Netflix's $1 Trillion Goal 'Very Realistic', Says Former Cable Executive: 'It's Not That Hard To Get There'

Former President of NBC Cable (now NBCUniversal Media), Tom Rogers has been bullish on Netflix Inc. (NASDAQ:NFLX) for several years. He says the company’s 5-year plan to hit $1 trillion in market capitalization by 2030 is “very realistic,” and not “that hard to get.”

What Happened: The media executive, who now serves as the Chairman of gaming platform Oorbit, joined CNBC’s “Fast Money” on Wednesday, expressing his thoughts on Netflix’s recent growth targets and why he feels that they are achievable.

Rogers says, “it [Netflix] can stay tougher under a downturn than just about any other media stock,” since only 4% of its revenues come from advertising.

While Netflix is currently in a defensive position due to its lower exposure to advertising, Rogers says that the company has to do well on advertising over the next 5 years to get to “the trillion-dollar market cap.”

“It’s not that hard to get there,” he says, “you probably have to get to 400 million subscribers,” which is 100 million more than they recently announced, or 20 million new subscriptions each year for the next five years.

Netflix is on track to hit 30% EBITDA margins this year, and according to Rogers, pushing that up to 40% within the next four and a half years is “eminently doable.” He points to the company's ad business as a key growth lever that’ll need to ramp up and scale to make that happen, while saying that “Netflix is a scale player” and “scale begets scale.”

Rogers says this new high-margin revenue stream could help Netflix triple its bottom line and double its top line, which at the stock’s current multiple “will get you to a trillion dollars.”

There is, however, a caveat, Rogers says, “Netflix’s engagement has to stay strong,” as it is the key to the platform’s pricing power and advertising revenue. He points out that the platform has dropped below 8% of all viewing time in March, losing market share to YouTube, which he expects to be covered during the company’s upcoming first-quarter earnings.

Why It Matters: According to a recent analysis by Jim Cramer, subscription businesses like Netflix and Spotify Technology SA (NYSE:SPOT) can weather economic uncertainties significantly better than others.

Other analysts have reiterated this claim, with Oppenheimer & Co.’s Jason Helfstein calling it the “cleanest story” in media, in the case of U.S. or global recession, once again citing the platform’s less reliance on advertising for revenue, reported by Deadline.

Price Action: Netflix stock ended down 1.54% on Wednesday ahead of its first quarter earnings release, but is up 5.87% in after-hours trading.

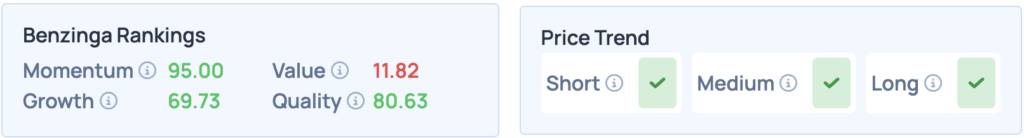

Netflix shows strong momentum across the board in Benzinga’s Edge Stock Rankings, only scoring low on ‘Value’ at 11.82. For more insights on the company and its peers, consider signing up for Benzinga Edge today.

Photo: marekfromrzeszow / Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: NBC Cable Netflix Tom Rogers Jim CramerEntertainment News Markets