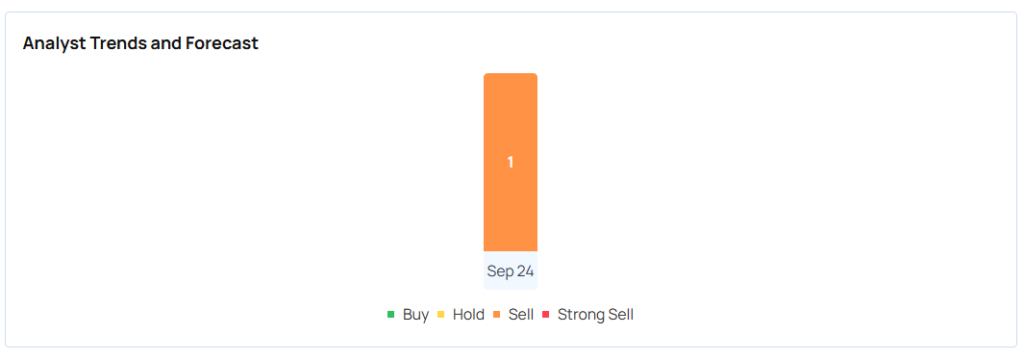

The price target of one analyst covering GME, Wedbush, is $10 with an ‘underperform' rating issued on Sept. 11, 2024. The average of three recent rating changes by the same analyst represents a 65.52% downside for the stock.

Read Next:

Photo courtesy: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: 13FCryptocurrency Market Summary News Hedge Funds Markets Analyst Ratings ETFs