Auto Slowdown Hits ON Semiconductor In Q4 — Q1 Outlook Also Dim: CEO Warns of 'Persisting Volatility Due To The Geopolitical Uncertainty'

ON Semiconductor Corp. (NASDAQ:ON) missed street expectations in the fourth quarter, predicting a sluggish first quarter for its automotive segment as its shares tumbled over 8% after the earnings report on Monday.

What Happened: Lower global automotive demand combined with slower-than-expected adoption of electric vehicles impacted the fourth-quarter results of the semiconductor company that supplies custom devices for automotive players.

According to its president and CEO, “Entering the first quarter, we expect persisting volatility due to the geopolitical uncertainty across all geographies as our customer assess their manufacturing footprints and the impact of tariffs,” said Hassane El-Khoury during its earnings call.

The management said that the company will be monitoring the demand signals of EV adoption, given the uncertainty around “EV tax credits and slowing infrastructure deployment.”

While the 8% sequential growth in the fourth quarter was driven by China, the company expects it to decline by 25% or more in the first quarter owing to the early Chinese New Year in the month of January.

The company is working on its ‘Fab Right’ strategy and reducing its operating expenditures via potential site closures, headcount reductions, and portfolio rationalization.

“The structural changes we plan on making will position us to react quickly and favorably to changing market conditions,” said company CFO Thad Trent.

The management expects a “meaningful impact” of opex reduction in the second quarter, and gross margin improvements by late in 2025.

Why It Matters: Its revenue declined by 15% year-on-year to $1.72 billion, missing the analyst consensus estimate of $1.76 billion, and its reported adjusted earnings of $0.95 per share missing the analyst consensus estimate of $0.97.

For the full year 2024, the revenue came in at $7.1 billion with a non-GAAP gross margin of 45.5% and a free cash flow of $1.2 billion.

In the first quarter, ON expects revenue in the range of $1.35-$1.45 billion and non-GAAP gross margin within 39-41%, with non-GAAP EPS at $0.45-$0.55.

“We believe electrification, AI data center and renewable energy are still the major growth drivers for our industry over the next decade, and we remain confident our technology and innovations in these markets will allow us to capitalize on those trends,” added CFO Trent.

Price Action: The shares fell by 8.21% to $47.04 apiece on Monday and slid by 0.09% in after-hours, whereas the exchange-traded fun tracking Nasdaq Composite index, Fidelity NASDAQ Composite Index ETF (NASDAQ:ONEQ) rose 0.92%.

ON shares have plunged 23.77% on a year-to-date basis, whereas it was down by 41.87% over the last one year.

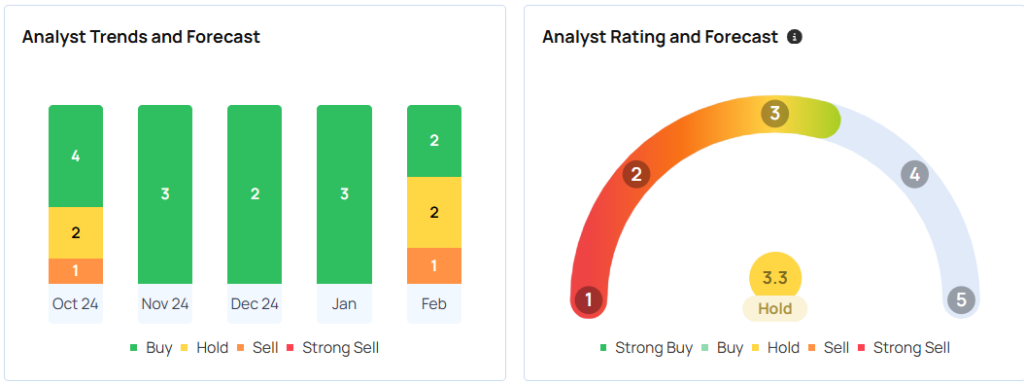

The average price target among 30 analysts tracked by Benzinga is $81.43 with a ‘hold' rating. The estimates range from $52 to $110 apiece. Recent ratings from Needham, Jefferies, and Rosenblatt suggest a $72.33 target, implying a potential upside of 53.90%.

Photo Courtesy: Ju Jae-young On Shutterstock.com

Read Next:

Latest Ratings for ON

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Morgan Stanley | Maintains | Equal-Weight | |

| Feb 2022 | Stifel | Maintains | Hold | |

| Feb 2022 | Susquehanna | Maintains | Positive |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Earnings Earnings Misses Equities Market Summary News Broad U.S. Equity ETFs Markets Analyst Ratings